Starting January 2026, Social Security beneficiaries across the United States will experience a 2.8% Cost-of-Living Adjustment (COLA) to their monthly payments. This increase, designed to help beneficiaries cope with rising living costs, will affect millions of retirees, disabled workers, and survivors, as well as individuals receiving Supplemental Security Income (SSI).

While this boost brings relief, recipients will also face new challenges due to rising healthcare costs and other economic pressures.

January 2026 Social Security COLA

| Key Fact | Detail/Statistic |

|---|---|

| COLA increase | 2.8% |

| Average retired worker benefit | ~$2,071 (after increase) |

| Average couple’s benefits | ~$3,208 (after increase) |

| SSI payments rise | From $967 to $994 for individuals |

| SSI couple’s maximum increase | From $1,450 to $1,491 |

| Medicare Premium Impact | 2026 premiums will rise, impacting net Social Security checks |

The 2.8% Increase Explained: What Does It Mean for Beneficiaries?

The 2.8% COLA represents a necessary adjustment to help Social Security payments keep pace with inflation. As inflation rises, the cost of everyday expenses such as food, housing, and medical care can outstrip the purchasing power of fixed-income recipients. This annual adjustment is a mechanism used by the Social Security Administration (SSA) to protect beneficiaries’ ability to maintain their standard of living.

This year, the average Social Security recipient will see their monthly payment increase by $56, bringing the typical benefit amount for retirees to $2,071. For couples, the average benefit will rise by $88, bringing the total to $3,208. Meanwhile, SSI recipients will see their payments rise by $27 per month (from $967 to $994 for individuals, and $1,450 to $1,491 for couples).

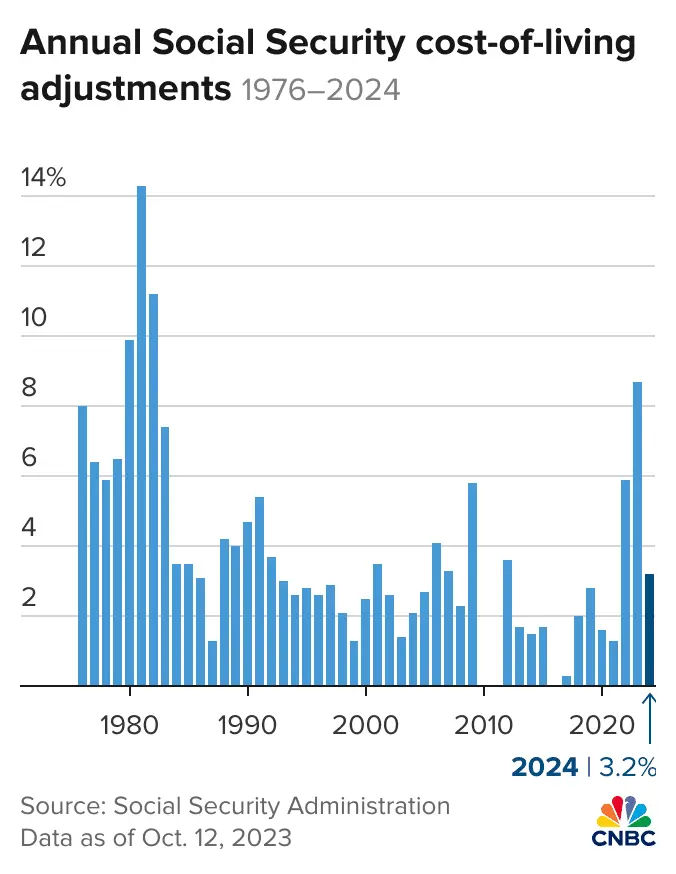

Historical Context: A Trend in COLA Increases

The 2.8% increase in 2026 is a significant shift, representing a substantial rise compared to previous years. Over the last few decades, COLA increases have ranged from 0% to 3.6%—often below the level of inflation, especially during periods of low inflation.

