The Trump $2,000 tariff dividend payment proposal has emerged as one of the most debated economic ideas of 2025, promoted as a way to return tariff revenue directly to American households.

As the year comes to an end, however, the proposal remains unfunded, unauthorized by Congress, and not scheduled for payment, despite increased public discussion and political attention .

$2,000 Tariff Dividend Payment

| Key Issue | Status at End of 2025 |

|---|---|

| $2,000 tariff dividend checks | Proposed only |

| Payments authorized | No |

| Payments issued in 2025 | No |

| Congressional legislation | Not introduced |

| Earliest possible timing | 2026 (speculative) |

What the Tariff Dividend Proposal Is—and Is Not

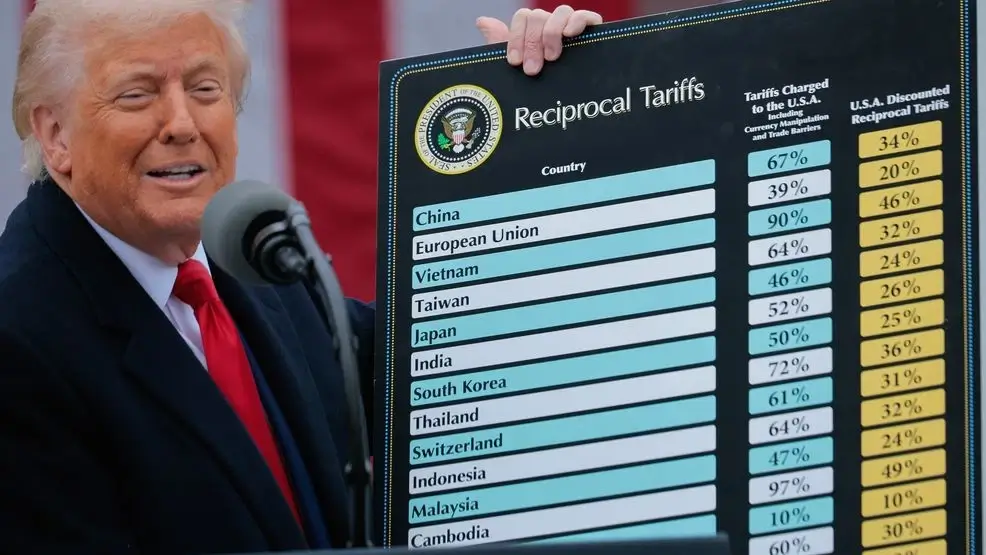

President Donald Trump has framed the tariff dividend as a direct return of money collected through tariffs imposed on imported goods during 2025. The concept is presented as a “dividend” rather than a stimulus, emphasizing redistribution of revenue rather than deficit spending.

Under the proposal as described publicly:

- Tariffs generate revenue through import duties

- A portion of that revenue would be returned to households

- Payments could reach “at least $2,000” per qualifying recipient

What the proposal is not:

- It is not a law

- It is not a funded program

- It is not administered by the IRS or Treasury at this time

No executive order or bill currently authorizes such payments.

What Has Changed as 2025 Comes to an End

More Specific Rhetoric, No Structural Progress

Early references to the tariff dividend were broad and aspirational. By late 2025, administration officials have offered more defined language, suggesting possible income limits and tentative timelines in 2026.

However, federal agencies have emphasized that:

- No administrative systems are being built

- No eligibility rules exist

- No funds have been earmarked

The proposal has evolved rhetorically, but not institutionally.

Why No Payments Are Possible Without Congress

Under the U.S. Constitution, Congress controls federal spending. Even though tariff revenue flows into the Treasury, it cannot be redistributed without explicit legislative authorization.

Federal officials have confirmed:

- The executive branch cannot issue checks unilaterally

- The IRS cannot distribute funds without statutory authority

- Tariff revenue currently goes into general federal accounts

Without legislation, the proposal cannot advance beyond discussion.

Funding Reality: Do Tariffs Cover the Cost?

