The AeroGrow International Inc. merger with Scotts Miracle-Gro Co. in 2021 has resulted in a settlement to resolve legal claims filed by minority shareholders. The dispute centered on whether shareholders received fair compensation when AeroGrow was taken private.

After years of litigation, a $15.98 million settlement fund has been established to compensate eligible investors. This article provides a clear guide on who is eligible, how to claim, and important deadlines for investors to follow.

Who Is Eligible for the AeroGrow Settlement Payout?

The AeroGrow Settlement Payout applies to shareholders who owned AeroGrow stock at the time of the merger’s closing date, which occurred on February 26, 2021. Eligible investors must meet the following criteria:

- Shareholders of record: If you owned AeroGrow common stock on February 26, 2021, you are considered a part of the settlement class.

- Shareholders who received $3.00 per share in merger consideration.

- Successors or assigns: Individuals or entities that acquired the rights to AeroGrow shares from eligible investors may also be included in the settlement.

It’s important to note that ownership at the merger date is the key criterion, not the purchase date of the shares.

Not Eligible:

- Those who sold shares prior to the merger.

- Individuals who opt out of the settlement process.

Claim verification will be based on ownership records, so it is critical to confirm these details with your broker or transfer agent.

Key Details and Breakdown of AeroGrow Settlement Payout

The $15.98 million settlement fund is designed to compensate eligible shareholders, with the following breakdown:

- Attorneys’ Fees and Expenses: A portion of the settlement will go toward covering legal costs, including attorneys’ fees.

- Settlement Administration Fees: This includes the costs of managing the claims process.

- Lead Plaintiff Service Awards: In some cases, lead plaintiffs may receive a service award for their efforts in bringing the case forward.

- Distribution to Eligible Shareholders: The remaining fund is allocated to shareholders based on the number of shares they held on February 26, 2021.

Once the necessary deductions for legal and administrative fees are made, the remaining amount will be distributed to shareholders based on the total number of shares eligible for the payout. The payment will be proportional to the number of shares each investor held during the merger.

Claim From the $15.98M AeroGrow Settlement Fund

For most eligible shareholders, claiming a portion of the AeroGrow Settlement Payout is automatic. Here’s how the process works:

- Eligibility Verification: Ensure that you held AeroGrow shares on the merger date. Shareholders who purchased or sold shares after February 26, 2021, are not eligible.

- No Claim Form Required: Unlike many class action settlements, no claim form is necessary for most eligible investors. Payments will be based on ownership records provided by brokers or the transfer agent handling the stock.

- Account Information: If your contact information or ownership records have changed, be sure to update them with your broker or the claims administrator to ensure payment accuracy.

- Monitoring Settlement Updates: Eligible investors should watch for updates from the administrator (typically A.B. Data Ltd.), who will notify recipients when payments are being processed.

Eligible investors do not need to take additional action unless they wish to opt out of the settlement or file an objection.

Timeline for Settlement Distribution

The court-approved settlement requires a few steps before payments are made:

- Fairness Hearing: The court will conduct a fairness hearing on April 30, 2026, where it will review the settlement terms and ensure fairness.

- Final Approval: After the fairness hearing, assuming no objections are raised, the settlement fund will be processed, and payments to eligible shareholders will begin.

- Distribution Start Date: Payment distribution is expected to begin in mid-2026, once the settlement has been fully approved and the necessary administrative procedures are complete.

Opting Out and Objections

While most shareholders will automatically receive their share of the settlement, there are options for those who wish to exclude themselves from the class action or challenge the settlement terms.

- Opting Out: Shareholders who want to exclude themselves from the settlement must file a notice with the court by March 9, 2026. Opting out means you will not receive a payout, but you may pursue a separate lawsuit.

- Objections: If you believe the settlement does not adequately address your interests, you can file an objection before the fairness hearing. The court will consider objections before finalizing the settlement.

Both opting out and objecting require submission of formal notices within the specified timeframes.

Legal Background and Impact on Shareholders

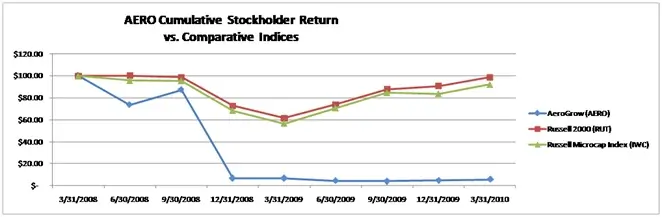

The class action lawsuit stems from claims of fiduciary duty violations. Minority shareholders alleged that the merger undervalued AeroGrow and that relevant financial information was inadequately disclosed, which led to a lack of fairness in the merger consideration.

The lawsuit challenged the fairness of the $3 per share paid to shareholders, claiming it did not fully represent the value of AeroGrow at the time of the merger. By agreeing to the settlement, AeroGrow and Scotts Miracle-Gro avoided the uncertainties and costs of continuing litigation.

While the companies did not admit any wrongdoing, the settlement offers a significant recovery for affected investors. For investors, this settlement provides a rare opportunity for restitution.

For many shareholders who may have felt that they were shortchanged during the merger process, the $15.98 million payout offers some compensation for those losses. The payout is expected to help restore trust in corporate governance for small investors.

Impact on Stock Market and Other Legal Precedents

The AeroGrow settlement payout has far-reaching implications beyond the company itself. The case highlights the importance of investor protections during corporate mergers, especially when minority shareholders may be left with little recourse to challenge unfavorable deals.

It also underscores the role of class actions in holding companies accountable for potentially unfair practices. This settlement is part of a broader trend in which companies involved in mergers or other corporate actions have faced shareholder lawsuits over the fairness of the transaction.

It serves as a reminder to investors to be vigilant about the terms of any corporate deal they are involved in and to recognize their right to fair treatment in the event of a merger. In similar cases, other companies facing allegations of unfair mergers could face similar lawsuits, and settlements like these might become more common as shareholders continue to assert their rights.

Tracking the Progress of the Settlement

If you are a shareholder, staying updated on the status of the settlement is critical. Here’s how you can do so:

- Monitor Notices from the Administrator: Pay close attention to notices from the settlement administrator regarding updates and deadlines.

- Check Court Filings: The court’s online system or the settlement administrator will provide regular updates on key developments.

- Contact the Administrator: If you have questions regarding your eligibility or payout, you can reach out to the administrator.

Investors should keep track of the official court updates and the administrator’s communication to avoid missing important deadlines.

Related Links

Anthem $12.8M Class Action Settlement – Step-by-Step Guide to Claim Before January 20

Social Security Survivor Rules – 11 Important Changes Widows and Widowers Often Miss

Final Thoughts on the AeroGrow Settlement

For eligible AeroGrow investors, the $15.98 million settlement payout offers a chance to receive compensation after a drawn-out legal process. While it may not fully address all concerns about the merger, it provides a resolution for many who felt the merger was conducted unfairly.

The AeroGrow case also sets a significant precedent for future shareholder litigation in mergers and acquisitions, ensuring that companies remain more accountable for their actions. By remaining aware of the opt-out and objection deadlines, eligible investors can make sure they receive their fair share of the settlement or take further legal action if necessary.

Investors who held shares in AeroGrow on the merger date are strongly encouraged to confirm their eligibility, track settlement updates, and ensure they receive the payout they are entitled to.