However, this 2.8% increase surpasses some earlier increases, which often failed to match the real inflation burden faced by Social Security recipients.

In 2022, the COLA was set at a historic 5.9% in response to skyrocketing inflation, the highest in four decades. In 2023, it dropped to 8.7% due to slightly improved economic conditions. The 2026 adjustment reflects ongoing inflation concerns but also signals a stabilization compared to the significant increases of recent years.

Impact of the COLA on Different Groups of Beneficiaries

Retirees

The 2.8% COLA will provide retirees with additional financial relief in the face of persistent inflation. This boost will help offset increased costs in healthcare, groceries, and other daily living expenses.

The average retired worker will receive an additional $56, bringing their monthly payment to around $2,071. While this amount may seem small, it can help recipients manage essential expenses and maintain their quality of life.

Disabled Workers (SSDI)

For Social Security Disability Insurance (SSDI) beneficiaries, the COLA provides a modest increase to monthly payments. The average SSDI beneficiary will see an additional $44, bringing their total to approximately $1,630 per month. Although it does not cover all rising expenses, this increase is a crucial lifeline for individuals unable to work due to severe disabilities.

Supplemental Security Income (SSI)

The SSI program, designed to assist individuals with limited income and resources, is similarly impacted by the 2.8% increase. SSI recipients will see their payments rise by $27, bringing individual payments from $967 to $994, and couples’ payments from $1,450 to $1,491.

Given that many SSI recipients are already living on the margins of poverty, this increase is essential in helping them maintain access to basic necessities.

When Will the COLA Payments Arrive?

As with every year, the timing of the COLA payments is important. Payments for January 2026 will begin arriving on the 1st of the month. However, due to the New Year’s holiday, some recipients—particularly those on SSI—will receive their payments a day earlier on December 31, 2025. Other Social Security recipients will see their payments based on their birthdate, as follows:

- Birthdays 1st–10th: Payment on January 14, 2026

- Birthdays 11th–20th: Payment on January 21, 2026

- Birthdays 21st–31st: Payment on January 28, 2026

Medicare Premium Increases: A Balancing Act

While the COLA increase provides relief, many beneficiaries will see a portion of it offset by rising Medicare premiums. The Medicare Part B premium, which covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items, is expected to rise again in 2026.

These increased premiums will be deducted from Social Security checks, affecting the net increase that beneficiaries will see in their monthly payments.

This increase is a challenge for many, especially those with complex medical needs or higher-than-average healthcare costs. While the COLA helps, it does not fully counterbalance the rising healthcare expenditures that Social Security recipients often face.

Related Links

Social Security January 2 Payments – Which Beneficiaries Are First to Receive Checks in 2026

Wells Fargo Cash Bonus – The One Requirement That Unlocks a $325 Payout

The Economic Context of the COLA Increase

The 2.8% COLA increase is set against the backdrop of a changing economic landscape. While inflation has slowed since the 2022 surge, it remains higher than in previous decades. Rising costs for housing, food, and healthcare have hit retirees and disabled workers particularly hard, as these groups typically rely on fixed incomes.

The COLA provides an important safeguard, but it doesn’t fully restore purchasing power to pre-inflation levels. Economists continue to debate whether such COLA adjustments can keep up with real inflation, especially in areas where living costs have skyrocketed.

Social Security reform discussions also revolve around how sustainable these kinds of adjustments are, given the long-term funding challenges facing the program.

The Future of Social Security: What’s Next?

Looking beyond 2026, the future of Social Security remains a significant topic of debate in Washington. Some policymakers argue for greater flexibility in the COLA calculation to better reflect the spending patterns of older Americans, while others push for structural changes to the program to ensure its long-term solvency.

As discussions about Social Security reform intensify, the COLA increase will likely remain a key point of focus. Advocates for Social Security recipients are pushing for adjustments that would keep pace with actual living costs, particularly for those facing higher-than-average healthcare expenses.