A Social Security increase confirmed for 2026 will raise monthly payments for more than 75 million beneficiaries, reflecting the federal program’s annual cost-of-living adjustment tied to inflation.

The increase affects retirees, disabled workers, survivors, dependents, and Supplemental Security Income recipients, with higher payments beginning in late 2025 and January 2026.

Social Security Increase Key Takeaways

- Over 75 million people will see higher payments

- The increase applies across retirement, disability, survivor, and SSI programs

- Payments rise automatically — no application required

- Net take-home pay may vary due to Medicare premiums and taxes

Why the 2026 Social Security Increase Was Triggered

Social Security benefits rise when inflation exceeds a legally defined threshold. The adjustment is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), comparing prices during the third quarter of the year with the same period a year earlier.

Because consumer prices rose during that measurement window, federal law required an automatic increase in benefits for 2026. This mechanism is designed to preserve purchasing power — not to provide a raise — ensuring benefits do not lose value as prices rise.

Who Is Included in the Social Security Increase

The 2026 adjustment applies broadly across the Social Security system.

Beneficiaries affected include:

- Retired workers and their spouses

- Disabled workers receiving SSDI

- Survivors, including widows and widowers

- Children and dependents

- Supplemental Security Income (SSI) recipients

Some individuals receive benefits under more than one category, and the increase applies to each eligible payment.

When Higher Payments Begin

Social Security retirement, disability, and survivor benefits

Most beneficiaries will see higher payments in January 2026, based on the established payment schedule:

- Birthdays 1–10: second Wednesday

- Birthdays 11–20: third Wednesday

- Birthdays 21–31: fourth Wednesday

- Long-time beneficiaries (pre-May 1997): early-month payments

SSI recipients

Because January 1, 2026 is a federal holiday, many SSI recipients receive their first COLA-adjusted payment on December 31, 2025.

How Much Benefits Increase — and Why It Differs by Person

The 2026 increase is applied as a percentage, not a flat dollar amount.

That means:

- Higher monthly benefits receive larger dollar increases

- Lower benefits receive smaller dollar increases

For example:

- A retiree receiving $1,200 per month sees a smaller increase than one receiving $2,400

- Couples receiving two benefits see a combined increase over the year

This structure preserves proportional differences rather than narrowing income gaps.

New Retirees vs. Long-Time Beneficiaries

New retirees

Those who claim benefits for the first time in 2026 will see the COLA built directly into their starting benefit. They do not receive a separate “increase” — their benefit simply begins at the adjusted level.

Existing beneficiaries

Long-time beneficiaries see the increase added to their current payment base, which then compounds with future COLAs.

Why this matters: Early claiming reductions — or delayed retirement credits — are also compounded by COLAs, magnifying their long-term impact.

Impact on Spousal and Survivor Benefits

The increase applies to:

- Spousal benefits

- Divorced-spouse benefits

- Survivor benefits

Because survivor benefits are often the largest single Social Security payment in a household, the higher-earning spouse’s COLA-adjusted benefit becomes especially important after death. This means the 2026 increase also shapes future survivor income, not just current payments.

SSI and Poverty Threshold Implications

For SSI recipients, the increase helps align benefits with rising living costs, but the effect can be complex.

- Higher SSI payments may push some recipients closer to income thresholds

- State supplemental payments may or may not increase alongside federal SSI

- Eligibility for related assistance programs can be affected

For many low-income households, the increase helps stabilize finances but does not eliminate financial strain.

Medicare Premiums May Offset Some Gains

While benefits rise, net income does not always increase by the same amount.

Medicare Part B deductions

Most retirees have Part B premiums deducted directly from their Social Security checks. If premiums rise in 2026, part of the COLA may be absorbed.

Income-related surcharges

Higher-income beneficiaries may also face IRMAA surcharges, which increase Medicare premiums and reduce net deposits. As a result, two beneficiaries with the same COLA percentage may experience very different take-home changes.

Taxes Can Change the Net Effect

Up to 85% of Social Security benefits can be subject to federal income tax, depending on total household income.

