The SSI January 2026 Payment will be issued before the start of the new year because January 1 falls on a federal holiday, triggering a routine scheduling adjustment under long-standing federal payment rules. The early deposit, expected on December 31, 2025, will include the annual cost-of-living adjustment and affects millions of low-income seniors and people with disabilities who rely on Supplemental Security Income for basic living expenses.

SSI January 2026 Payment

| Key Fact | Detail |

|---|---|

| Payment Date Shift | January 2026 SSI paid on Dec. 31, 2025 |

| Reason for Early Payment | Jan. 1 is a federal holiday |

| Extra Payment? | No |

| COLA Applied | Yes |

| Next Payment After Jan. | Early February 2026 |

What the SSI January 2026 Payment Change Means

The Supplemental Security Income program, commonly known as SSI, is a federally administered benefit that provides monthly cash assistance to individuals with very limited income and financial resources. Eligible recipients include older adults, people with disabilities, and individuals who are blind, many of whom depend on the program to cover food, housing, utilities, and medical co-payments.

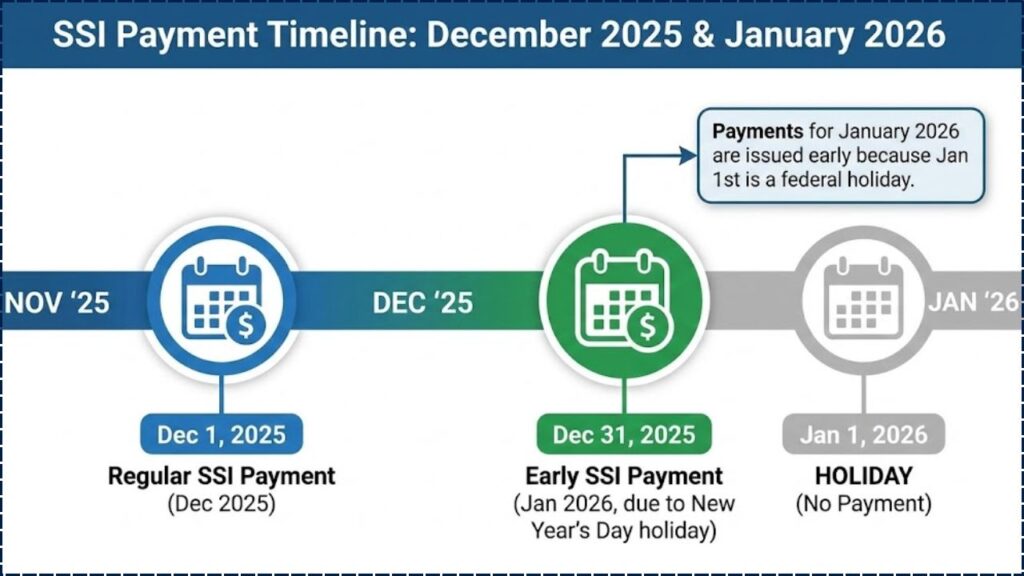

Under standard procedures, SSI payments are issued on the first day of each calendar month. This predictable schedule allows recipients to plan around fixed expenses such as rent or utility bills. However, when the first day of the month falls on a weekend or a federal holiday, federal payment rules require that benefits be disbursed on the preceding business day.

In 2026, New Year’s Day falls on a Thursday and is recognized as a federal holiday. As a result, the SSI January 2026 Payment will be issued on December 31, 2025, the last business day of the year. The adjustment follows a formula used consistently across decades and applies automatically without requiring any action from beneficiaries.

Federal officials emphasize that this is not a policy change aimed at increasing benefits or accelerating payments permanently. It is an administrative shift designed to ensure that recipients are not delayed in accessing funds due to government office closures.

