If you’re trying to figure out how big your Social Security check could realistically be, you’re not alone. Many people hear about eye‑catching headline numbers and wonder whether they can ever reach those maximum Social Security payments or if those figures are just for ultra‑high earners. Understanding how the system actually calculates benefits can help you see where you stand and what levers you can still pull before you file. When it comes to maximum Social Security payments, how much retirees can receive per month depends on three things your lifetime earnings, how long you worked, and the age at which you start your benefit. If you learn how those pieces work together, you can stop guessing and start planning your claiming strategy like an informed insider instead of hoping for the best.

When people talk about “maximum Social Security payments: how much retirees can receive per month,” they’re usually referring to the absolute highest check the system will pay someone retiring in a specific year. That top figure is reserved for a tiny group of workers who earned very high wages for at least 35 years and claimed at the most favorable age. Most retirees never hit that ceiling, but the maximum still matters because it shows what Social Security can do at its best. It also reminds you that your choices – especially your earnings in key years and the age you file can move your personal benefit up or down quite a bit, even if you don’t come close to the official maximum Social Security payments.

Maximum Social Security Payments

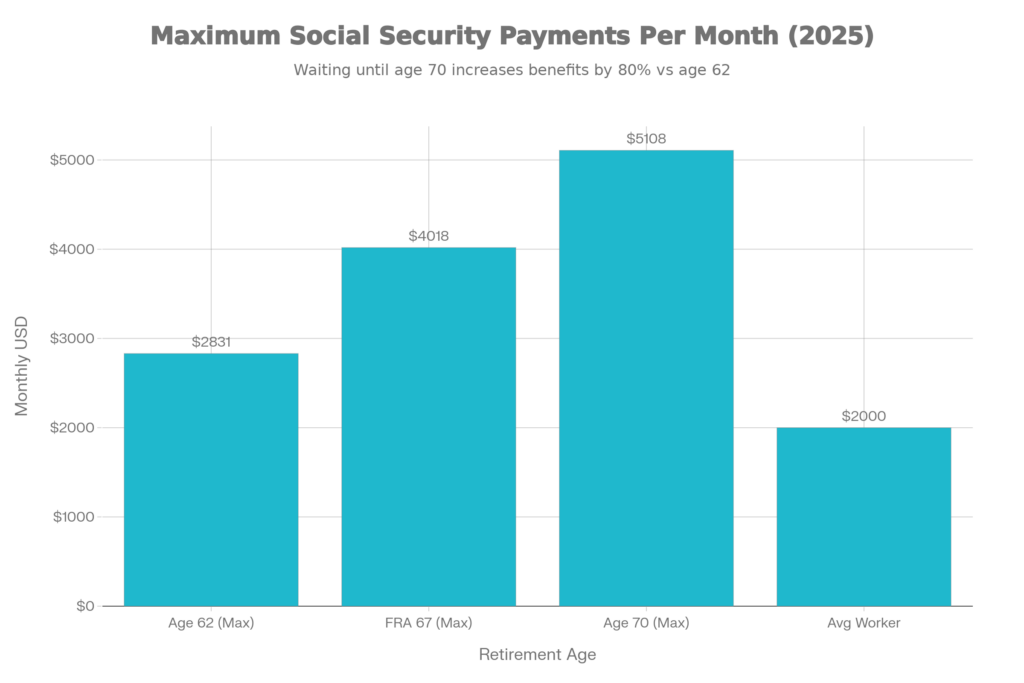

| Retirement Age (2025 Rules) | Maximum Monthly Benefit | Approximate Yearly Benefit | Typical Use Case |

|---|---|---|---|

| Age 62 | $2,831 | About $33,972 | Early filers who had very high lifetime earnings but can’t or don’t want to wait |

| Full Retirement Age (around 67) | $4,018 | About $48,216 | High earners who work long careers and file “on time” |

| Age 70 | $5,108 | About $61,296 | Top tier maximum Social Security payments for those who delay and maximize credits |

| Average Retired Worker | Around $2,000 | Around $24,000 | What many typical retirees actually see in their bank account |

This table shows the gap between the maximum Social Security payments and the reality for most people. It’s a good gut‑check: if your own earnings history or claiming age look very different from the maximum scenario, you should expect something closer to the average.

What Is The Maximum Social Security Check

The maximum Social Security check for someone retiring under today’s rules is over five thousand dollars per month at age 70. That’s the headline number that grabs attention, but it sits at the very top of the scale. To get anywhere near that, you need a long, high‑earning career and patience to delay your claim.

At full retirement age, the maximum Social Security payments are lower but still substantial, landing in the low four‑thousand‑dollar range per month. Claiming as early as 62 shrinks the top payment to the mid‑two‑thousand range. The key idea is that the “maximum” is not one fixed number – there are different maximums for each claiming age, and the later you file (up to 70), the higher your potential monthly check.

