President Donald Trump has proposed a $2,000 tariff dividend to distribute funds raised through tariffs to U.S. citizens. However, while the idea has gained attention, its implementation remains uncertain, with unresolved questions about who qualifies and how SNAP benefits may interact with the payments.

This article examines the current status of the proposal, potential eligibility, and its impact on SNAP recipients.

Trump $2,000 Tariff Dividend Update

| Key Fact | Detail |

|---|---|

| Proposal Timeline | Payments could begin in 2026, though unclear |

| Expected Amount | $2,000 per eligible individual |

| SNAP Impact | Uncertainty about how it would affect eligibility |

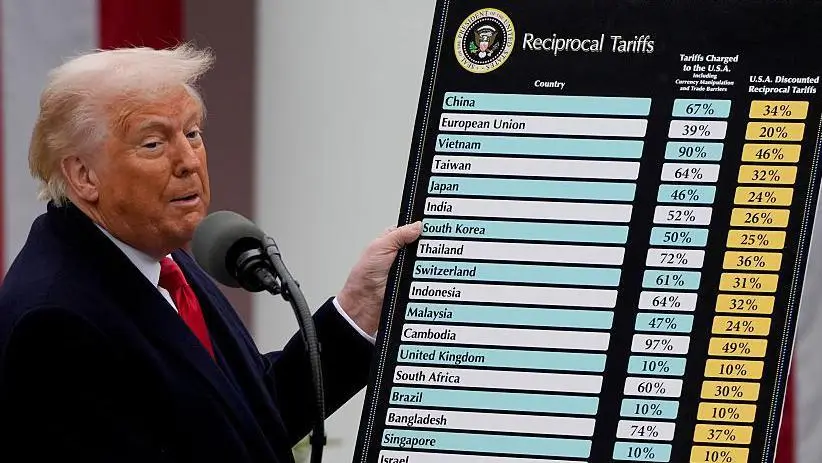

| Tariff Revenue Source | Funded through revenue from tariffs on imports |

What is the $2,000 Tariff Dividend?

The $2,000 tariff dividend is part of President Donald Trump’s broader economic plan, which was introduced during his second term in office. The idea is to return a portion of the revenue generated by tariffs on imported goods to American citizens, especially those with low and middle incomes.

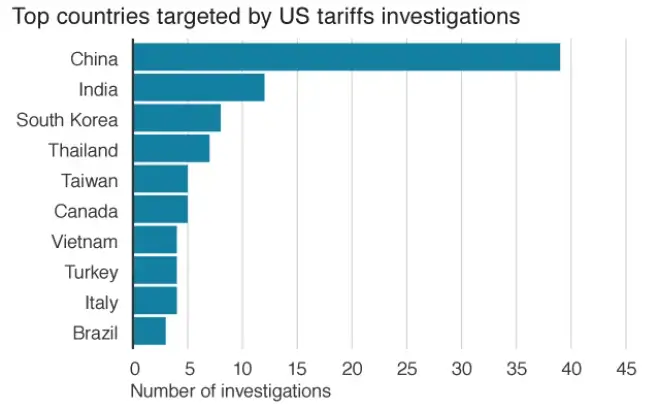

Trump has proposed distributing $2,000 per person to eligible households. Trump’s tariffs, particularly those targeting Chinese imports, were intended to raise revenue for the government.

According to his proposal, the funds generated from these tariffs could be redistributed directly to American citizens, allowing them to benefit from the trade policy that some critics claim harms consumers by raising prices.

Although the proposal has been widely discussed, its specifics remain unclear. It is uncertain whether the payments would be in the form of direct checks, tax credits, or other forms of financial relief, and how those payments would be distributed.

Current Status: Policy Development and Legislative Hurdles

While Trump has repeatedly advocated for the tariff dividend, its legal feasibility and timeline remain uncertain. As of 2026, no formal legislation has been passed, and the $2,000 dividend has yet to be implemented. The tariff funds that could support this initiative remain a key sticking point.

Although tariffs have generated some revenue, they do not yet appear to be sufficient to fund a broad $2,000 payment to all Americans. Critics argue that the idea requires congressional approval, as the U.S. Constitution grants Congress the power to allocate spending, and the executive branch does not have the authority to unilaterally distribute taxpayer money without legislative action.

In response, Trump has suggested that he could proceed with the payments using executive authority, but most legal experts disagree with this interpretation of the law. For any meaningful rollout of the tariff dividend, Congress would need to pass legislation explicitly authorizing the payments.

If the legislation is passed, the payments could begin as early as 2026. However, the complexities involved in determining the amount of tariff revenue, as well as legal and procedural hurdles, mean that this timeline remains speculative at best.

Who May Qualify for the $2,000 Tariff Dividend?

