The U.S. Internal Revenue Service (IRS) has made waves with the announcement of the expansion of its Direct File program for the 2026 tax season. This new free tax filing tool is poised to change how millions of Americans file their taxes, potentially simplifying a notoriously complex process.

The IRS Direct File system promises to eliminate the need for third-party tax preparation services, offering a streamlined solution that cuts costs and saves time. With the growing interest in making tax filing more accessible and transparent, Direct File could significantly impact tax season in the coming years.

IRS ‘Direct File’ 2026 Expansion: Key Features and Benefits

The 2026 IRS Direct File system is set to provide a seamless experience for taxpayers, offering a free way to file federal taxes directly through the IRS. This service is designed to save taxpayers money, reduce reliance on external software, and enhance the filing experience with modern technology. Here’s a closer look at the key features and anticipated benefits of IRS Direct File:

| Feature | Details |

|---|---|

| Cost | Free |

| Eligible Taxpayers | Available to all income levels |

| Filing Process | Direct submission to the IRS with step-by-step guidance |

| Security Features | Robust data protection protocols |

| Accessibility | Mobile- and desktop-compatible, user-friendly interface |

| Additional Benefits | Real-time error checking, automatic form generation |

The 2026 IRS Direct File expansion represents a pivotal moment in the evolution of the tax filing process. While the IRS has long relied on partnerships with private tax preparation companies, the agency’s decision to directly provide a filing tool for taxpayers marks a new chapter.

By offering a government-run, easy-to-use solution, IRS Direct File could drastically reduce the friction many face during tax season. Below, we explore the IRS Direct File system, how it compares to other options, and the expected impact it will have on the tax filing process in 2026.

How IRS Direct File Will Work: A Overview

The 2026 IRS Direct File tool offers a user-friendly, direct connection to the IRS filing system. Here’s how the system is expected to function for taxpayers:

- Accessing the Tool: Taxpayers can access IRS Direct File directly via the IRS website or mobile app. The tool will be free to use for all income levels, unlike other programs that restrict eligibility based on income.

- User-Friendly Interface: The system guides users through each section of their tax return with intuitive, step-by-step prompts. This interface is designed to make it easy for even those with little tax knowledge to complete their returns.

- Real-Time Error Checking: As users enter information, the system automatically checks for potential errors or discrepancies. This reduces the likelihood of submitting incorrect data and helps ensure accuracy.

- Direct Submission: Once the tax return is complete, the filing is submitted directly to the IRS, bypassing third-party software providers. This ensures a faster processing time and minimizes potential delays.

- No Hidden Fees: Since IRS Direct File is free, taxpayers will not encounter hidden fees that often come with commercial tax preparation tools. This makes it an attractive option for taxpayers who want to save money during tax season.

Benefits of IRS Direct File: Simplifying Tax Season for Everyone

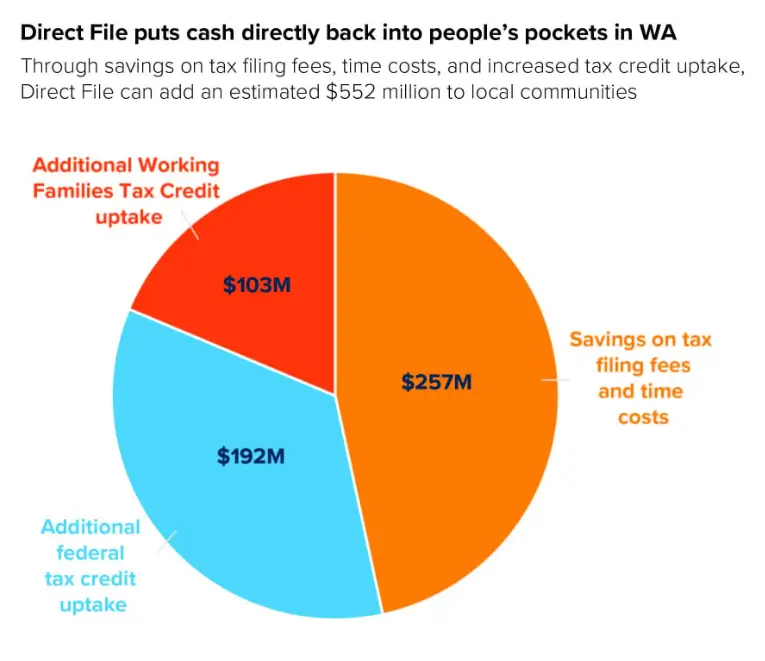

The 2026 IRS Direct File initiative brings several clear advantages to the tax-filing experience, particularly in terms of cost savings and ease of use. The most significant benefit is the reduction in filing costs.