Who Actually Qualifies For The Max

To qualify for the true maximum Social Security payments, you have to tick off several strict boxes that most people will not meet. In practical terms, that means:

- Working at least 35 years in jobs covered by Social Security

- Earning at or above the annual taxable wage cap for most or all of those years

- Waiting until age 70 to claim, so you collect the full delayed retirement credits

Missing just a few of these elements such as taking time out of the workforce, having several years with lower pay, or filing before age 70 can pull your benefit down from the maximum. That’s why these upper‑end checks are rare, even among successful professionals. The maximum Social Security payments are more like a best‑case model than a typical outcome.

How Much Most Retirees Actually Receive

- While the maximum Social Security payments sound impressive, most retirees live much closer to the average benefit. The typical retired worker’s monthly check is roughly around the low two‑thousand‑dollar mark, not four or five thousand. That amount is still important, but it’s not usually enough to fund a comfortable retirement all by itself.

- This is why planners constantly remind people to treat Social Security as one piece of a broader income plan. If your personal benefit is likely to be closer to the average, then savings in 401(k)s, IRAs, pensions, or other investments need to fill the gap. For many households, especially couples, combining two modest benefits can create a more stable base, even if neither partner is anywhere near the maximum Social Security payments.

How Your Claiming Age Changes Your Payment

Your claiming age is one of the few levers you fully control, and it can dramatically change your monthly amount. Claiming as soon as you’re eligible, at 62, permanently locks in a smaller check, even if you had strong earnings. The formula applies a reduction because you’re expected to receive benefits for more years. Waiting until full retirement age removes that early‑claiming penalty and lets you receive 100% of your calculated benefit. If you go further and delay to age 70, you earn extra credits for each year you wait, up to a cap. That’s how maximum Social Security payments at 70 can be thousands of dollars higher than at 62 for the same worker. In other words, timing alone can be the difference between a modest and a very strong monthly check.

How Social Security Calculates Your Benefit

Behind every benefit amount is a formula that starts with your 35 highest‑earning years, adjusted for wage inflation. Those years are averaged to produce your “average indexed monthly earnings.” If you have fewer than 35 years of work, Social Security fills the missing years with zeros, which drags your average down.

Next, a progressive formula converts that average into your “primary insurance amount,” which is what you’d receive at full retirement age. The system replaces a higher percentage of low earnings and a lower percentage of very high earnings, giving lower‑income workers a stronger safety net. Your final monthly check is then adjusted up or down based on the age you actually start benefits, which is why the maximum Social Security payments come at 70, not at the earliest claiming age.

Strategies To Get The Biggest Check You Can

Even if you know you’ll never hit the official maximum Social Security payments, there’s a lot you can do to raise your own benefit:

- Work at least 35 years so you avoid zeros in your calculation

- Increase late‑career earnings, if possible, because higher recent wages can replace weaker years

- Delay claiming closer to full retirement age or even to 70, especially if you expect to live a long life

- Coordinate with a spouse so that combined benefits and survivor protections work in your favor

You don’t have to perfectly optimize every factor to see real improvement. Even one or two extra years of work at a higher salary, or delaying your claim a year or two, can noticeably increase your monthly payment. Think of the maximum Social Security payments as the top of the ladder and your personal choices as the steps that move you higher.

SNAP Benefits in 2026: New Approval and Renewal Rules You Need to Know

Why COLA and the Taxable Maximum Matter

- Two technical details quietly shape both future maximum Social Security payments and your own benefit over time: cost‑of‑living adjustments and the taxable wage cap.

- Cost‑of‑living adjustments (COLAs) are annual increases designed to keep benefits roughly in line with inflation. These boosts apply across the board, so they increase both the average benefit and the maximum check over time. If inflation stays elevated, COLAs can become a major force in lifting your real income later in retirement.

- The taxable maximum, on the other hand, is the yearly earnings limit on which you pay Social Security tax and earn credit for future benefits. If your salary goes above that threshold, the extra income doesn’t increase your benefit. For someone aiming at or near the maximum Social Security payments, consistently earning at or above this cap for decades is essential.

FAQs on Maximum Social Security Payments

What is the maximum Social Security payment per month right now?

The maximum Social Security payment for someone claiming at age 70 under current rules is a little over five thousand dollars per month.

How can I qualify for the maximum Social Security benefit?

To qualify for the top end of maximum Social Security payments, you generally need 35 years of very high earnings that hit the taxable wage cap, and you must delay claiming until age 70.

What is the average Social Security check for retirees?

The average retired worker benefit is much lower than the maximum Social Security payments, hovering around the low two‑thousand‑dollar range per month.

Does delaying Social Security always increase my monthly payment?

Delaying your claim beyond 62 almost always increases your monthly check up to age 70, after which there’s no further benefit from waiting.