In 2026, millions of homeowners in the United States and beyond may qualify for property tax relief through newly introduced exemptions and savings initiatives. These programs target seniors, low-income families, and first-time homebuyers, offering significant financial relief in the face of rising property values.

As local governments across the country implement various tax cuts, freezes, and credits, understanding who can benefit from these changes is essential for property owners looking to reduce their tax burdens. Here’s what you need to know.

Property Tax Relief 2026

| Key Fact | Details |

|---|---|

| Homestead Exemptions | Reduced property assessments for primary residences. |

| Senior Citizen Relief | Tax freezes or exemptions for homeowners aged 65 and older. |

| Low-Income Programs | Income-based relief for low-income homeowners. |

| New First-Time Buyer Relief | Tax credits and deductions for new homeowners in some states. |

Who Qualifies for Property Tax Relief?

Property tax relief programs in 2026 aim to support homeowners in various circumstances. While some states introduce universal measures, many others focus on specific demographics, such as seniors, low-income earners, and those purchasing their first home.

Homestead Exemptions for Primary Residences

Homestead exemptions are one of the most widely used forms of property tax relief across the United States. These exemptions generally reduce the taxable value of an owner’s primary residence, which can lead to significant savings.

For example, in states like Texas, homeowners can benefit from a standard exemption that lowers the taxable value of their property by a specified amount.

In 2026, many localities are expanding or enhancing these exemptions in an effort to address affordability concerns as property values continue to rise. Homeowners must typically file for homestead exemptions through their local tax office, but the benefits are substantial, especially in high-cost areas.

“Homestead exemptions are one of the easiest and most accessible ways for homeowners to reduce their property tax burden,” said Tanya Simmons, a property tax expert with the National Association of Realtors. “These exemptions are available in most states, and qualifying for them is a relatively simple process.”

Relief for Senior Citizens

Across the United States, more states are offering property tax relief programs specifically designed for seniors. These programs generally offer two forms of assistance: property tax freezes and property tax exemptions.

A tax freeze means that the assessed value of a senior’s property will not increase, regardless of the local tax rate or market fluctuations. In states like New York and California, seniors aged 65 or older may qualify for tax freezes, meaning their annual property taxes remain consistent even as property values and tax rates increase.

Other states, such as Ohio and Texas, offer partial exemptions, allowing seniors to exclude a portion of their property’s assessed value from taxation.

The eligibility criteria for senior citizen property tax relief typically include income limits, age restrictions, and residency requirements. Some areas may also apply these programs only to homeowners who have lived in their property for a certain number of years.

“These relief programs help ensure that seniors—many of whom are on fixed incomes—are not pushed out of their homes by rising property taxes,” said Emma Clark, a senior policy analyst at the National Institute on Aging.

Low-Income Property Tax Relief Programs

For low-income homeowners, many jurisdictions offer property tax relief based on income eligibility. These programs are particularly important for individuals and families who own homes but may struggle to pay rising property taxes due to limited financial resources.

In 2026, more states are expanding these programs, which include tax freezes, reductions, and rebates.

For example, Illinois and Pennsylvania have been offering low-income seniors and disabled residents property tax rebates, with some states expanding eligibility to include younger low-income homeowners. These rebates can significantly reduce a property owner’s tax burden.

“Low-income property tax relief helps provide stability for families in economically challenged areas, ensuring they can stay in their homes despite rising housing costs,” said Carl Davis, a senior research associate at the Institute on Taxation and Economic Policy (ITEP).

First-Time Homebuyer Relief

Several states and local governments have implemented new initiatives targeting first-time homebuyers in 2026. These programs often provide tax credits, exemptions, or deductions to reduce the financial strain on new homeowners.

In states like Florida and Illinois, first-time homebuyers may qualify for exemptions on a portion of their property’s assessed value, or they may receive tax credits that offset their property taxes for several years.

These programs are designed to make homeownership more accessible for individuals and families who might otherwise be priced out of the housing market. In some cases, these tax incentives are tied to income limits or other eligibility requirements, ensuring that the relief benefits those who need it most.

