The Medicaid program, which provides health coverage to millions of low‑income individuals in the U.S., has been plagued by issues of improper payments for years. These errors, often caused by outdated records or miscommunication between state and federal agencies, have resulted in millions of dollars in waste.

One particularly glaring issue has been the $207 million in improper payments made to deceased beneficiaries — money that should not have been allocated to individuals who no longer needed the benefits.

To address this long‑standing problem, a new law has been passed that promises to reform the Medicaid system, reduce waste, and ensure funds are used appropriately. With a focus on improving eligibility checks, automating data verification, and increasing transparency, this law aims to fix the $207 million gap and secure the financial future of Medicaid.

The New Massive Medicaid Reform: Key Features and Its Impact

This reform law is a pivotal step in overhauling how Medicaid processes and distributes funds. Through a series of key provisions, it aims to eliminate improper payments and restore confidence in the program’s financial integrity.

1. Quarterly Death Record Audits

A central feature of the law requires Medicaid agencies to cross‑check enrollees against the Social Security Administration’s Death Master File on a quarterly basis. This critical step will ensure that payments are no longer made on behalf of deceased beneficiaries, a long‑standing issue that has cost the program millions.

The Death Master File includes vital information, such as death dates and personal identification numbers, which can help Medicaid quickly identify and remove ineligible individuals from the rolls.

2. Automated Eligibility Verification

The law also mandates the automation of eligibility verification. This system will cross‑reference beneficiary data with national and state databases to ensure that only eligible individuals remain enrolled.

Automation will reduce human error, speed up verification, and improve the overall accuracy of Medicaid records, ensuring faster processing times and more reliable eligibility checks.

3. Enhanced Oversight and Transparency

The reform expands the federal government’s role in overseeing Medicaid programs by mandating stricter audits and transparency in financial reporting. States will be required to report improper payments and demonstrate corrective actions, holding them accountable for any discrepancies.

This greater oversight is designed to ensure the integrity of the Medicaid program, preventing future waste and misuse of funds.

4. Improved Data Sharing and Technology Integration

Another key provision is increased access to key federal databases, allowing Medicaid agencies to better track enrollee data and prevent eligibility errors.

The law also encourages the use of new technologies to streamline processes, improve data sharing, and automate manual tasks, ultimately reducing costs and enhancing efficiency.

The $207 Million Gap: Why It Matters

Improper payments have been a serious problem for Medicaid for years, and the $207 million gap represents just one part of the larger issue. Between mid‑2021 and mid‑2022, millions of dollars were spent on behalf of deceased beneficiaries, highlighting systemic inefficiencies.

These errors, primarily driven by outdated or incomplete records, have undermined the integrity of the Medicaid program and drained valuable taxpayer dollars. This new law focuses on eliminating these inefficiencies, preventing wasteful spending, and ensuring funds go to those who truly need them.

By closing the $207 million gap and establishing systems for ongoing eligibility checks, the law promises to significantly improve Medicaid’s financial health and sustainability.

Real-World Examples of Medicaid’s Wasteful Payments

To understand the impact of improper payments, consider real-world examples where these errors have caused issues for both taxpayers and beneficiaries. One major issue identified in audits was payments for deceased individuals, which resulted in Medicaid covering medical expenses for people who were no longer alive.

This means taxpayer dollars were allocated incorrectly and services that were never provided were paid for. In some cases, beneficiaries who were mistakenly enrolled after their eligibility changed — due to factors such as income increase or relocation — also continued receiving benefits they were no longer qualified for, contributing further to unnecessary waste.

By automating checks and expanding access to the Death Master File, the law aims to eliminate these errors, ensuring that only those who need help will receive it.

The Role of Technology in Medicaid Reform

One of the most promising aspects of the new law is its focus on technology integration. The use of automated data verification and access to more comprehensive databases will help reduce human error and improve the speed of eligibility checks.

Technologies like artificial intelligence (AI) and data analytics could further enhance the program’s efficiency, helping identify patterns in data that could indicate improper payments and preventing fraud before it happens.

For instance, advanced data matching technologies will allow Medicaid to cross-check enrollee information in real-time, ensuring that changes in a person’s eligibility status — such as death or changes in income — are processed quickly. These improvements will help prevent errors and ensure that Medicaid funds are being spent responsibly.

Comparing Medicaid’s Reform to Other Government Programs

Medicaid isn’t the only public assistance program that has struggled with improper payments. Programs like Medicare and Social Security have faced similar challenges in verifying eligibility and ensuring accurate payments. However, the new Medicaid law could serve as a model for future reforms in these areas.

By focusing on data accuracy, increased audits, and the use of technology, Medicaid’s reforms could pave the way for more efficient operations in other public health and social programs. It demonstrates that systemic change can occur when data sharing and automation are prioritized.

Impact on the Medicaid Enrollment Process

For Medicaid beneficiaries, this law is expected to streamline the enrollment process while ensuring that only those who are truly eligible receive benefits. This reform will likely lead to faster enrollment times and more efficient processing of applications.