Why Two SSI Payments Arrive in December

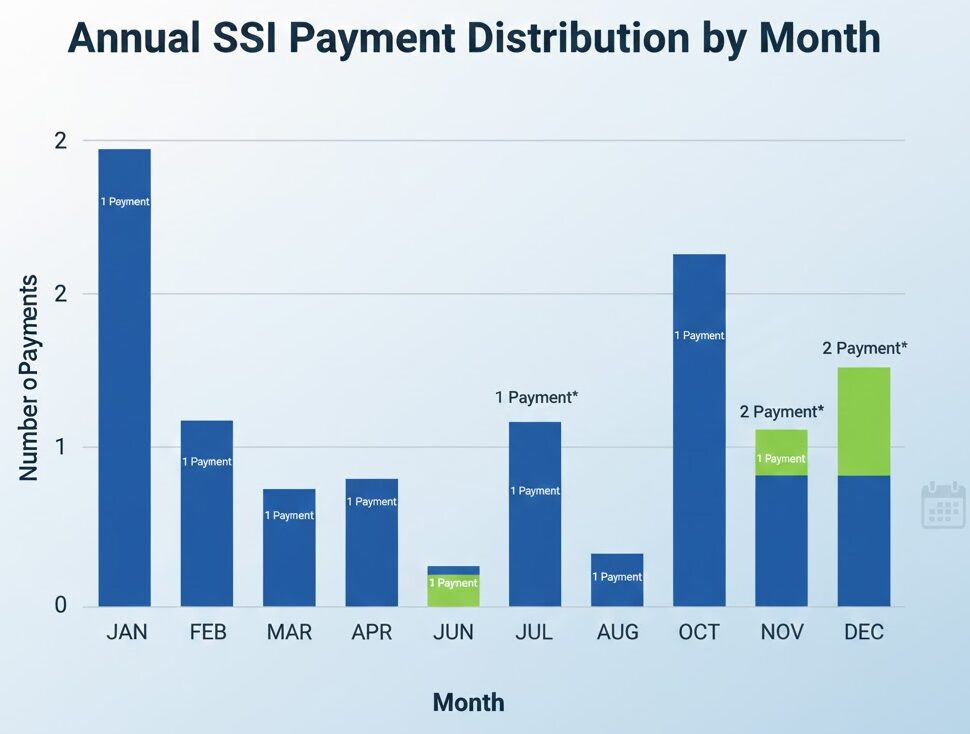

The calendar adjustment means SSI recipients will receive two payments during December 2025. One payment, issued at the beginning of the month, covers December benefits. The second payment, issued on December 31, covers January 2026 benefits.

This pattern often leads to confusion, particularly among first-time recipients or individuals who track income strictly by calendar month. Financial counselors and advocacy organizations frequently warn beneficiaries not to interpret the second December payment as a bonus or extra assistance.

From an accounting perspective, the federal government still issues only twelve SSI payments per year. The appearance of an additional December payment is the result of timing, not increased annual support.

Historically, similar double-payment months have occurred when holidays such as New Year’s Day, Labor Day, or the first day of a month falling on a weekend require schedule changes. The policy is applied uniformly nationwide.

How Much Beneficiaries Will Receive in 2026

The SSI January 2026 Payment will be the first to reflect the annual cost-of-living adjustment, commonly referred to as COLA. The COLA is applied each year to help benefits keep pace with inflation, particularly rising costs for food, housing, and energy.

While the COLA percentage varies year to year based on inflation trends, its application follows a consistent formula used across federal benefit programs. The adjustment affects both SSI and Social Security retirement and disability benefits, though the programs themselves are distinct.

For 2026, the maximum federal SSI benefit levels are expected to rise modestly. These maximums apply only to recipients with no countable income and minimal resources. Most beneficiaries receive less than the federal maximum due to earnings, pensions, or other forms of assistance that are counted under program rules.

State governments may also provide supplemental payments on top of the federal benefit. These state supplements vary widely in amount and eligibility requirements, meaning two recipients with identical federal benefits may receive different total payments depending on where they live.

