Millions of Americans who rely on monthly Social Security income will see their first payments of 2026 arrive earlier than usual, with checks issued on January 2, 2026, for a specific group of beneficiaries.

The Social Security January 2 Payments follow federal scheduling rules tied to holidays and weekends, determining which recipients are paid first as the new year begins.

Social Security January 2 Payments

| Key Fact | Detail |

|---|---|

| First payment date | January 2, 2026 |

| Who is paid first | Pre-May 1997 beneficiaries |

| SSI January payment | Issued Dec. 31, 2025 |

| COLA applied | January 2026 benefits |

| Delivery | Direct deposit / Direct Express |

Why January 2 Is the First Social Security Payment Date of 2026

Social Security benefits are not issued on weekends or federal holidays. When a scheduled payment date falls on either, the payment is released on the preceding business day. In 2026, January 1 falls on New Year’s Day, a federal holiday.

As a result, payments that would normally be issued on January 3 are advanced to Friday, January 2 under standard procedures used by the Social Security Administration. This adjustment is routine and occurs several times each year when holidays intersect with payment schedules.

Which Beneficiaries Receive Social Security Payments on January 2, 2026

Long-Time Beneficiaries Paid Before May 1997

The largest group receiving January 2 payments includes individuals who began receiving Social Security before May 1, 1997. These beneficiaries remain on a legacy payment cycle that issues benefits on the 3rd of each month rather than on a birth-date-based Wednesday.

Because January 3, 2026, falls on a Saturday, the payment is moved to the prior business day. This group includes retirees, disabled workers, and survivors who enrolled before the payment system was modernized in the late 1990s.

Beneficiaries Receiving Both Social Security and SSI

Individuals who receive both Social Security and Supplemental Security Income (SSI) also receive their Social Security benefit on January 2.

SSI is normally paid on the 1st of each month, but because January 1, 2026, is a holiday, the SSI payment is issued on December 31, 2025. The Social Security portion follows on January 2, maintaining program separation while avoiding delays.

When All Other Beneficiaries Are Paid in January 2026

Beneficiaries who began receiving Social Security after May 1997 are paid on Wednesdays based on their birth date:

- January 14, 2026 – Birthdays from the 1st through the 10th

- January 21, 2026 – Birthdays from the 11th through the 20th

- January 28, 2026 – Birthdays from the 21st through the 31st

This staggered schedule spreads payment processing across the month and reduces administrative strain.

Cost-of-Living Adjustment and January Payments

January payments are significant because they reflect the annual cost-of-living adjustment (COLA). For 2026, beneficiaries receive higher monthly amounts intended to offset inflation.

For Social Security recipients, the COLA appears in January. For SSI recipients, it appears in the December 31, 2025 payment because that check represents January benefits. This timing difference often causes confusion at the start of the year.

Medicare Premium Deductions and Net Payment Amounts

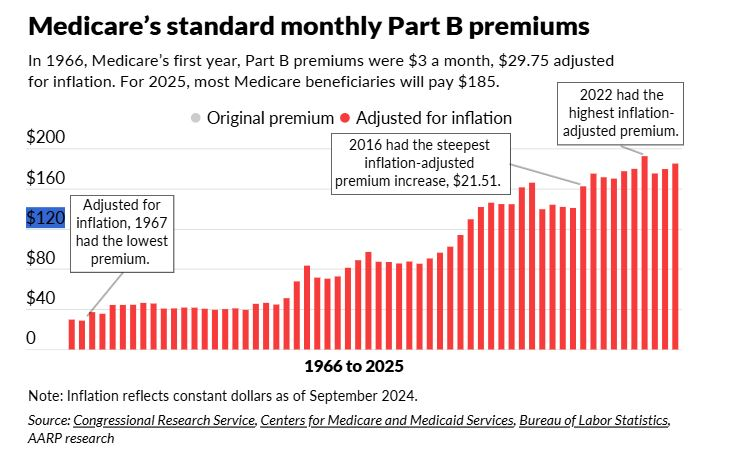

Many beneficiaries have Medicare Part B premiums deducted directly from their Social Security payments. These deductions are applied before funds are deposited, meaning the amount received on January 2 reflects any updated premiums.

Some higher-income beneficiaries may also see IRMAA surcharges, which can reduce the net deposit amount even as the COLA increases gross benefits. SSA advises beneficiaries to review benefit statements carefully to understand changes.

How Payments Are Processed by Treasury and Banks

Social Security payments are issued by the U.S. Treasury and transmitted electronically to banks and Direct Express accounts.

While SSA releases funds on January 2, banks control posting times. Some institutions credit deposits overnight, while others process them later in the day or next business day. State-specific bank holidays or internal processing schedules can also affect posting times.

What to Do If a January 2 Payment Is Delayed

SSA advises beneficiaries to:

- Wait three business days before reporting a missing payment

- Check bank or Direct Express account history

- Confirm payment date through a “my Social Security” account

Most delays are caused by bank processing, not SSA errors.

Direct Express vs. Bank Deposits

Beneficiaries using Direct Express cards typically receive funds on the official payment date. Bank account holders may see deposits earlier or later depending on their institution. SSA recommends electronic payment methods to avoid postal delays and reduce fraud risk.

Impact on Beneficiaries Living Abroad

Beneficiaries living outside the United States generally receive payments on the same schedule, though international banking systems may introduce additional delays. SSA encourages overseas recipients to use U.S. bank accounts when possible to ensure timely deposits.

Fraud and Scam Warnings at the Start of the Year

SSA warns that scammers often target beneficiaries around January payment changes, claiming early payments or COLA adjustments require verification. SSA does not contact beneficiaries by phone, email, or text to request personal information related to payments.

Historical Context: How January Payments Have Shifted Before

Early January payments are not unusual. Similar shifts occurred in:

- 2021 (New Year’s Day on Friday)

- 2016 (holiday-weekend overlap)

Each instance followed the same administrative rules used in 2026.

Looking Ahead: Other Holiday Shifts in 2026

Additional payment shifts may occur later in 2026 when federal holidays overlap with scheduled payment dates, particularly in July and October. Understanding January’s schedule helps beneficiaries anticipate similar adjustments later in the year.

Related Links

Working While Collecting Social Security – How the New 2026 Rules May Change Your Monthly Check

The Social Security January 2 Payments ensure that long-time beneficiaries and those receiving combined benefits start 2026 with uninterrupted income despite holiday timing. While the early payment is routine, officials urge beneficiaries to understand the schedule, monitor deposits carefully, and plan budgets accordingly as the year begins.

FAQs About Social Security January 2 Payments

Is the January 2 payment extra money?

No. It is a regular monthly benefit paid early due to calendar rules.

Will everyone be paid on January 2?

No. Most beneficiaries are paid later in January based on birth date.

Does the January payment include the COLA?

Yes. January payments reflect the 2026 cost-of-living adjustment.