The Social Security payroll tax limit for 2026 is set to rise to $160,200, meaning that any earnings above this threshold will no longer be subject to Social Security taxes. This adjustment, which is part of the yearly recalculation based on wage inflation, affects millions of American workers.

In this article, we break down how much you can earn before taxes rise, the long-term implications of this change, and its impact on Social Security benefits.

Social Security Payroll Tax Limit 2026

| Key Fact | Detail/Statistic |

|---|---|

| 2026 Social Security Tax Limit | $160,200 (estimated) |

| Tax Rate | 6.2% for employees; 12.4% for self-employed individuals |

| Earnings Beyond Limit | Income above $160,200 will not be subject to Social Security tax |

| Increase from 2025 | Increase of $5,500 from 2025 limit of $154,700 |

| Estimated Impact on 2026 Budget | Higher cap contributes to a projected $1.2 trillion in Social Security tax revenue |

Understanding the Social Security Payroll Tax Limit

The Social Security payroll tax applies to earnings up to a certain annual limit, after which wages are no longer taxed for the program. In 2026, this limit is projected to rise to $160,200, a slight increase from the 2025 limit of $154,700. Workers with annual earnings exceeding this threshold will not contribute additional income to the Social Security trust fund for the remainder of the year.

This cap applies to wages earned by employees as well as self-employed individuals, with the same limit for both groups. However, while employees and employers each pay 6.2% on wages up to the limit, self-employed individuals are responsible for the full 12.4% tax.

The Social Security Administration (SSA) updates the payroll tax limit annually, based on changes in the national average wage index. These adjustments ensure that the system keeps pace with inflation and wage growth, preserving the tax base.

Why the Tax Limit Changes Each Year

The cap on Social Security taxable income isn’t arbitrary; it is tied directly to wage growth across the country. Every year, the SSA calculates this cap to reflect the average wage increase. If wages rise significantly in any given year, the tax limit is adjusted accordingly.

This mechanism is intended to keep Social Security revenues in line with the overall growth of wages, helping fund the benefits of current and future retirees.

For instance, as wages in high-paying sectors like technology and finance increase, the Social Security tax limit will also rise to ensure the program’s solvency. However, this also means that the top earners face fewer tax obligations for Social Security after reaching the cap.

How This Affects High Earners

While an increase in the Social Security payroll tax limit may seem inconsequential to high-income earners, it has direct implications for the total taxes they pay. For individuals earning $250,000 in 2026, they will pay the Social Security tax on the first $160,200 of their income, but their $89,800 in income beyond that amount will not be subject to the tax.

This creates a situation where higher-income individuals contribute a smaller percentage of their total earnings to Social Security, especially when compared to middle and lower-income workers who pay the tax on nearly all of their earnings.

The Impact on Social Security Benefits

Although the payroll tax is capped, the amount you contribute to Social Security impacts the benefits you’ll eventually receive. The Social Security program calculates benefits based on your highest-earning years, so individuals with higher lifetime earnings generally receive higher monthly payments upon retirement. However, once income surpasses the taxable maximum, no further contributions are made, even though the individual may be earning significantly more.

For example, a worker earning $200,000 annually will contribute the same amount to Social Security as a worker earning $160,200, despite the former’s higher total income. This system leads some to argue that the wealthy are contributing disproportionately less, given their income.

Long-Term Effects on the Social Security Trust Fund

The increase in the Social Security payroll tax limit for 2026 has broad implications for the future sustainability of the Social Security system. As wages grow in high-paying industries, fewer workers pay taxes on their full income.

This raises the question of whether the current system is financially viable long-term, especially as the U.S. population continues to age. According to projections from the SSA, the total Social Security tax revenue is expected to reach $1.2 trillion by 2026, but this revenue might not be sufficient to cover the growing number of beneficiaries.

Without a change to the taxable income cap, the trust fund could face a shortfall in the coming decades, leading to possible future reforms.

