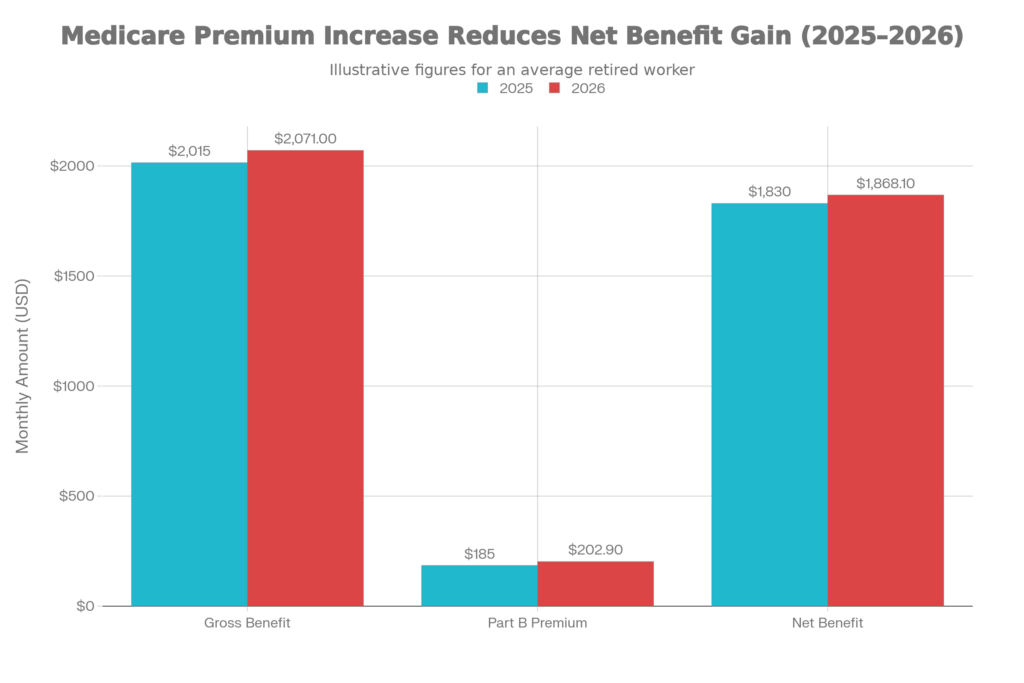

One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why centers on a simple reality: your Social Security raise and your Medicare bill are moving in opposite directions. The cost-of-living adjustment gives you a percentage bump in benefits, but Medicare Part B premiums are rising faster in percentage terms, cutting into the extra money you thought you were getting. For many older Americans, the increase in medical deductions will soak up a significant slice of their 2026 benefit boost, turning what looked like a helpful raise into a far smaller improvement in real life.

In practical terms, retirees will see their gross monthly payment rise and then immediately watch a chunk of that increase disappear into higher healthcare costs. That gap between gross and net benefits is the core of One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why. If you do not pay close attention to both sides of the equation, you might think Social Security has made a mistake when your check ends up only a little higher than last year’s, or barely higher at all.

One Social Security Update in 2026

| Factor | 2025 | 2026 | Effect On Retirees |

|---|---|---|---|

| Annual Social Security COLA | Higher recent inflation-driven level | Smaller but still positive increase | Raises gross monthly benefits for retirees, spouses, survivors, and disability recipients. |

| Average Retired Worker Benefit | Lower starting figure | Modest monthly increase | Adds only a limited amount of extra cash each month before deductions. |

| Medicare Part B Standard Premium | Lower monthly premium | Noticeably higher premium | A flat-dollar increase automatically deducted from most Social Security checks. |

| Net Effect on Typical Check | COLA larger than premium increase in dollars | COLA partly offset by premium jump | Net raise shrinks; many feel only a small gain in take-home benefits. |

| Impact On Low-Benefit Retirees | COLA provides modest relief | Premium eats up a big share | Small checks see much of the raise wiped out by higher Medicare costs. |

| Impact On High-Income Retirees | Higher IRMAA surcharges already apply | Surcharges rise with new brackets | Some see big premium jumps that heavily erode their Social Security increase. |

| Earnings Test Limits | Lower limits in 2025 | Slightly higher limits in 2026 | Early claimers can earn a bit more from work before benefits are withheld. |

| Tax Rules On Seniors | Prior standard rules | New senior-focused tax relief in some cases | May help some older households offset the benefit of higher Medicare costs through reduced tax. |

How The 2026 COLA Helps on Paper

Every year, Social Security recalculates benefits using a cost-of-living adjustment tied to a government inflation index. For 2026, that adjustment is enough to push the average retired worker’s monthly benefit up by a noticeable but not dramatic amount. The idea is simple: as prices go up over time, your check should not stay frozen, or you would fall behind very quickly. The 2026 COLA, however, is smaller than the inflation spikes seen in some previous years, which means the raise is more modest. For retirees who have already been stretched by several years of rising prices, the new increase feels more like a catch-up move than a true gain. It improves the gross number on your statement, but it does not guarantee that your budget will suddenly feel relaxed or comfortable.