For years, Americans have relied on paid tax preparation software or professionals, which can add up to hundreds of dollars each year. By providing a free and simple alternative, Direct File helps reduce the financial burden of tax filing.

Additionally, Direct File streamlines the entire filing process. Rather than spending hours navigating confusing tax forms or dealing with third-party tax services, users can now quickly and efficiently complete their tax returns using an easy-to-navigate IRS system. This could save valuable time, especially for individuals with straightforward tax situations.

Addressing User Experience: How the IRS Ensures Accessibility for All Taxpayers

One of the core features of IRS Direct File is its user-friendly interface, which is designed to be accessible for everyone, including those with limited digital literacy. The tool offers step-by-step guidance throughout the filing process, and the system is compatible with both desktop computers and mobile devices.

The IRS has ensured that the interface is responsive and easy to use, making it a suitable option for a wide range of taxpayers, including elderly individuals or those without extensive technological experience.

Further, the system includes features designed for individuals with disabilities, such as screen reader compatibility and voice guidance for visually impaired users. This inclusivity ensures that IRS Direct File caters to all eligible individuals, regardless of their technological proficiency or physical limitations.

Challenges and Limitations of IRS Direct File

While the 2026 IRS Direct File offers clear advantages, there are challenges that need to be addressed. Some critics argue that IRS Direct File may not be suitable for more complex tax situations, such as those involving business ownership, multiple income sources, or intricate tax credits.

Individuals in these categories may still prefer professional tax preparers or advanced tax software tools that offer more in-depth guidance. Additionally, while the IRS Direct File system is free, it does not cover state tax returns.

Taxpayers in most states will still need to rely on third-party services or state-specific programs to file their state taxes, unless the system is updated to accommodate this in the future.

Taxpayer Feedback and Insights from the Pilot Program

During the pilot phases of IRS Direct File, many taxpayers praised the system for its simplicity and ease of use. In a report from IRS officials, 85% of participants said they found the tool to be intuitive, with a high satisfaction rate.

However, some users reported that they struggled to navigate more advanced tax features, which could make the system less ideal for people with complex financial situations. Moving forward, the IRS Direct File team will likely address these concerns by improving the tool’s capabilities and expanding its options to handle more complicated tax returns.

This feedback is essential for fine-tuning the system and ensuring it serves the widest possible audience in 2026 and beyond.

Political and Industry Implications: Government-Run Tax Filing and the Future of the Industry

The IRS Direct File expansion represents a significant shift in tax preparation, not just in convenience and cost but also in terms of government policy. Tax preparation companies, including major players like TurboTax and H&R Block, have long lobbied against a government-run tax filing system, arguing that it would reduce their market share and impact their business models.

The introduction of Direct File is expected to create tension within the tax preparation industry, as these companies now face direct competition from the government.

At the same time, politicians and policy advocates have voiced support for the IRS Direct File, seeing it as a way to increase transparency and fairness in the tax filing process. The debate over the future of government-run tax filing tools is likely to be a central topic in upcoming discussions around tax reform.

Related Links

Social Security Payments on January 14: Will You Receive a Check? Check Eligibility Criteria

Expected Launch and Impact: What to Expect in 2026

The 2026 IRS Direct File program will officially launch at the start of the 2026 tax season. While the exact timeline for availability may vary based on testing and updates, it is expected that the IRS Direct File tool will be available to all taxpayers with income levels qualifying for direct electronic filing.

Those who are eligible for free filing options will be able to use IRS Direct File to submit their federal tax returns seamlessly.

Looking ahead, IRS Direct File could set a precedent for other countries seeking to simplify their tax systems, providing a model for more accessible, affordable, and efficient tax filing solutions.