Millions of Americans are scheduled to receive Social Security January 14 payments under the federal government’s staggered benefit system, according to the Social Security Administration.

The payments apply to specific retirement, disability, and survivor beneficiaries and include the 2026 cost-of-living adjustment designed to offset inflation.

Social Security January 14 Payments

| Key Fact | Detail |

|---|---|

| Payment Date | January 14, 2026 |

| Eligible Birthdays | Jan 1–10 |

| COLA Increase | 2.8% |

| Programs Covered | Retirement, SSDI, Survivors |

| Payment Method | Direct Deposit / Direct Express |

Understanding Social Security January 14 Payments

The Social Security January 14 payments are part of the SSA’s structured distribution schedule, which staggers benefit deposits across multiple Wednesdays each month. This system has been in place since the late 1990s to improve administrative efficiency and reduce processing bottlenecks.

Under SSA rules, beneficiaries who started receiving Social Security after May 1997 and were born between the 1st and 10th of any month are paid on the second Wednesday of the month, which falls on January 14 in 2026.

According to the SSA, more than 70 million Americans receive monthly Social Security or Supplemental Security Income benefits, making predictable scheduling essential.

How the Payment Schedule Is Determined

Birth Date-Based Distribution

The SSA assigns payment dates based on a beneficiary’s day of birth:

- January 14: Birthdays on the 1st–10th

- January 21: Birthdays on the 11th–20th

- January 28: Birthdays on the 21st–31st

This schedule applies to most retirement, disability, and survivor beneficiaries.

Exceptions to the Rule

Certain beneficiaries are paid earlier:

- Individuals receiving benefits before May 1997

- People who receive both Social Security and SSI

- SSI-only recipients, who follow a separate schedule

These groups typically receive payments at the beginning of the month.

Who Qualifies for Social Security January 14 Payments?

Retirement Beneficiaries

Retired workers receiving monthly benefits qualify if their birthday falls between January 1 and January 10 and they enrolled after May 1997.

Disability Beneficiaries (SSDI)

Recipients of Social Security Disability Insurance follow the same schedule as retirees, using identical eligibility rules.

Survivor and Dependent Benefits

Spouses, children, and dependents receiving survivor benefits also qualify under the same framework.

Who Does Not Qualify

- SSI-only recipients

- Beneficiaries born after January 10

- Individuals paid under pre-1997 rules

The 2026 Cost-of-Living Adjustment Explained

The 2026 COLA increase of 2.8% reflects inflation trends measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

According to SSA data:

- The average monthly retirement benefit rose by about $56

- Actual increases vary depending on benefit level and deductions

However, analysts caution that higher Medicare Part B premiums may offset some gains.

“COLAs protect purchasing power, but rising healthcare costs continue to pressure retirees,” said a policy analyst at the Center on Budget and Policy Priorities.

How Social Security January 14 Payments Are Delivered

Direct Deposit

Roughly 99% of beneficiaries receive payments electronically, either via bank deposit or the Direct Express debit card. Electronic delivery reduces fraud risk and ensures faster access to funds.

Bank Processing Times

Although the SSA releases payments on January 14, banks may post deposits at different times during the day. Delays of up to three business days can occur, particularly after holidays.

Check Your Social Security Payment Status

Online Access

The SSA recommends using the “my Social Security” portal to:

- View payment dates and amounts

- Update banking information

- Review benefit history

Phone and In-Person Support

Beneficiaries can call 1-800-772-1213 or visit a local SSA office if issues arise.

What to Do If Your Payment Is Missing

The SSA advises beneficiaries to:

- Wait three business days

- Contact your bank

- Call the SSA if the payment does not appear

Missing payments are rare but may occur due to banking or identity verification issues.

Fraud Risks and Payment Scams

The SSA warns beneficiaries to be alert for scams, especially around payment dates. The agency does not:

- Demand payment via gift cards

- Threaten arrest

- Request personal information by email or text

Suspected fraud should be reported to the SSA Office of Inspector General.

Why These Payments Matter

According to SSA data:

- About 40% of retirees rely on Social Security for at least half their income

- For low-income seniors, it accounts for most or all monthly income

Predictable January payments help beneficiaries cover rent, utilities, food, and medical expenses.

