For millions of Americans, Social Security represents the foundation of retirement income. Yet, many retirees fail to maximize the potential benefits they can receive through the program. By understanding the strategies available for optimizing Social Security payments, individuals can significantly increase their monthly checks and secure a more comfortable retirement.

This article explores three smart strategies to increase your Social Security benefits and ensure a higher monthly retirement check. These strategies focus on delaying your claim, maximizing your earnings history, and coordinating spousal and survivor benefits. Understanding how to apply these strategies can make a major difference in your financial future.

1. Delay Your Claim to Maximize Monthly Benefits

One of the most effective strategies for boosting your Social Security retirement check is to delay your claim. The longer you wait to claim your benefits, the larger your monthly payment will be. For many retirees, this strategy can increase lifetime income by thousands of dollars.

How Delayed Retirement Credits Work

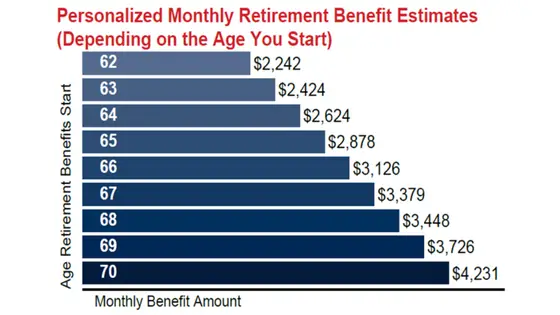

When you delay claiming your benefits past your Full Retirement Age (FRA)—typically between 66 and 67 depending on your birth year—the SSA rewards you with Delayed Retirement Credits (DRCs). For each year you wait past FRA up to age 70, your monthly benefit increases by approximately 8%. This increase is guaranteed for life and is adjusted for inflation.

For instance, if you wait until age 70 to claim, you will receive approximately 24% more each month than if you had claimed at FRA. This compounded increase makes delaying one of the best strategies for maximizing your Social Security income.

When Should You Delay?

Delaying your Social Security benefits works well for individuals who expect to live well into their 80s or beyond. However, claiming early—at age 62, for example—comes with a permanent reduction in monthly benefits, which can be as high as 30% lower than the FRA amount.

The decision on when to claim should be based on factors such as your health, financial needs, and life expectancy. If you can afford to wait, delaying benefits can be one of the highest guaranteed returns on investment available, offering a safe, risk-free return of 8% annually.

For retirees in good health or those with access to other income sources, this is a compelling reason to postpone claiming.

2. Maximize Your Earnings Record

Your Social Security benefits are based on your 35 highest-earning years, so another key strategy is to maximize your lifetime earnings. Here are two ways to do this:

Work Longer and Replace Low-Earning Years

If you are still in the workforce or approaching retirement, consider working longer to replace your lower-earning years with higher-earning ones. This is particularly valuable for people who took time off from work or had lower earnings during certain periods in their career.

By continuing to work, especially if you earn near the maximum taxable earnings level, you can significantly increase your average monthly earnings, which will result in a higher Primary Insurance Amount (PIA) and therefore a larger Social Security check.

Review Your Earnings History

The SSA uses your lifetime earnings history to calculate your Social Security benefits. However, mistakes can happen. It’s essential to regularly review your Social Security Statement for errors. A mistake, such as missing income, could lead to a lower-than-expected benefit.

You can access your statement online through the SSA website, and if you notice discrepancies, you can request corrections. Ensuring your earnings record is accurate is an easy way to guarantee you’re not leaving money on the table.

3. Coordinate Spousal and Survivor Benefits

If you’re married, you can optimize your Social Security benefits by coordinating with your spouse’s benefits. The rules surrounding spousal benefits can help maximize the overall household benefit.

Spousal Benefits

A spouse is entitled to receive up to 50% of the other spouse’s Full Retirement Age benefit, provided it exceeds the amount they would receive based on their own earnings record. This is especially useful for couples where one spouse has little or no work history.

When to Claim Spousal Benefits

The decision on when to claim spousal benefits should take into account both spouses’ earnings records and retirement timelines. For instance, it may be beneficial for one spouse to claim at FRA, while the other delays, to ensure the highest combined benefits. A well-planned strategy can significantly boost a couple’s monthly Social Security income.

Survivor Benefits

When one spouse passes away, the surviving spouse can claim the higher of the two benefits—not both. To ensure that the survivor receives the largest possible benefit, it may be beneficial to delay the higher-earning spouse’s claim until age 70.

Doing so not only increases the retiree’s monthly benefit but also boosts the survivor’s future benefit. This strategy can be particularly important if the surviving spouse is younger and expects to live longer. By maximizing the higher earner’s benefit, the surviving spouse will have a larger benefit to rely on throughout their life.

Additional Considerations for Maximizing Social Security Benefits

In addition to delaying your claim, maximizing your earnings, and coordinating spousal benefits, consider the following strategies to further boost your Social Security benefits:

How Social Security Benefits Are Taxed

Social Security benefits are subject to federal income tax depending on your total income. If your combined income exceeds certain thresholds, you may be taxed on up to 85% of your benefits. The more you earn from other sources in retirement, the more likely your Social Security benefits will be taxed.

Some states also tax Social Security benefits, so it’s essential to understand your state’s tax rules to fully plan your retirement income.

Related Links

$50 Cash Relief Program Explained – How Short-Term Aid Helped Families During SNAP Pauses

Home Insurance Costs Rising – Why Higher Home Prices and Mortgage Rates Make Coverage More Important

Integrating Social Security with Other Retirement Savings

While Social Security is a vital income source, it should be integrated into a broader retirement strategy that includes other savings accounts like 401(k)s, IRAs, and pensions. Using Social Security to supplement these accounts will ensure a more robust and diversified income in retirement.

In addition, planning for the long-term care and healthcare costs in retirement is crucial. Social Security does not cover these expenses, so building additional savings for healthcare is a key part of retirement planning.

Make Your Social Security Work for You

Maximizing your Social Security benefits requires careful planning and strategy. By delaying your claim, maximizing your earnings history, and coordinating with your spouse’s benefits, you can significantly increase your monthly check and ensure a more financially secure retirement.

Social Security is a cornerstone of retirement income for most Americans, and understanding how to leverage the rules to your advantage is essential. Whether you’re already retired or planning for the future, these three smart steps will help you increase your retirement income and provide a stronger foundation for your retirement years.