Understanding Eligibility and Payment Calculations

SSI is a means-tested program, which distinguishes it from Social Security retirement or disability insurance. Eligibility and payment amounts are determined by income, assets, and living arrangements rather than work history.

Countable income includes wages, certain government benefits, and in-kind support such as free housing or food provided by family members. Assets such as savings accounts, vehicles beyond certain limits, or property not used as a primary residence can also affect eligibility.

Because of these rules, changes in income or household circumstances can alter monthly SSI payments. Advocacy groups encourage recipients to report changes promptly to avoid overpayments, which the government may later seek to recover.

The SSI January 2026 Payment will reflect any reported changes processed before the payment date, reinforcing the importance of accurate and timely communication with program administrators.

Impact on Household Planning

For many recipients, SSI represents the primary or sole source of monthly income. As a result, payment timing has significant implications for household budgeting.

The early January payment means that recipients must stretch the December 31 deposit across the entire month of January. The next SSI payment after December 31 is scheduled for early February 2026, creating a longer-than-usual gap between deposits.

Financial counselors often advise beneficiaries to earmark the late-December payment specifically for January expenses. Failure to do so can leave households facing shortages late in the month, particularly for rent, heating costs, or prescription medications.

Economists note that while the calendar shift is predictable, it exposes the limited financial flexibility faced by many low-income households. Even temporary disruptions in cash flow can have outsized effects when savings are minimal or nonexistent.

Differences Between SSI and Other Social Security Payments

Although SSI is administered by the same federal agency that oversees Social Security retirement and disability insurance, the programs operate under different rules.

Social Security retirement and disability payments are based on a recipient’s earnings history and are generally issued on a staggered schedule tied to birth dates. SSI payments, by contrast, are issued on a uniform schedule for all recipients.

During months with holidays or weekends, both programs may issue payments earlier than usual, but the mechanisms and dates can differ. This distinction is particularly important for individuals who receive both SSI and Social Security benefits, as they may see deposits on separate dates.

The SSI January 2026 Payment follows the SSI calendar only and does not affect the timing of other Social Security benefits.

Administrative and Policy Context

The early January payment highlights the complexity of administering large federal benefit programs that serve millions of recipients nationwide. Payment schedules must account for banking systems, federal holidays, and state-level coordination.

From a policy standpoint, the shift does not reflect legislative action or changes to program funding. Instead, it demonstrates how administrative rules interact with the calendar to ensure continuity of payments.

Policy analysts note that such adjustments often generate public attention despite being routine. This attention can be beneficial, they argue, if it prompts greater awareness of benefit rules and encourages better financial planning among recipients.

Public Perception and Common Misunderstandings

Each year that includes an early January SSI payment tends to generate similar misconceptions. Some recipients believe they have received an extra payment, while others worry that a payment has been skipped.

Advocacy organizations and legal aid clinics frequently address these concerns through outreach campaigns, emphasizing that the total annual benefit remains unchanged.

Clear communication is especially important for vulnerable populations, including older adults and individuals with cognitive or physical disabilities, who may rely on caregivers or representative payees to manage finances.

Looking Ahead

As inflation trends, demographic shifts, and fiscal pressures continue to shape federal benefit programs, cost-of-living adjustments and payment schedules will remain a focal point for policymakers and advocates alike.

For now, federal officials stress that the SSI January 2026 Payment follows long-established rules and does not alter eligibility standards, benefit formulas, or the overall structure of the program.

Recipients are encouraged to review annual payment calendars, maintain accurate records, and plan carefully for months when payments arrive earlier than expected.

FAQs About SSI January 2026 Payment

Is the early payment a bonus or extra benefit?

No. It is the regular January benefit issued early due to a federal holiday.

Will there be fewer payments in 2026?

No. SSI recipients still receive twelve payments over the year.

Does everyone receive the same amount?

No. Payments vary based on income, resources, living arrangements, and state supplements.

Will this affect other government benefits?

No. The schedule change applies only to SSI and does not alter eligibility for other programs.