A higher benefit may:

- Push some retirees into taxable thresholds

- Increase overall tax liability

- Reduce the perceived value of the COLA

State tax treatment varies widely, adding another layer of complexity.

Regional Cost Pressures: Why COLA Feels Different by Location

COLAs are national, but living costs are not.

- Housing and healthcare costs vary sharply by region

- Some areas experience inflation far above the national average

- Others see slower cost growth

As a result, beneficiaries in high-cost regions may feel the increase is insufficient, while those in lower-cost areas may experience more relief.

What the Social Security Increase Does Not Do

Despite common assumptions, the 2026 increase:

- Does not change eligibility rules

- Does not raise retirement ages

- Does not eliminate benefit reductions for early claiming

- Does not guarantee higher net income after deductions

It strictly adjusts benefit amounts based on inflation.

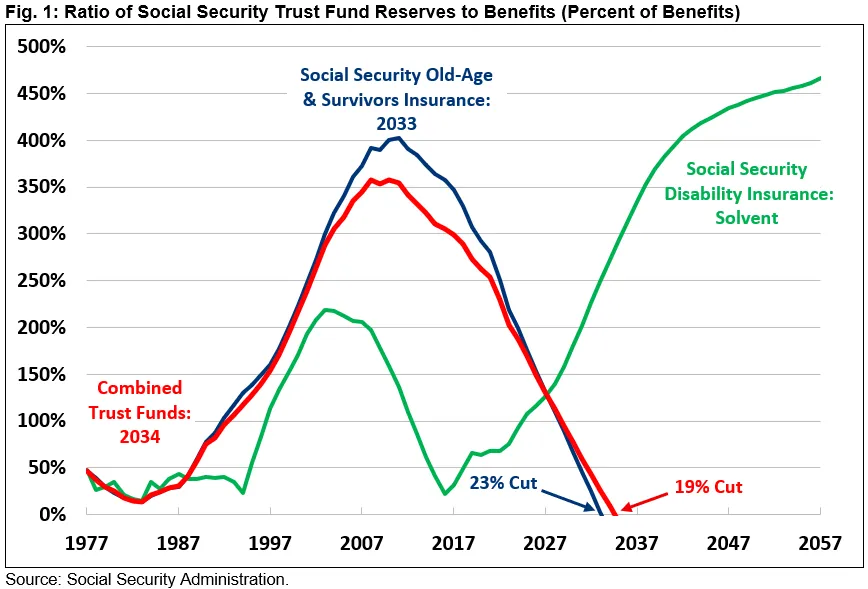

What the 2026 Social Security Increase Signals for the Future

The size of the 2026 adjustment suggests moderating inflation compared with earlier years. Future COLAs will depend on upcoming inflation data, not on prior increases. Because COLAs compound, even moderate adjustments shape benefit growth over time — for better or worse.

What Beneficiaries Should Check Now

Before the first 2026 payment arrives, beneficiaries should:

- Review their annual COLA notice

- Confirm updated benefit amounts online

- Check Medicare premium deductions

- Revisit tax withholding or estimated payments

- Update household budgets

These steps help prevent surprises and clarify net income expectations.

Common Myths — and the Facts

Myth: Everyone gets the same dollar increase

Fact: Everyone gets the same percentage increase

Myth: The COLA is a raise

Fact: It is an inflation adjustment

Myth: Higher benefits always mean higher take-home pay

Fact: Medicare and taxes can offset gains

Related Links

Pennsylvania Reopens Refund Window for Renters and Homeowners — How to Apply?

Texas SNAP Update: December Deposits Continue With Benefits Up to $1,789

The Social Security increase confirmed for 2026 will raise payments for more than 75 million Americans, helping benefits keep pace with inflation. While the adjustment provides meaningful relief, its real-world impact depends on healthcare costs, taxes, and household circumstances. Understanding how the increase fits into the broader retirement picture is essential for planning ahead.

FAQs About Social Security Increase

Do I need to apply for the 2026 increase?

No. It is automatic.

Will the increase ever be taken away?

No. Once applied, it becomes part of your permanent benefit.

Does the increase affect working beneficiaries?

Yes. Earnings limits rise alongside COLA adjustments.