In early 2026, President Donald Trump reignited discussions about a potential $2,000 stimulus payment tied to U.S. tariff revenue. The proposal, often referred to as a tariff dividend, has caught the public’s attention, with supporters arguing it could provide crucial relief to Americans in need.

However, no formal approval has been given for such a payment, and it remains unclear whether this idea will move forward or if qualifying Americans will receive any funds in the future.

While the idea of a $2,000 tariff dividend has generated considerable attention in the media, especially in the context of the ongoing debate about trade policies and government spending, there’s a critical distinction: this remains a proposal, not an actual program. It would require new legislation, careful structuring, and formal approval from Congress and the IRS before any payments could be issued.

What the $2,000 Stimulus Proposal Really Is

The proposed $2,000 stimulus isn’t yet a formal government plan. Instead, it’s based on the idea of distributing tariff revenue back to American consumers. President Trump and some of his advisors have suggested that the government should use money generated from tariffs on imports to fund direct payments to U.S. residents.

Trump has indicated that such payments could be a dividend or rebate, benefiting individuals and families. However, this plan has not been passed into law. A White House spokesperson confirmed that the idea is still being considered and that no payments are scheduled for 2026.

Any such payment would require a new act of Congress, including clear guidelines on who qualifies and how payments would be processed.

The Economics of a Tariff Dividend

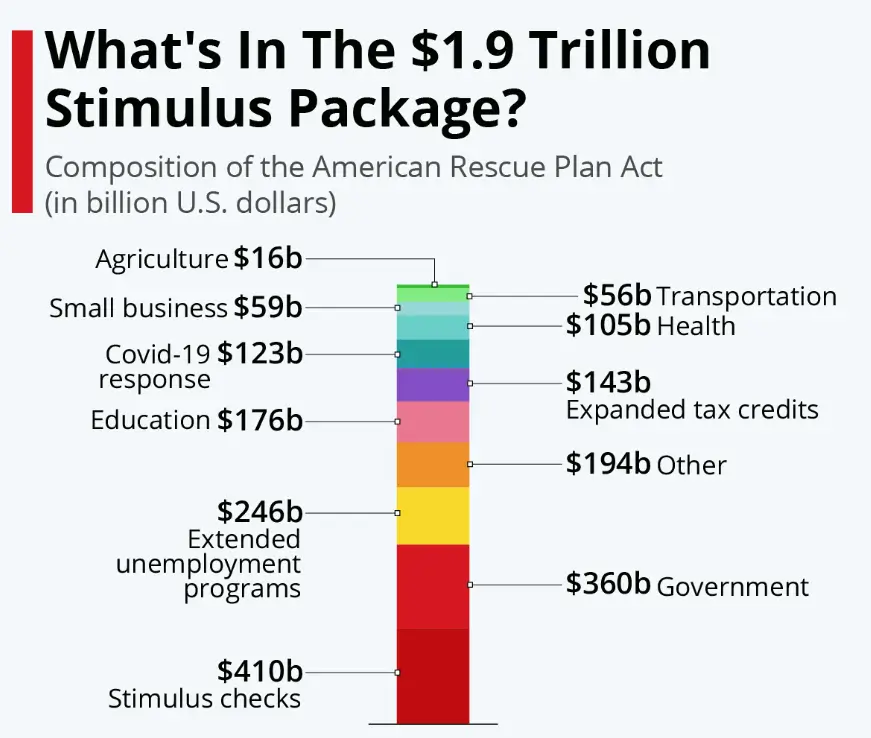

In theory, this tariff dividend would be funded by revenue collected from tariffs on foreign goods. Trump and his allies argue that these taxes should be shared with U.S. residents, especially given the increased revenue from tariffs imposed during his administration.

Estimates suggest that the U.S. could collect between $158 billion and $207 billion from tariffs in 2025 and 2026. This is why advocates of the dividend argue that there is sufficient funding for widespread $2,000 payments.

However, there is a critical flaw in the proposal’s logic. Tariff revenue is unlikely to cover the full cost of sending $2,000 checks to every eligible American. Independent economic analysts have argued that tariffs disproportionately affect consumers by raising the price of goods, which could offset the benefits of any rebate payments.

Additionally, the total cost of sending $2,000 checks to everyone in the U.S. would likely surpass the tariff revenue generated, creating budgetary challenges.

Who Could Qualify for the Trump’s $2,000 Stimulus Payment — If It Happens?