However, it’s important for recipients to keep their information up to date, as any inaccuracies could result in delays or potential issues with their benefits.

Additionally, the appeals process will be strengthened, providing beneficiaries with the opportunity to challenge any wrongful removals from Medicaid, ensuring that no one who is eligible is disenrolled unjustly.

Reactions from Stakeholders and Healthcare Advocates

Healthcare advocates have largely praised the law for its focus on improving Medicaid’s integrity. They argue that improving eligibility verification will reduce waste while ensuring that Medicaid funds are directed to those who need them most.

Advocates for low‑income individuals also believe the law will help streamline access to necessary care, while ensuring that fraud and waste are minimized.

Some state Medicaid directors have raised concerns about the administrative burden of implementing the new law, particularly in states with outdated infrastructure. However, the federal government is providing resources and support to help states transition smoothly.

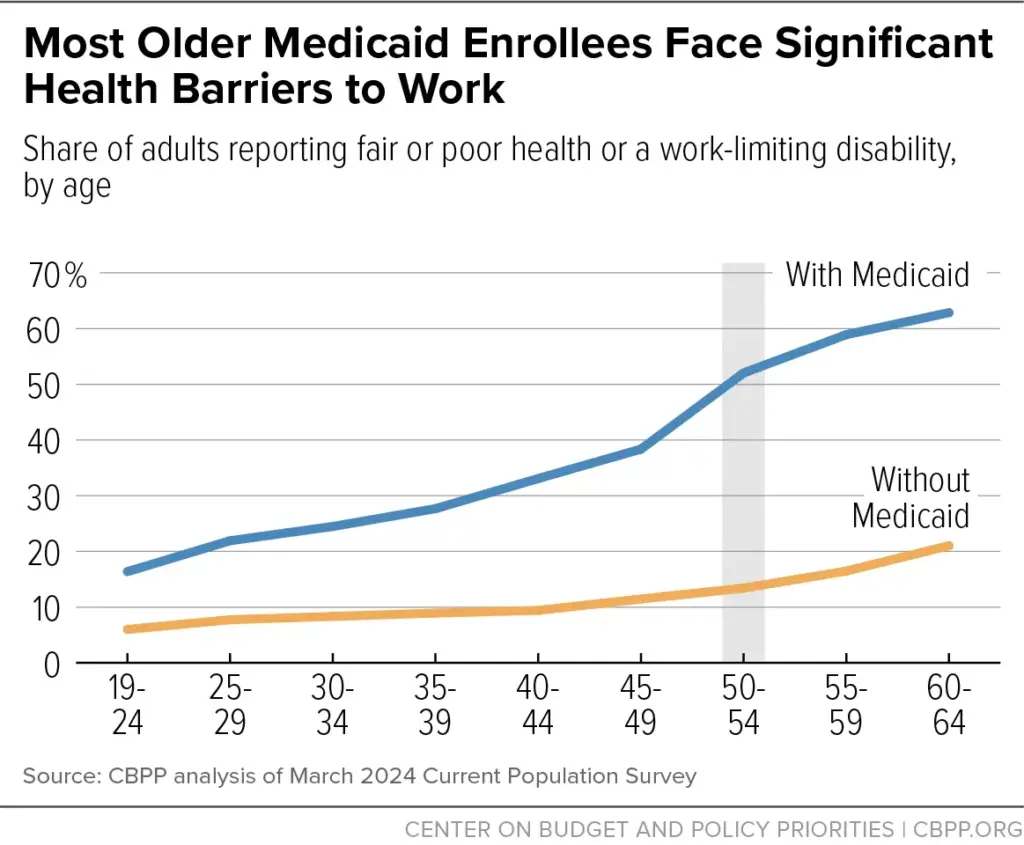

Challenges and Possible Drawbacks of Massive Medicaid Reform

While the new law aims to improve efficiency, there are challenges to overcome. One concern is the administrative cost involved in implementing new systems and ensuring accurate verification, especially in states with older systems.

Additionally, there is the potential for errors or wrongful disenrollment during the transition to automated systems. Despite these challenges, the overall goal of improving accuracy and accountability remains a priority, with mechanisms in place to protect legitimate beneficiaries from being wrongly excluded from the program.

Related Links

Rayus Radiology Settlement 2025: What the Website Tracking Lawsuit Was About

IRS Enforcement Reminder: When Missed Tax Deadlines Can Lead to Account Seizures

A Stronger, More Efficient Medicaid Program

The new Medicaid reform law is a game‑changer for the program, addressing the issue of improper payments head‑on and setting the stage for a more efficient, accountable system. By closing the $207 million gap in improper payments and strengthening eligibility checks, the law promises to save taxpayer dollars and ensure that Medicaid continues to serve those who truly need it.

The focus on technology, transparency, and regular audits marks a shift towards a more streamlined, data‑driven approach to public health management.

For beneficiaries, the law offers a more reliable program with improved access to benefits, while taxpayers can rest assured that their money is being used effectively. As the law is implemented, its success will likely have far‑reaching effects, setting the stage for future reforms across other federal programs and ensuring better use of public funds in the long term.