As the year draws to a close, many New Yorkers are still anxiously awaiting their inflation rebate checks. While millions have already received their one-time payments, a significant number of residents have found themselves left out, leading to confusion and frustration.

These checks, designed to help alleviate the financial strain caused by rising costs, are a part of the 2025 state budget. However, several factors, including address issues, filing delays, and the staggered mailing process, explain why some New Yorkers are still waiting for their rebates.

Inflation Rebate Checks

| Filing Status | Income Threshold | Refund Amount |

|---|---|---|

| Single | ≤ $75,000 | $200 |

| Single | $75,001–$150,000 | $150 |

| Married Joint | ≤ $150,000 | $400 |

| Married Joint | $150,001–$300,000 | $300 |

| Head of Household | ≤ $75,000 | $200 |

| Other | Varies | $150–$400 |

The New York State Department of Taxation and Finance began mailing the rebate checks in late September 2025, but the distribution process continues through December 2025. For some, this means waiting longer than expected for a financial lifeline designed to help ease inflation’s impact on their households.

What Are Inflation Rebate Checks and Who Qualifies?

New York’s inflation rebate checks are automatic, one-time payments that are part of the state’s ongoing efforts to mitigate the financial burden that inflation has placed on residents. The checks were announced as part of the 2025–2026 state budget and are aimed at providing financial relief to New York taxpayers who filed their 2023 tax returns.

Eligible individuals can expect payments that range between $150 and $400, depending on their income and filing status. The amount received is based on the taxpayer’s 2023 adjusted gross income and whether they filed as a single or married individual. Here’s a breakdown:

The payments were issued based on the 2023 tax filings with no need for additional applications, meaning that if you filed your 2023 taxes, you were automatically considered for the rebate.

The Staggered Payment System: Why Some Residents Are Still Waiting

New Yorkers who filed their tax returns earlier in the year may have already received their rebate checks, but others are still waiting. This delay can be attributed to the staggered payment system used by the state. The New York State Department of Taxation and Finance did not send all checks at once; instead, they began issuing them in late September 2025, with the process set to continue through December 2025.

The payment order is based on when your 2023 tax return was processed. Those who filed their returns early in the tax season were among the first to receive their rebates.

However, for those who filed closer to the deadline or had their returns processed later in the year, the checks are arriving later in the distribution period. Additionally, those who filed more complex tax returns may experience longer processing times.

Key Factors Influencing Payment Timing

- Address on File: The mailing address you provided on your 2023 tax return is critical. If you’ve moved since your last filing or have an outdated address on file, it can delay your check’s arrival. The Department of Taxation and Finance will send the payment to the address on your most recent tax return. If you’ve changed addresses and haven’t updated it with the department, you may experience a delay.

- Tax Filing Date: Taxpayers who filed their returns later in the filing season or required additional processing (such as amendments or audits) may see a delay. This backlog has added a few weeks to the expected time frame for some individuals.

- Processing Delays: In some cases, the New York Department of Taxation and Finance needs to verify the details of tax returns, which could delay the issuance of checks. Refunds for certain filings that are flagged for verification or review may be subject to longer processing times.

- Mail Delivery Times: The U.S. Postal Service (USPS) also plays a role in the delays, particularly in rural or hard-to-reach areas. Mail service delays have been reported in some parts of New York, meaning even if a check was mailed, it may take additional time to arrive.

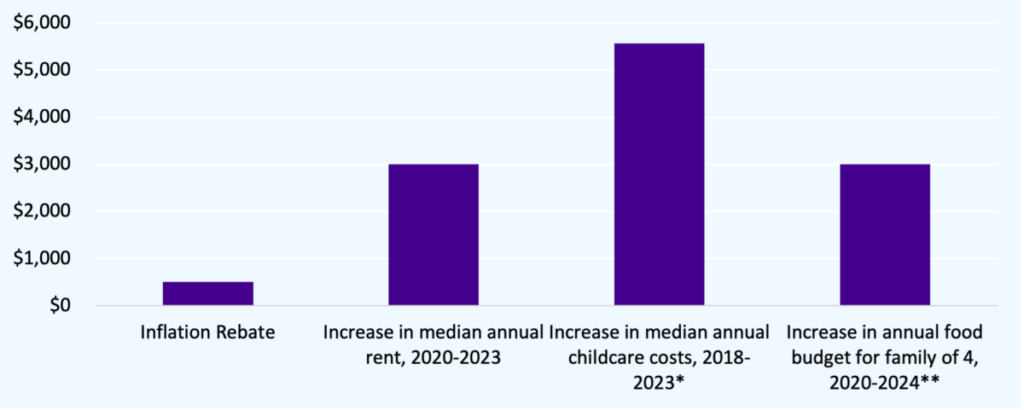

Impacts on Low-Income New Yorkers

Delays in receiving the inflation rebate check can disproportionately affect low-income families, the very group the rebate was designed to help. For many residents, particularly those who depend on public assistance programs like SNAP, this one-time payment is a vital source of income.

The rebate is meant to provide immediate relief against the rising cost of living — particularly grocery prices, gas, and other essentials.

When a check is delayed, it can create financial hardship, especially for individuals who are already struggling to make ends meet. Many New Yorkers in these communities rely on the timely receipt of these funds to offset costs during the winter months when heating and holiday spending add additional financial strain.

Detailed Analysis of the Rebate Program’s Economic Impact

The inflation rebate checks are more than just a financial relief measure for individuals — they are a stimulus for the local economy. With millions of checks being sent out, these payments are expected to boost consumer spending in local businesses across New York State.

According to economic analysts, low-income households are more likely to spend any extra income they receive, making the inflation rebate a key tool in stimulating demand for goods and services.

As a result, small businesses and local retailers are among the primary beneficiaries of this economic injection, especially in areas hit hardest by inflation. The checks help ensure that people have the means to spend in their communities, keeping cash circulating within the state.

Government Response to Ongoing Issues

The New York State Department of Taxation and Finance has acknowledged the delays and is working to improve the distribution process. They have stated that the full disbursement of rebates will continue until December 2025, and that residents should continue to watch for check delivery.

Officials are also ensuring that address errors and incorrect processing will be corrected, and efforts are being made to accelerate the remaining payments.

However, due to the complexity of the mailing system, there are limitations in what can be done in terms of faster distribution.

Support Resources for Individuals Facing Financial Hardship

For those experiencing delays and financial strain, there are several state and federal resources that New Yorkers can access:

- SNAP (Supplemental Nutrition Assistance Program): Offers support for eligible individuals and families to buy food.

- HEAP (Home Energy Assistance Program): Provides help with heating costs, especially during the winter months.

- Emergency Rental Assistance: Available for those struggling to pay rent due to financial hardship.

For those experiencing delays in receiving the inflation rebate check, it is important to explore other available government assistance programs to help meet immediate needs.

Related Links

SNAP Benefits in 2026: New Approval and Renewal Rules You Need to Know

Christmas Eve Tax Refunds: Why Millions of Americans Are Seeing Payments This Week

Patience and Preparation

While inflation rebate checks are a vital lifeline for many New Yorkers, the distribution process has been a source of delays for some. By understanding how the payment system works, staying updated on tax filings and address changes, and following the guidance provided by the Department of Taxation and Finance, residents can ensure they receive their payments in a timely mannear.

However, for those still waiting, the message is clear: patience is key, and the checks should arrive within the expected period.

If you’ve waited through the expected mailing period with no check and believe you should have received one, updating your address and verifying your tax return status through the Department’s online services or contacting the Tax Department directly are the recommended next steps.