Claims that the IRS sending $1,390 relief payments in January 2026 have spread rapidly online, raising expectations among millions of Americans.

Yet a review of federal law, congressional records, and official tax guidance shows no evidence of a new nationwide relief program, highlighting how routine tax refunds are often mischaracterized as stimulus payments.

$1,390 Relief Payments in January 2026

| Topic | Verified Status |

|---|---|

| $1,390 IRS relief checks | Not authorized |

| January 2026 payments | Routine tax refunds only |

| Congressional approval | No bill passed |

| IRS confirmation | No official announcement |

| Scam risk | Elevated |

What Is Being Claimed — and Why It Matters

Online posts, videos, and articles claim that Americans will automatically receive $1,390 from the federal government in January 2026. Some assert the payments are tied to inflation relief, tariff revenues, or unspent federal funds.

Such claims matter because they influence household financial planning. For lower- and middle-income families, the expectation of a guaranteed payment can affect spending decisions, debt management, and tax filing behavior.

However, none of the claims cite enacted legislation, official budget documents, or statements from the Internal Revenue Service or the U.S. Treasury.

The Legal Reality: How IRS Payments Are Actually Created

The IRS does not have independent authority to issue relief payments. Every large-scale federal payment program follows the same legal path:

- Congress passes legislation authorizing payments

- The president signs the bill into law

- The Treasury Department funds the program

- The IRS administers distribution

This process governed all pandemic-era stimulus checks between 2020 and 2021. Without congressional action, no new relief payments—of any amount—can legally be issued. As of now, Congress has passed no law authorizing $1,390 payments in 2026.

Where the $1,390 Number Likely Comes From

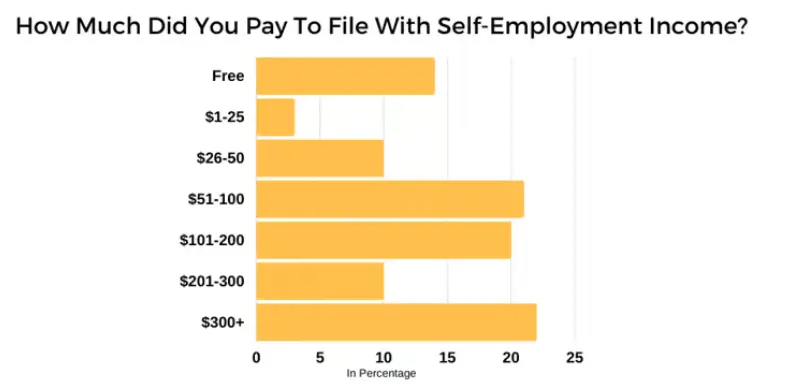

Tax experts say the figure closely resembles:

- The average federal tax refund received by many filers

- Typical outcomes from refundable credits such as the Earned Income Tax Credit

- Aggregated refund amounts misrepresented as uniform payments

“Refund averages are often mistaken for guaranteed benefits,” said Howard Gleckman of the Urban-Brookings Tax Policy Center in prior public analysis. “That confusion fuels viral misinformation.” A refund is not relief. It is the return of overpaid taxes.

What Payments Are Legitimate in January 2026

Regular Tax Refunds

Taxpayers who file early for the 2025 tax year may receive refunds in January 2026. Refund timing depends on filing method, accuracy, and whether direct deposit is selected.

Refundable Tax Credits

Credits such as:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit

can result in sizable refunds, but amounts vary by income, family size, and eligibility.

Amended or Corrected Returns

Some taxpayers may receive additional payments if the IRS adjusts a return or processes an amended filing. These are individual outcomes, not universal programs.

Why Stimulus Rumors Continue Years After the Pandemic

Economists point to several forces sustaining these claims:

- Residual expectations from COVID-era stimulus

- High inflation fatigue, even as inflation cools

- Election-year speculation

- Algorithm-driven content amplification

During the pandemic, stimulus checks were unprecedented in speed and scale. That experience reshaped public expectations of government response during economic stress. But fiscal conditions have changed.

The Economic Context: Why New Relief Is Unlikely

Federal budget pressures are far greater today than in 2020:

- Rising interest costs on national debt

- Reduced appetite for deficit spending

- Political division over entitlement expansion

Most current economic proposals focus on targeted tax credits, not universal cash payments. “There is little bipartisan support for broad stimulus checks outside of a severe recession,” said Elaine Maag, a senior fellow at the Urban Institute.

Heightened Scam Risk for Taxpayers

False payment claims create fertile ground for fraud.

The IRS warns taxpayers to be cautious of:

- Emails or texts claiming “pre-approved payments”

- Requests for verification fees

- Links mimicking IRS branding

- Social media messages promising guaranteed checks

The IRS does not initiate contact through text messages or social platforms.

What to Do If You’re Expecting Money

Financial professionals recommend:

- Filing taxes early and accurately

- Using official IRS refund tracking tools

- Updating direct deposit information

- Ignoring unofficial payment claims

Rely exclusively on IRS.gov or established national news organizations for confirmation.

Related Links

Social Security January 2 Payments – Which Beneficiaries Are First to Receive Checks in 2026

Wells Fargo Cash Bonus – The One Requirement That Unlocks a $325 Payout

Could New Relief Still Happen Later in 2026?

While Congress could theoretically pass new aid legislation, there is currently:

- No active bill

- No budget allocation

- No implementation timeline

Any future program would require months of legislative and administrative preparation.

Despite widespread online claims, there is no evidence that the IRS sending $1,390 relief payments in January 2026 is real. What Americans may receive instead are ordinary tax refunds or credits based on individual filings, not a new federal relief initiative. Until Congress acts, the claim remains misinformation.