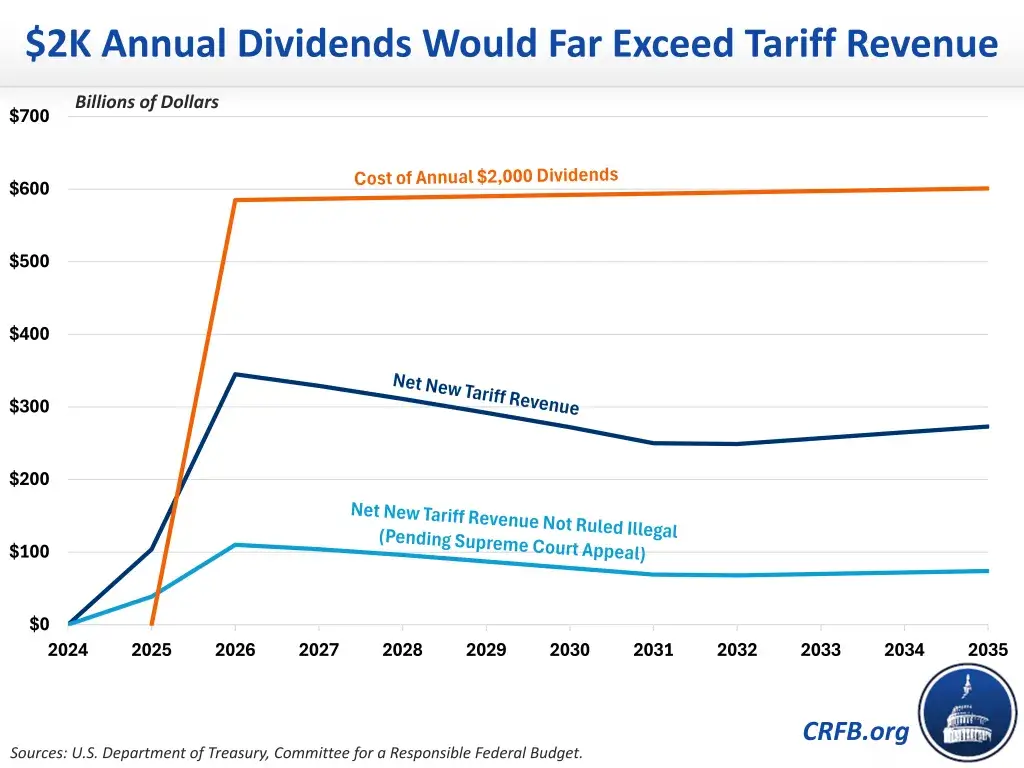

Independent analysts question whether tariff revenue could support payments of this scale.

Key concerns include:

- Nationwide $2,000 payments could cost hundreds of billions of dollars

- Annual tariff revenue is significantly lower than that amount

- Administrative costs would further reduce available funds

Economists also note that tariffs are largely paid by consumers through higher prices, meaning dividends would partially recycle money already absorbed by households.

Economic Trade-Offs and Inflation Concerns

Supporters argue the dividend could offset higher consumer prices caused by tariffs. Critics counter that:

- Cash payments may increase inflationary pressure

- Tariffs raise prices unevenly across income groups

- Deficit risks remain if revenue falls short

Many economists warn that the policy could create a cycle in which tariffs raise prices and dividends attempt—imperfectly—to compensate for those increases.

Distribution Challenges: How Would Payments Actually Work?

Unlike prior stimulus programs, there is no existing framework for tariff dividend distribution.

Unresolved questions include:

- Would payments be handled by the IRS or Treasury?

- Would tax returns determine eligibility?

- Would households without recent filings be excluded?

Building such infrastructure would take months, even after legislation passes.

How $2,000 Tariff Dividend Payment Compares to Past Federal Payments

The tariff dividend differs sharply from:

- COVID-era stimulus checks, which were deficit-funded and emergency-based

- The Alaska Permanent Fund, which is state-level and constitutionally established

There is no federal precedent for a nationwide tariff-funded dividend.

Impact on Businesses and Supply Chains

Business groups have expressed mixed reactions:

- Import-dependent retailers warn tariffs raise costs

- Manufacturers see uneven protection across sectors

- Small businesses face pricing and inventory volatility

Many argue that consumer dividends do not resolve underlying cost pressures caused by tariffs.

State-Level Economic Effects

Tariff impacts vary by region:

- Port states face higher import costs

- Manufacturing hubs may see selective benefits

- Agricultural states risk retaliatory trade measures

Any dividend program would distribute funds nationally, regardless of where tariffs have the greatest local impact.

International and Trade Partner Response

Foreign governments have criticized expanded tariffs as protectionist. Trade partners argue that redistributing tariff revenue domestically:

- Does not offset global supply chain disruption

- May invite retaliatory measures

- Increases uncertainty in global markets

Trade analysts warn that dividend payments could further politicize trade policy.

Misinformation and Scam Warnings About $2,000 Tariff Dividend Payment

Federal agencies have warned the public about false claims involving:

- “Automatic” checks

- Registration websites

- Fees required to receive dividends

Officials stress that no legitimate application exists, and any such claims are fraudulent.

Related Links

Social Security Tax Rules by State – Check Which States Will Tax Your Benefits in 2026

What to Watch in 2026

Signs the proposal is advancing would include:

- Introduction of legislation

- Congressional Budget Office cost estimates

- Treasury or IRS planning guidance

- Clear eligibility definitions

Absent these steps, the proposal remains aspirational.

As 2025 ends, the Trump $2,000 tariff dividend payment remains a prominent political proposal rather than an operational policy. While messaging has become more detailed, the absence of legislation, funding certainty, and administrative planning means Americans should view the idea as conceptual, not imminent.