Why Medicare Part B Premiums Cut Into Your Raise

- Medicare Part B premiums are the main reason One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why has real teeth. Part B pays for outpatient care, doctor visits, and many services you use regularly, and its monthly premium is set to jump sharply in 2026. Unlike some other costs, this premium is not optional for most people on Medicare; it is simply taken out before your Social Security money ever reaches you.

- Because the premium increase is a flat dollar amount, it affects every beneficiary enrolled in Part B, no matter how large or small their benefit. For someone with a generous check, the extra deduction may just sting a bit; for someone living on a small Social Security benefit, that same deduction can eat up a huge piece of their raise. The result is that many retirees will see a much smaller net increase than the official COLA suggests.

Who Feels the Pain the Most?

- One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why hits certain groups harder than others. Retirees with relatively low Social Security payments are the most vulnerable because a fixed increase in Medicare premiums consumes a larger share of their total income. If your check is modest to begin with, you simply do not have much room for any new deduction.

- Higher-income retirees face a different kind of squeeze. If your income crosses specific thresholds, you pay income-related surcharges on top of the standard Part B premium. In years when both the base premium and the surcharges rise, this can mean an especially large jump in total Medicare costs. Even though your Social Security benefit increases, you may feel like you are running in place once all the extra healthcare deductions are taken out.

The Hold Harmless Rule – Protection With Limits

- There is a built-in safeguard in the system called the “hold harmless” rule, designed to prevent certain beneficiaries from seeing their net Social Security payment fall just because Medicare Part B premiums went up. If you qualify, the rule ensures that your premium increase cannot be larger than your COLA, so your check does not actually go down from one year to the next.

- However, this protection has two big limitations. First, it does not apply to everyone, including many who pay surcharges or who do not have their premiums deducted directly from their Social Security check. Second, even if you are protected, your net increase can still be tiny because most or all of your raise is absorbed by the higher premium. In other words, hold harmless can keep you from going backward, but it does not guarantee meaningful progress.

Other 2026 Changes That Quietly Shape Your Benefit

- Beyond One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why, several smaller policy changes will also influence how far your check stretches. The earnings test limit for people who claim benefits before full retirement age rises a bit, allowing you to earn slightly more from work before Social Security starts temporarily withholding part of your benefit. For early retirees who still do some part-time work, that extra room can help stabilize monthly cash flow.

- At the same time, there are tax changes that may benefit some seniors, such as larger age-based deductions or adjustments to tax brackets. These shifts do not change the amount Social Security pays you, but they can reduce how much of that income is eaten up by federal taxes. For some middle-income retirees, smart planning around these tax rules can partially offset the impact of higher Medicare premiums.

Federal Proposal Could Require 39 States to Repay Foster Youth Social Security Funds – Check Details

Practical Ways To Protect Your Take-Home Pay

- If you are worried about One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why, the first step is to study your benefits letter as soon as you receive it. Compare the gross benefit, the Medicare deductions, and the net amount so you clearly see how much of your raise is being lost to healthcare costs. Knowing the exact numbers helps you plan instead of guessing.

- Next, review your Medicare coverage during the appropriate enrollment window. In some cases, choosing a different Medicare Advantage or Part D plan can lower your overall healthcare costs, even if the core Part B premium is set by law. If your income is limited, look into state and federal assistance programs that help with premiums, deductibles, and drug costs. Even a modest subsidy can free up more of your Social Security raise for everyday expenses.

FAQs on Social Security Update in 2026

Will my Social Security check actually go down in 2026?

For most people, the check will still be slightly higher, but One Social Security Update in 2026 May Reduce Take-Home Benefits Here’s Why means that your raise may be much smaller than the official COLA suggests.

Why does Medicare Part B have such a big impact on my Social Security raise?

Medicare Part B premiums are automatically deducted from your check if you are enrolled and receiving benefits, so any increase in that premium directly reduces your take-home amount.

Is there any protection against my check getting smaller because of Medicare increases?

Yes, the hold harmless rule can prevent certain beneficiaries from seeing their net check reduced solely due to a higher Part B premium.

What can I do now to prepare for the 2026 update?

Start by estimating your 2026 benefit using your current amount and the expected COLA, then subtract the new Medicare premium to see your likely net figure.