Millions of Supplemental Security Income (SSI) recipients in the United States may notice what appears to be a Social Security third check arriving close to the end of January 2026. The payments are legitimate and expected, but they do not represent new or bonus money. Instead, they result from long-standing federal payment rules combined with the timing of holidays and weekends at the start of the year.

The unusual clustering of payments has drawn attention because it coincides with the 2026 cost-of-living adjustment (COLA), which raises monthly benefit amounts. For recipients living on fixed incomes, the timing can significantly affect budgeting, rent payments, and eligibility calculations for other assistance programs.

Social Security Third Check

| Key Fact | Detail |

|---|---|

| PRIMARY-KEYWORD | “Social Security third check” refers to closely timed SSI payments, not extra benefits |

| Maximum SSI benefit in 2026 | Up to $994 for individuals and $1,491 for couples |

| Reason for timing shift | Federal holidays and weekend payment rules |

| Next adjusted SSI payment | January 30, 2026 |

What Is the “Social Security Third Check”?

The term Social Security third check is informal and not used by the Social Security Administration. It has emerged in media coverage and online discussions to describe situations in which SSI recipients see three deposits within a short period, often spanning late December and January.

Under normal circumstances, SSI benefits are paid once per month. However, when payment dates are shifted earlier because of holidays or weekends, deposits may arrive in rapid succession. This can create the impression of an extra check even though the annual total benefit amount remains unchanged.

Experts emphasize that understanding the distinction between payment timing and payment entitlement is essential. “These are standard benefits paid on an adjusted schedule,” the SSA has repeatedly stated in public guidance. “They are not additional payments.”

Why It Happens: Calendar Rules and the 2026 Cost-of-Living Adjustment

Federal Holiday and Weekend Effects

SSI payments are typically issued on the first day of each month. When that date falls on a federal holiday or weekend, the SSA issues the payment on the preceding business day to ensure beneficiaries are not delayed in receiving funds.

In early 2026, two calendar factors converge:

- January 1, 2026, is a federal holiday (New Year’s Day), prompting January’s SSI payment to be issued on December 31, 2025.

- February 1, 2026, falls on a Sunday, leading the February payment to be issued on Friday, January 30, 2026.

As a result, eligible recipients may receive payments on December 1, December 31, and January 30, all within roughly eight weeks.

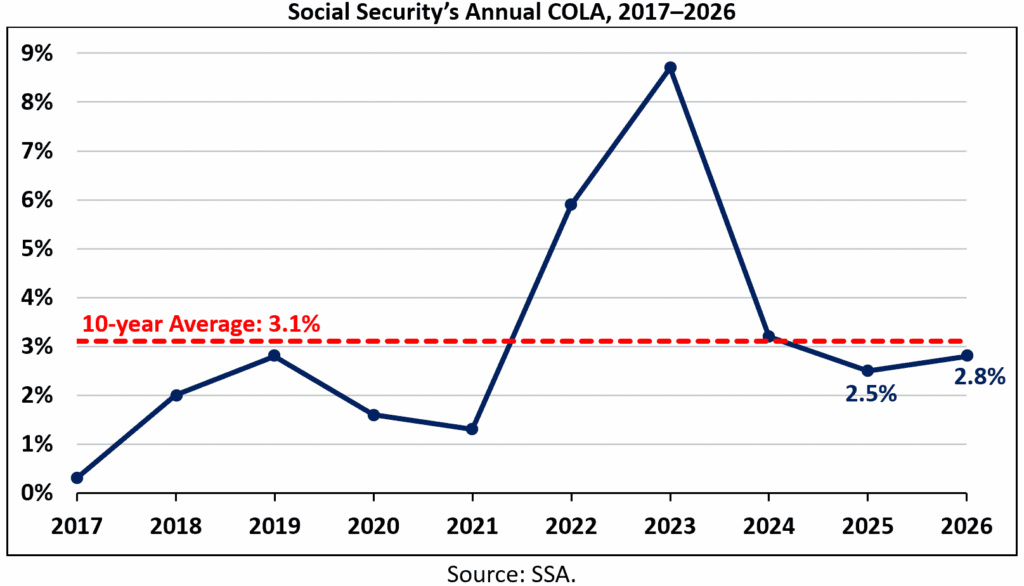

2.8 % Cost-of-Living Adjustment

Adding to the attention is the 2.8 % COLA for 2026, which raises SSI payment amounts to:

- $994 per month for individuals

- $1,491 per month for eligible couples

The COLA is based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) and is designed to preserve purchasing power amid rising prices for housing, food, and medical care.

Who Is Affected?

The calendar shift primarily affects SSI recipients, not all Social Security beneficiaries. SSI is a means-tested program serving individuals who are aged, blind, or disabled and have limited income and resources.

Those receiving Social Security retirement, survivor, or disability insurance (SSDI) typically receive payments based on their birth dates and will not see three clustered payments during this period.

Housing advocates note that SSI recipients are often among the most economically vulnerable. Even small changes in payment timing can affect rent cycles, utility payments, and access to food assistance.

How Much Could a Recipient See?

At the maximum benefit level, an eligible couple could receive up to $4,432 across the three deposits. While the amount may appear substantial, it represents three separate monthly payments, not a lump-sum bonus.

Financial counselors caution recipients to budget carefully, noting that there will be no SSI payment issued in February 2026, because that month’s benefit was paid early in January.

What Recipients Should Know

This is not extra income. The SSA stresses that early payments do not increase annual benefits and should be managed accordingly.

Recipients are encouraged to:

- Review official SSA payment schedules

- Track deposits through a My Social Security account

- Avoid assuming that early payments indicate eligibility changes

Broader Context: Changes in 2026

Beyond payment timing, 2026 brings several broader changes:

- Higher earnings limits for Social Security beneficiaries who work

- Adjustments to the taxable earnings cap

- Continued debate in Congress over long-term program solvency

While none of these changes directly create a “third check,” they contribute to public confusion about benefit increases and schedules.

Why the “Third Check” Narrative Persists

Public misunderstanding of Social Security payment mechanics is common. Advocacy groups point to:

- Complex benefit rules

- Limited financial literacy resources

- Viral social media claims that exaggerate payment changes

This environment allows misleading narratives about “extra checks” to spread quickly, particularly among older Americans who rely on fixed incomes.

Budgeting Challenges for SSI Recipients

Receiving multiple payments close together can complicate monthly budgeting. Experts advise setting aside funds for months when no deposit arrives.

Nonprofit financial counselors recommend treating early payments as if they arrived on their original schedule to avoid shortfalls later in the year.

How This Affects Other Benefits

Early SSI payments can temporarily inflate bank balances, potentially affecting eligibility for programs such as:

- Supplemental Nutrition Assistance Program (SNAP)

- Medicaid in some states

Recipients should consult caseworkers if they have concerns about asset limits.

Tax Refunds Could Be Bigger in 2026 — Here’s When the IRS Will Start Accepting Returns

Historical Precedent

Similar payment clusters have occurred in previous years when calendar alignments produced early payments. The SSA has consistently applied the same rules, underscoring that this is a routine administrative practice rather than a policy shift.

FAQs About Social Security Third Check

Is the Social Security third check real?

Yes, but it reflects timing, not extra money.

Will everyone on Social Security get it?

No. It primarily affects SSI recipients.

Will there be fewer payments later?

There will be no SSI payment in February 2026 because it is paid early.