As tax season 2026 begins, Americans are facing a series of hidden changes to tax laws and IRS procedures that could result in smaller refunds or even unexpected bills.

While some tax benefits have been reduced or eliminated, others have new eligibility criteria. Understanding these changes ahead of time is essential to avoid costly surprises when your refund arrives.

IRS Refunds 2026

| Key Fact | Detail |

|---|---|

| Child Tax Credit (CTC) | The expanded CTC has been scaled back, reducing the amount for many families. |

| Pandemic Relief Expiry | Expiration of relief measures like expanded EITC and stimulus checks. |

| Standard Deduction Changes | Higher standard deductions for 2026, but fewer benefits for high-income filers. |

| EITC Eligibility Adjustments | Adjustments to the Earned Income Tax Credit could lead to smaller refunds for middle-class families. |

| Refund Delays | Refunds for certain credits (EITC, CTC) will be delayed until mid-February. |

What’s Changing for IRS Refunds in 2026?

1. Child Tax Credit (CTC) Gets Smaller

The Child Tax Credit (CTC) underwent significant changes under the American Rescue Plan of 2021, where the credit was expanded to $3,600 per child for children under six and $3,000 for children between six and 17. However, starting with tax year 2026, many of these changes have reverted to the previous amounts:

- The maximum CTC will be capped at $2,000 per child.

- The additional $500 available for children aged 6 to 17 will no longer apply.

This means that families who have been receiving large refunds from the expanded CTC may see significantly smaller refunds in 2026. Specifically, if you have multiple children, you could lose up to $1,800 in potential credits.

Expert Insight: Tax advisor Amy Reynolds from H&R Block states, “Families that received a larger CTC in previous years may be shocked by a substantial reduction in 2026, especially if they have multiple dependents.”

2. Expiration of Pandemic Relief Measures

Several pandemic-related tax credits and relief provisions introduced during the COVID-19 pandemic have now expired. These included:

- The expanded Earned Income Tax Credit (EITC) for childless workers.

- The third round of stimulus checks in 2021.

- Expanded eligibility for unemployment benefits and paid leave.

These provisions significantly boosted refunds for millions of families in 2021 and 2022. However, as the pandemic era fades into the past, these expanded benefits will no longer be available, meaning lower refunds for those who benefited from them in previous years.

For instance, the expanded EITC, which provided extra credits to lower-income workers without children, has been rolled back. Taxpayers who qualified for this boost in 2020 and 2021 will see their credit shrink to pre-pandemic levels.

Expert Insight: According to David M. Williams, a financial analyst, “Many households that were accustomed to the extra EITC and stimulus checks may find that their refunds are much smaller this year. Families who were not aware of the expiration of these benefits will need to plan accordingly.”

3. Standard Deduction: More for Some, Less for Others

In 2026, the standard deduction has risen slightly to $16,100 for single filers and $32,200 for married couples filing jointly. This increase is designed to keep up with inflation and provides some tax relief, but the impact varies depending on income levels.

For high-income earners, the benefits of itemizing deductions may now be more limited due to caps on the deduction of mortgage interest and property taxes. The higher standard deduction could leave these filers less incentivized to itemize, potentially reducing tax benefits if they are used to claiming larger itemized deductions.

Expert Insight: Carlos Medina, an IRS consultant, explains, “For many middle-income households, the higher standard deduction will result in a simpler tax filing process. However, for high-income taxpayers with complex deductions, the change could reduce their tax planning flexibility.”

4. The Earned Income Tax Credit (EITC) Gets Smaller for Some

For 2026, the Earned Income Tax Credit (EITC) has undergone adjustments that will affect middle-class families, especially those without children. The phase-out limits have been lowered, meaning many taxpayers who were previously eligible for the credit will no longer qualify or will receive a reduced refund.

Taxpayers who used to qualify for the EITC based on their income and number of children may find that they no longer meet the eligibility criteria due to income phase-outs or reduced benefit amounts.

Expert Insight: The EITC is a key refund booster for low- and middle-income families, but these changes will leave some filers without access to the credit. Financial planner Olivia Richardson advises, “Taxpayers should understand whether their income now exceeds the new thresholds to avoid surprises. Many families could see a refund cut or no refund at all.”

5. Refund Delays: Key Dates to Know

Taxpayers expecting EITC or CTC refunds will face a delay in receiving their refunds. The IRS has confirmed that refunds involving these credits will not be issued before mid-February 2026. This delay is part of the IRS’s efforts to ensure that these credits are being claimed accurately and to reduce fraud.

Taxpayers who file early, especially those with EITC and CTC, should be prepared for a longer wait before their refunds are issued.