Key Areas for Property Owners to Watch in 2026

Changes in Property Tax Rates

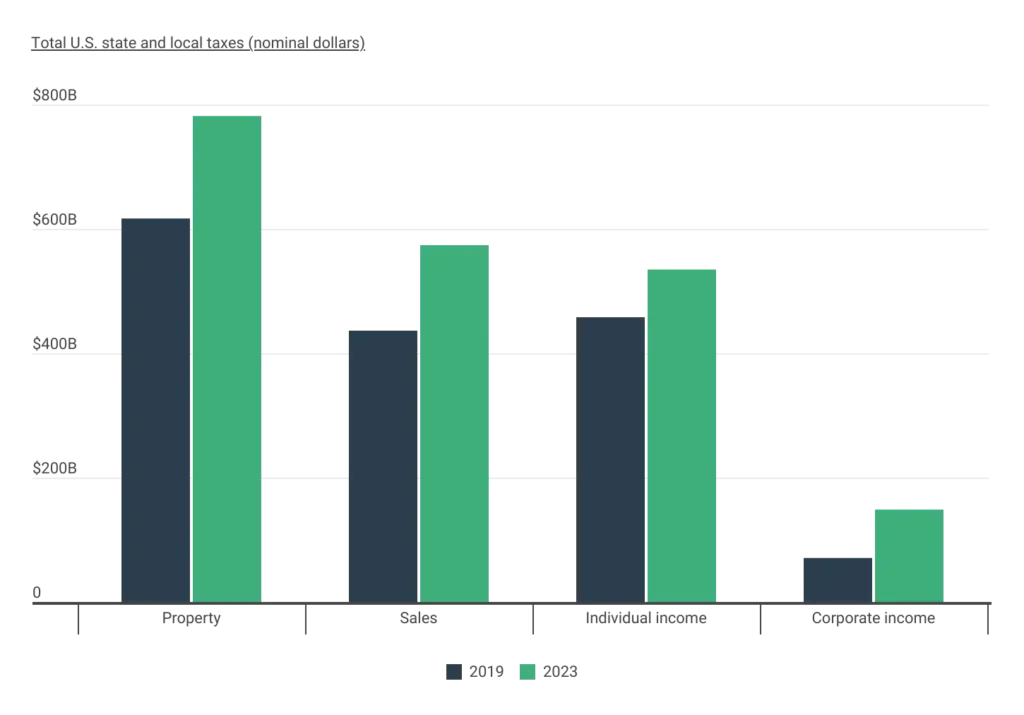

While many areas are introducing exemptions and freezes, property tax rates in some regions may continue to rise. This trend is particularly evident in fast-growing areas where property values are increasing at a rapid pace.

Homeowners should be aware of potential rate hikes in their jurisdiction and take advantage of relief programs to mitigate these increases.

For instance, in states like California, local governments may raise tax rates to accommodate growing infrastructure and service costs. Homeowners in these areas should regularly check for new programs or exemptions that can help offset the higher taxes.

The Impact of Inflation on Property Taxes

Inflation and rising construction costs also play a significant role in property tax assessments. Many localities base property taxes on the assessed value of a home, which is determined by its market value.

In times of high inflation or rapid price increases, property values can rise significantly, leading to higher tax assessments.

“Inflationary pressures on housing markets mean that property owners may face larger tax assessments, even as they qualify for relief programs,” explained Davis. “That’s why it’s important for homeowners to stay informed about changes to both their property values and available tax exemptions.”

New Federal Initiatives for Property Tax Relief

In addition to state and local programs, there are emerging federal initiatives aimed at providing broader property tax relief. The American Homeownership Act of 2026, for example, proposes tax credits for homeowners across the country who face increasing property tax burdens due to rising home prices.

The proposed law aims to offer a refundable credit based on the percentage increase in property tax assessments, effectively offsetting the additional costs faced by homeowners.

Federal tax relief measures are still in the early stages of development, but experts expect they will provide additional financial relief to homeowners in high-cost areas. The initiative also includes provisions for targeted assistance to families in economically distressed regions.

“This is a critical step in addressing the nationwide issue of housing affordability,” said Kevin Walters, an economist at the Urban Institute. “While the primary focus is on lowering taxes, it also ensures that homeowners aren’t disproportionately impacted by the local tax base increase.”

Apply for Property Tax Relief in 2026

The process for applying for property tax relief varies depending on the type of relief and the state or local government involved. In general, homeowners must file an application with their local tax authority to claim exemptions, freezes, or rebates.

The application process can often be completed online, but homeowners should be prepared to provide supporting documentation, such as proof of age, income, and residency.

Many jurisdictions offer deadlines for filing these applications, so it’s crucial to submit all required paperwork before the cutoff dates. Homeowners should check with their local tax office or online portals for specific instructions on how to apply.

“Be sure to double-check the eligibility criteria and deadlines for your area’s property tax relief programs,” advised Simmons. “Filing late or missing important documents can delay your benefits.”

Related Links

SNAP Food Ban 2026 – Full List of States That Will Restrict Certain Foods From Benefits

Anthem $12.8M Class Action Settlement – Step-by-Step Guide to Claim Before January 20

Property Tax Relief Remains Critical

As property taxes continue to climb, especially in high-demand areas, the need for property tax relief programs has never been greater. In 2026, new exemptions, freezes, and rebates offer a lifeline to homeowners, particularly seniors, low-income families, and first-time buyers.

By understanding the available programs and how to apply for them, homeowners can take important steps toward lowering their tax bills and ensuring they remain in their homes. While the landscape of property tax relief is evolving, it is clear that local governments across the country are increasingly prioritizing homeowner support.

Looking forward, it is likely that we will continue to see innovations and expansions in property tax relief measures aimed at addressing the challenges posed by rising property values and economic uncertainty.

FAQs About Property Tax Relief 2026

Q: What is a homestead exemption?

A: A homestead exemption reduces the taxable value of a homeowner’s primary residence, leading to lower property taxes. Eligibility requirements vary by state and locality.

Q: How do I qualify for senior citizen property tax relief?

A: Seniors aged 65 or older may qualify for property tax freezes or reductions. Specific eligibility criteria, such as income limits, vary by state and municipality.

Q: Can first-time homebuyers get property tax relief?

A: Yes, many states offer tax credits, exemptions, or deductions for first-time homebuyers to help reduce their property tax burden.