One of the most contentious issues surrounding the $2,000 tariff dividend proposal is determining who will qualify for the payment. While Trump’s plan is aimed at providing economic relief to most American households, several factors could determine eligibility:

1. Income Limits

It is likely that eligibility would be based on household income. Like previous economic stimulus checks, the $2,000 dividend may be limited to individuals or families who earn below a certain threshold. The specific income cut-off has not been defined, but discussions suggest that it would exclude high-income households similar to the $75,000 income cap applied in past COVID relief efforts.

2. Residency and Citizenship

The tariff dividend would likely be available only to U.S. citizens or legal residents, which would exclude undocumented individuals. Similar to past relief programs, there may also be eligibility criteria based on age, with payments potentially limited to adults over 18, though dependents and children might also be included.

3. Household Size

It is not yet clear whether the dividend would be calculated per individual or per household. Previous stimulus checks have been per person, and some analysts speculate that the $2,000 dividend would follow this model, allowing households with more members to receive more significant benefits.

How Could SNAP Fit Into the $2,000 Tariff Dividend?

SNAP (Supplemental Nutrition Assistance Program), commonly known as food stamps, serves as a critical part of the U.S. social safety net for low-income families. One of the most important questions surrounding the $2,000 tariff dividend is how it would interact with existing benefit programs, especially SNAP.

1. Impact on SNAP Eligibility

Since SNAP benefits are means-tested, they are based on a household’s income. If individuals receive the $2,000 tariff dividend, that money could count as income and potentially affect their eligibility for SNAP benefits.

Some advocates worry that people who receive the payment may see their SNAP benefits reduced if the dividend is treated as income under existing rules.

On the other hand, it is possible that policymakers could exempt the $2,000 tariff dividend from income calculations for the purposes of SNAP eligibility. This would ensure that individuals continue to receive food assistance, despite the additional payment.

2. SNAP Benefit Increases and Policy Considerations

Advocates of SNAP worry that if the tariff dividend is counted as income, the result could be a reduction in benefits for millions of eligible households. This is especially concerning given the rising costs of food and inflation.

To address this, lawmakers would need to clarify whether the dividend would affect other welfare programs, and if any reforms would be necessary to prevent negative impacts on food security. In a broader sense, the interaction between these two programs raises larger questions about the relationship between direct financial aid and food assistance programs.

The tariff dividend could serve as an additional source of income for families in need, but if not handled properly, it could result in households receiving less overall support from government programs like SNAP.

The Economic and Legal Challenges of Implementing the Tariff Dividend

Economic Feasibility

While the idea of distributing $2,000 to Americans sounds appealing, experts warn that economic sustainability may be a concern. The federal deficit is already at historically high levels, and many economists believe that such large payments could exacerbate inflation and further strain federal resources.

Additionally, tariff revenues fluctuate depending on trade policies and global economic conditions. Relying on tariffs as a long-term revenue source for such significant direct payments may be risky.

There is a concern that as tariffs come and go, dividend payments could be unsustainable, leading to deficits in the future.

Legal Roadblocks

As mentioned earlier, the biggest legal obstacle facing the $2,000 tariff dividend is the need for congressional approval. The proposal raises questions about the executive branch’s authority to redistribute federal funds without explicit legislation.

Furthermore, trade tariffs themselves have been a point of legal contention, especially as the U.S.-China trade war continues to have long-lasting effects on U.S. commerce. Courts have questioned the legality of some tariffs, adding another layer of uncertainty to the plan’s viability.

Public Response and Political Implications

The $2,000 tariff dividend has sparked a mixed reaction from the public and political circles. Some have praised the idea as a fair way to distribute funds generated by trade policies, especially if it targets working and middle-class Americans.

Others have expressed concerns about inflation, the lack of transparency, and the potential for unintended consequences on programs like SNAP. Both Republican and Democratic lawmakers are divided over the dividend’s feasibility and fairness.

Some Republicans, particularly those aligned with Trump’s America First agenda, have backed the idea, while others have expressed reservations due to concerns over the deficit and long-term economic health.

On the Democratic side, while there is general support for direct payments, concerns about the tariff system’s fairness and economic impact have led to skepticism.

Related Links

Social Security Age 70 Strategy – How Waiting Can Push Benefits Near $2,500 a Month

IRS Filing Extension Update – Has the Tax Deadline Been Moved? What We Know

What’s Next for the $2,000 Tariff Dividend?

At this stage, the $2,000 tariff dividend remains an unresolved proposal. There are many hurdles to clear before it could become a reality, including legislative approval, legal challenges, and logistical issues in distributing the payments.

As of now, the details about eligibility, the distribution mechanism, and the broader economic impact are still unclear.

Americans interested in this proposal should stay informed about potential developments and continue to monitor the policy discussions surrounding trade, tariff revenues, and their implications for food assistance programs like SNAP.