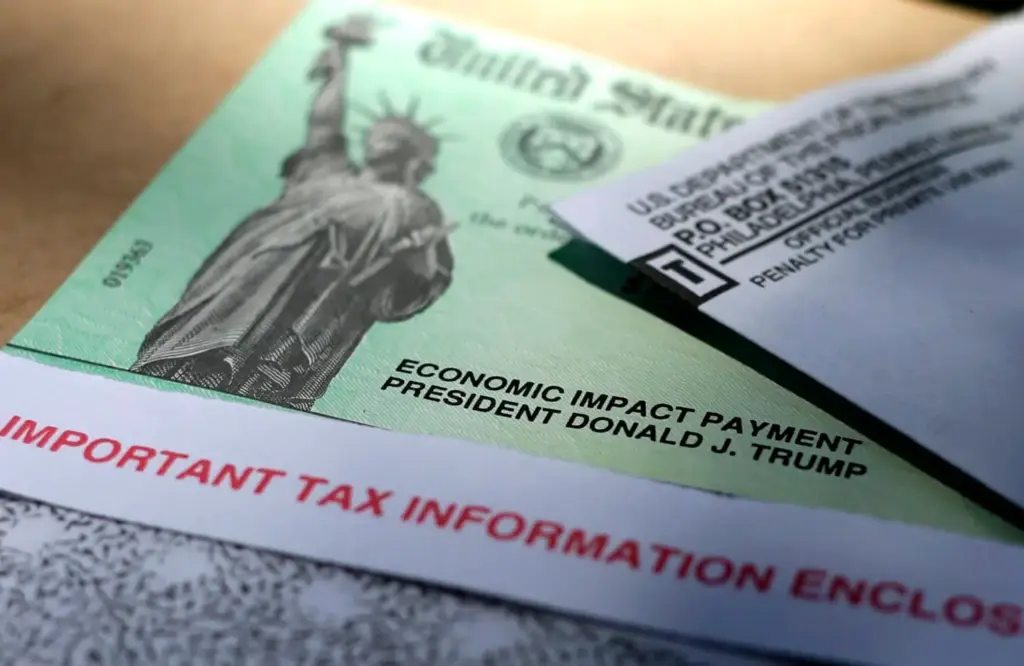

Although the $2,000 tariff dividend has not been formally approved, there are indications of who might qualify if such a plan were to be enacted. Based on Trump’s public comments, the following groups are most likely to be included:

- Middle‑ and Lower‑Income Individuals: Trump has suggested that the payments would be targeted at people who need the money, implying a focus on those earning below a certain threshold, similar to previous federal relief programs.

- Households Under a Certain Income Limit: The payment might be phased out for individuals earning above $100,000 per year, following the structure of the 2021 COVID‑19 stimulus checks. Families with dependent children could also receive more based on the number of qualifying members.

- U.S. Citizens or Residents: As with previous stimulus payments, only U.S. citizens or resident aliens would qualify for these checks.

Despite these outlines, it’s important to remember that no official eligibility criteria exist yet, as Congress would need to pass a bill that sets out the exact details.

Legal and Constitutional Challenges

A significant obstacle to the $2,000 tariff dividend is the constitutional and legal framework for federal spending. The U.S. government operates under a system of checks and balances, where Congress controls spending decisions, not the executive branch.

Legislation Would Be Required

For this program to go forward, Congress would need to introduce and pass a bill that authorizes the use of tariff revenue for rebate checks. While the executive branch can propose such measures, it cannot issue direct payments without Congressional approval.

Additionally, legal questions about the use of tariff revenue and whether it can be designated for payments to U.S. households would need to be resolved. If the plan moves forward, it could face legal challenges, particularly if the funds are perceived to be misallocated.

The Political Landscape: Support and Opposition

The proposed $2,000 tariff dividend has not gained uniform support across the political spectrum. While Trump’s supporters argue that such a payment would provide much‑needed relief to American families, critics have raised several concerns:

- Fiscal Responsibility: Critics argue that the proposed payments could increase the federal deficit unless offset by other tax revenue or spending cuts.

- Inflationary Risks: Some economists suggest that sending out additional money to consumers could drive up demand, exacerbating inflation, especially if the payments coincide with an already strong economy.

Despite these concerns, the idea of targeted relief — like the $2,000 rebate check — has broad public appeal, especially among middle‑ and working‑class families.

Comparison to Other Countries’ Stimulus Programs

While the $2,000 tariff dividend remains speculative, other countries have issued similar direct payments tied to economic relief:

- Canada: During the COVID‑19 pandemic, Canada issued direct “emergency relief payments” to its residents, which were aimed at supporting individuals facing job losses or business closures.

- United Kingdom: The U.K. implemented the Self‑Employed Income Support Scheme, providing funds to workers who were not eligible for standard unemployment benefits.

Similar to these international programs, direct cash payments are seen as an effective way to quickly put money into people’s hands, helping them meet urgent financial needs.

Stay Informed and What to Do Now

If you’re wondering whether the $2,000 payment is a reality, the best course of action is to stay informed through official channels:

- Watch for Congressional Action: Any official announcement regarding direct payments or tariff dividends will come from Congress or the White House.

- Check the IRS Website: If new payments are authorized, the IRS will provide guidance on eligibility, payment timelines, and how to apply.

- Don’t Fall for Scams: Be cautious about any solicitation claiming you can “apply now” for a $2,000 check. Any legitimate payment program will not require upfront fees or third‑party applications.

Currently, there’s no formal application process for such a payment. However, you should remain vigilant about possible updates on this proposal through trusted news outlets and official government sources.

Related Links

U.S. Driving License Changes Coming in 2026 — New Rules Take Effect Starting January

VA COLA Increase 2026: Check the New Rates, Eligibility Rules & Full Payment Schedule

What’s Next for the $2,000 Stimulus?

At this time, the $2,000 tariff dividend is not more than a proposal — no payments have been scheduled or authorized by Congress or the IRS. The idea remains tied to discussions about tariffs, economic relief, and future stimulus plans.

Americans hoping for clarity on whether they’ll qualify for such a payment should monitor the actions of Congress, the White House, and the IRS. Any potential program will need formal legislation and clear eligibility requirements before checks can be distributed.

Until then, staying updated is the best way to know if you will be among those who receive a stimulus check in 2026.