Expert Insight: The IRS’s Marilyn Alvarez, an expert on tax administration, states, “It’s essential for taxpayers to be aware of these delays, especially if they need the refund quickly for expenses. Filing with accuracy can help speed up the process.”

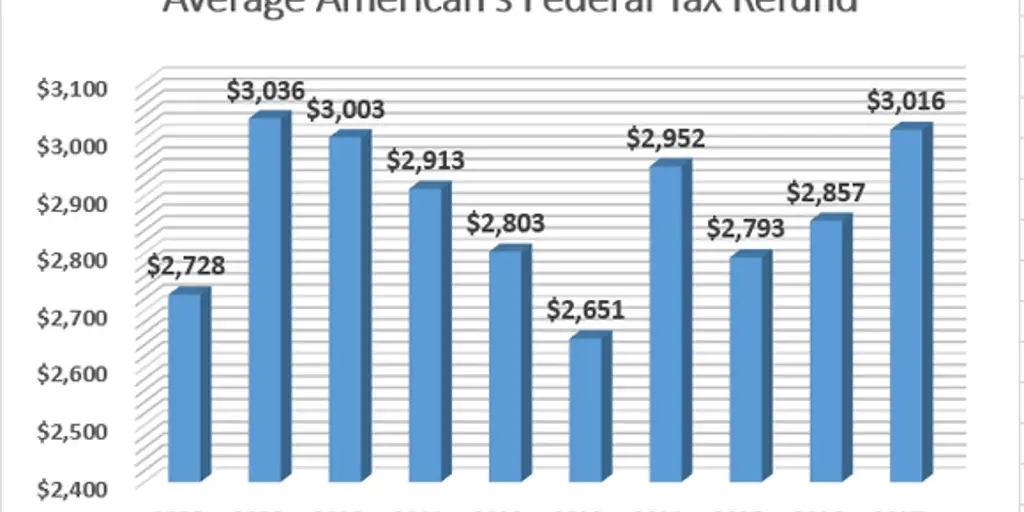

How These Changes Could Impact Your Refund

For many taxpayers, the changes in the IRS tax law could significantly impact their refunds for 2026. Families that received larger refunds in previous years may find that their refunds are much smaller due to reduced tax credits and deductions. Lower-income families, in particular, will see the biggest reductions due to the expiration of pandemic relief measures.

For higher-income earners, changes in the standard deduction and limits on itemized deductions could result in fewer tax savings from their deductions, especially for those with large medical, mortgage, or property tax expenses.

Avoid Losing Out on Your Refund

- Review Eligibility for Tax Credits and Deductions: Make sure you qualify for the Child Tax Credit, Earned Income Tax Credit, or any other available deductions. If you’re unsure, consider using tax software or working with a tax professional.

- File Early and Electronically: Filing early ensures faster processing and avoids long wait times for refunds, especially for EITC and CTC claimants. E-filing with direct deposit also speeds up your refund.

- Know the New Phase-Out Thresholds: Be aware of changes to the EITC and CTC, particularly if your income has changed or if you’re filing for the first time after receiving pandemic benefits.

- Consult a Tax Professional: With so many changes in 2026, consulting a tax professional can help you navigate the complexities of the new tax code, ensuring that you don’t miss out on any potential refunds or credits.

Related Links

First Social Security Check of 2026 – Check Three Things New Payments Will Look Like

Property Tax Relief 2026 – Who Can Qualify for New Exemptions and Savings

The Hidden Cost of IRS Refund Changes in 2026

The changes to tax laws and IRS procedures for 2026 are likely to lower the refund amounts for millions of Americans. The reduction of the Child Tax Credit, expiration of pandemic relief, and adjustments to the Earned Income Tax Credit will hit low- and middle-income households the hardest. Higher-income earners will also feel the pinch due to modifications to the standard deduction and limited itemized deductions.

To ensure you don’t lose out, file early, check your eligibility for all credits and deductions, and use direct deposit for faster processing. By understanding the updates and adjusting your filing approach, you can minimize the impact of these changes on your 2026 refund.

KEY DEADLINES

- Tax Filing Start Date: January 26, 2026

- Refund Processing (EITC, CTC): Mid-February 2026

- Tax Filing Deadline: April 15, 2026

FAQs About IRS Refunds 2026

Q: Will my Child Tax Credit be reduced for 2026?

A: Yes. The expanded Child Tax Credit has been reduced, and many families will receive only $2,000 per child instead of the expanded amounts from previous years.

Q: Why are my refunds delayed this year?

A: Refunds involving EITC and CTC credits will be delayed until mid-February 2026 to allow for further review and fraud prevention.

Q: What should I do if I think I qualify for a credit but my refund is smaller than expected?

A: Ensure that you meet the updated eligibility criteria for credits like EITC and CTC. Consider consulting a tax professional if you have concerns about changes to your eligibility.