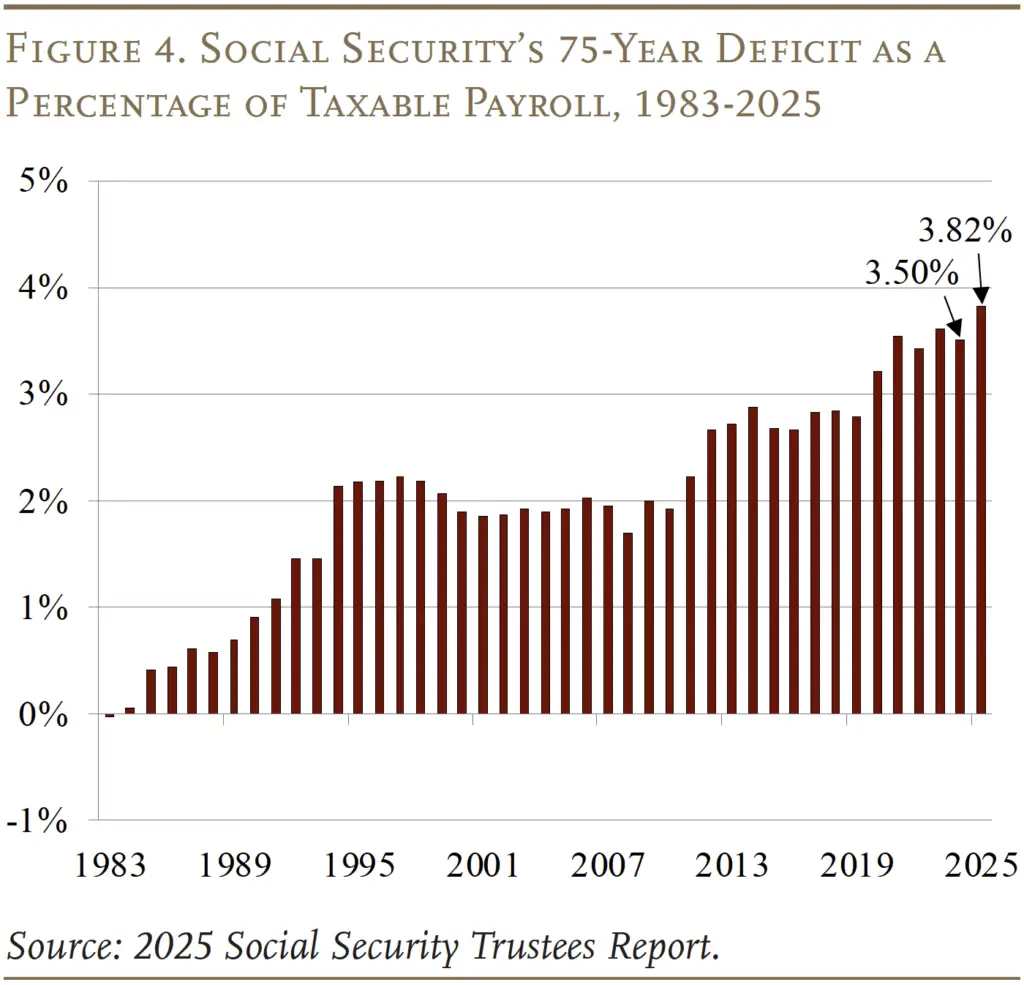

Long-Term Outlook for Social Security

While January payments remain unaffected, the program faces long-term funding challenges. Trustees project the trust fund could be depleted in the mid-2030s without legislative action.

Congressional debates continue over potential reforms, including tax changes and benefit adjustments, though no immediate changes are expected for 2026 payments.

Related Links

Social Security January Payments – When to Expect Your Check and Key 2026 Dates to Know

Social Security Benefit Boost 2026 – 3 Practical Moves to Increase Your Monthly Check

For now, the Social Security January 14 payments remain on schedule, offering stability to millions of Americans at the start of the year. Beneficiaries are encouraged to monitor accounts and use SSA tools to stay informed as the year progresses.

FAQs About Social Security January 14 Payments

Will everyone get paid on January 14?

No. Only eligible beneficiaries born between January 1 and 10.

Does SSI follow the same schedule?

No. SSI payments follow a separate calendar.

Can payment dates change?

Only when holidays or federal closures require adjustments.