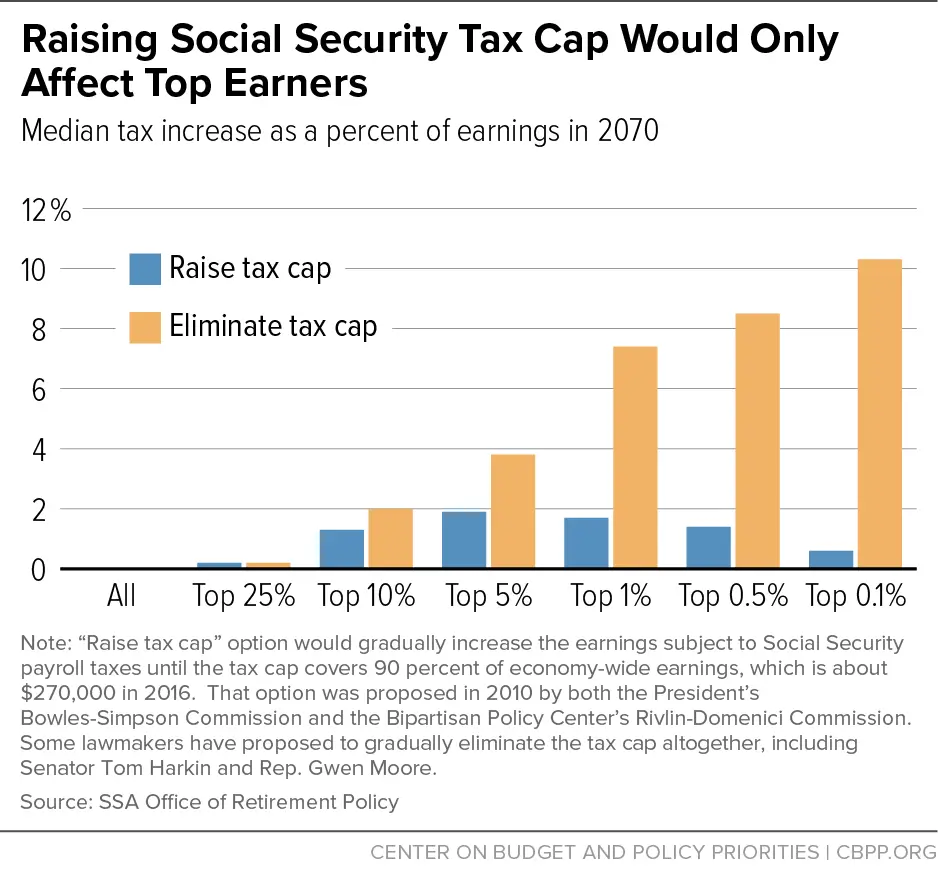

Potential Social Security Reforms: Raising or Removing the Cap

Given the concerns over the program’s solvency, many policymakers have discussed raising or removing the Social Security tax cap altogether. This would ensure that high earners contribute a more equitable share to the program, potentially extending the trust fund’s life and increasing benefits for lower earners.

Several proposals have been made to either increase the taxable maximum or remove the cap entirely. While these changes could help strengthen Social Security, they would also increase taxes on high earners, making them a tough sell politically.

Supporters of reform argue that the current cap system is unfair, as it allows the wealthiest individuals to contribute a smaller percentage of their income toward Social Security.

However, opponents worry that removing the cap could result in significant tax hikes for small businesses and high-income individuals, potentially stifling economic growth.

The Politics of Social Security Tax Reform

The debate over Social Security tax limits is not just about fairness but also about the future of the program. As the population ages, fewer workers will be supporting more retirees, placing strain on the program’s finances.

Policymakers are faced with tough decisions about whether to raise taxes, cut benefits, or reform the system in other ways. Some reform advocates suggest a gradual approach, such as raising the tax cap incrementally over time.

Others propose more drastic measures, including overhauling the benefit structure itself. Regardless of the path taken, the discussion is unlikely to end soon, and workers—especially high earners—should stay informed about potential changes.

What This Means for Retirement Planning

For those approaching retirement, the rise in the tax limit could have several implications. First, high earners who have maxed out their Social Security contributions each year will notice that the cap has risen slightly. This means they will contribute more in 2026 than they did in 2025.

Second, individuals nearing the limit may want to consider how this change affects their long-term retirement planning, especially if the tax structure shifts further in the coming years.

Advisors often recommend that individuals maximize their contributions to Social Security to maximize their future benefits. However, it’s essential to understand how the changes in the tax cap could impact both your contributions and the benefits you will receive once you retire.

Related Links

Tax Refunds Could Be Bigger in 2026 — Here’s When the IRS Will Start Accepting Returns

IRS Sending $1,390 Relief Payments in January 2026 — Check Your Eligibility & Payment Date

The adjustment to the Social Security payroll tax limit in 2026 reflects a complex balancing act between maintaining program solvency and addressing fairness in the tax system.

While high earners may see little direct impact from the change, it underscores broader debates about the future of Social Security and the potential need for reform. As the conversation continues, workers of all income levels should remain vigilant and prepared for any future changes that may come.

FAQs About Social Security Payroll Tax Limit 2026

Q: What happens to my Social Security tax after I exceed the cap?

A: Once you exceed the Social Security payroll tax limit, your income will no longer be subject to the Social Security tax for the rest of the year.

Q: Does exceeding the tax limit affect my Social Security benefits?

A: Yes, although your contributions stop once you exceed the cap, your benefits are based on your highest earning years. Earnings above the cap will not increase your future benefits.

Q: Will the Social Security tax cap continue to rise?

A: Yes, the cap is adjusted annually based on wage inflation, and it is expected to rise in the future.