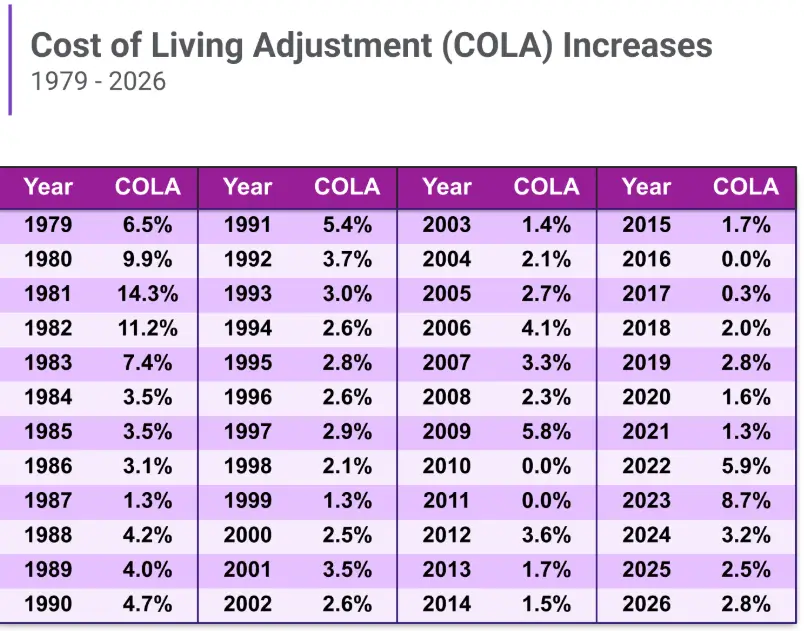

In 2026, Social Security beneficiaries are set to receive a 2.8% increase in their monthly payments as part of the Cost of Living Adjustment (COLA).

While this boost offers some relief, inflation continues to challenge recipients. Here’s what the upcoming COLA means for beneficiaries and what’s next in future adjustments.

Social Security COLA Estimates

| Key Fact | Details |

|---|---|

| COLA Increase for 2026 | 2.8% increase for Social Security beneficiaries |

| Average Monthly Increase | Approx. $56 for retirees, up to $2,064 per month |

| SSI and Disability Payments | 2.8% increase also applies to SSI and SSDI beneficiaries |

| Medicare Premium Impact | Higher premiums may offset COLA gains for some beneficiaries |

| 2027 COLA Projection | 2.5% increase projected for 2027 |

Social Security COLA: A Critical Update for Beneficiaries

The Social Security Cost of Living Adjustment (COLA) is a vital tool designed to help recipients keep pace with inflation. Each year, Social Security beneficiaries, including retirees, disabled individuals, and survivors, receive an annual COLA that reflects the change in the cost of living.

This year, beneficiaries will see a 2.8% increase in their monthly payments, which translates to about an average $56 increase for Social Security retirement benefits, based on current estimates. The 2.8% increase for 2026 follows a slightly lower 2.5% boost in 2025, a reflection of inflation patterns observed over the past year.

As the cost of goods and services continues to climb, especially in areas like healthcare and housing, the COLA adjustment remains crucial for helping recipients maintain purchasing power.

However, many beneficiaries are still struggling with the growing gap between inflation and the adjustment provided.In this article, we will dive deeper into how the 2026 COLA was determined, what it means for Social Security recipients, and what the future of COLA looks like for 2027 and beyond.

How Social Security COLA Works and Why It Matters

Each year, the Social Security Administration (SSA) adjusts benefits based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index tracks the average changes in prices of goods and services, such as food, housing, and medical expenses, to determine the cost of living for workers.

The increase in the CPI-W from the third quarter of one year to the same period the next year determines the COLA percentage. In 2026, the 2.8% COLA reflects a moderate increase in inflation, which has slowed somewhat from previous years but still remains a burden for many Social Security recipients.

For instance, rising healthcare costs, housing expenses, and other necessities are not fully captured by the CPI-W, meaning many seniors and disabled individuals find themselves falling behind despite the COLA increase.

While this COLA adjustment helps, inflation has consistently outpaced these annual increases, leading to concerns among advocates about the adequacy of future COLA increases in preserving the purchasing power of Social Security beneficiaries.

What Does the 2.8% COLA Increase Mean for Beneficiaries?

The 2026 COLA provides an important boost for the more than 70 million Social Security recipients, including retirees, individuals with disabilities, survivors, and Supplemental Security Income (SSI) recipients.

The average retiree benefit will rise by $56 per month, with the average monthly Social Security check now set to increase from about $2,008 to $2,064. However, while this increase offers some relief from inflation, Medicare Part B premiums — which are automatically deducted from Social Security checks for many beneficiaries — are expected to climb in 2026.

This could mean that a portion of the COLA gain is offset by higher healthcare costs, particularly for those who rely on Medicare for doctor visits and outpatient services.

SSI and Disability Recipients Also See an Increase

Along with retirees, Supplemental Security Income (SSI) recipients will also receive the 2.8% COLA, helping low‑income seniors, blind individuals, and disabled people meet the rising costs of living.

The increase is particularly crucial for those living on limited resources, and the SSI program is designed to ensure that these individuals can afford basic necessities such as food, shelter, and clothing.

Impact of Rising Healthcare Costs on Social Security Beneficiaries

One of the biggest challenges facing Social Security recipients is the increasing cost of healthcare, which disproportionately affects older adults and individuals with disabilities. As Medicare premiums rise, beneficiaries who rely on Social Security for income may see a smaller net increase than expected.

For example, in 2026, the average Medicare Part B premium could rise by approximately $10 per month, cutting into the $56 increase that beneficiaries receive from the COLA.

Moreover, prescription drug costs and hospital care are major drivers of inflation in healthcare, which often outpaces the adjustments made to Social Security benefits. The Medicare deductible and co-pay amounts for certain services are also set to increase, leading to even higher out-of-pocket costs for seniors.

Looking Ahead: What’s Next for COLA in 2027 and Beyond?

As inflation continues to impact the purchasing power of Social Security recipients, questions loom about future COLA increases. Early estimates for 2027 predict a 2.5% increase, slightly lower than the 2026 adjustment.

These estimates are based on current inflation trends and economic projections, but CPI-W measurements and economic conditions could change, affecting the actual increase. For beneficiaries, a 2.5% COLA in 2027 could still provide a vital boost, but challenges remain.

Advocates argue that inflation often outpaces the COLA, and the aging U.S. population means that more seniors will rely on Social Security for their entire income, making it critical that future adjustments keep pace with rising costs.

Social Security Reform: Addressing Long-Term Sustainability

Despite regular COLA adjustments, Social Security faces long-term financial challenges. The Social Security trust fund is projected to be depleted by 2033 unless legislative action is taken to address the program’s funding shortfall.

This could lead to reduced benefits unless Congress intervenes with changes such as raising the payroll tax, adjusting benefits, or finding new funding sources.

Calls for COLA Adjustments and Reform

While the current COLA system offers some relief, it has also been criticized for not fully addressing the unique economic pressures facing seniors.

In particular, advocates argue for a senior-specific inflation measure (CPI-E) that would better reflect the spending patterns of older Americans, who spend a larger proportion of their income on healthcare.

Public Opinion and the Push for Reform

Public opinion on COLA adjustments and Social Security reform remains divided. While many beneficiaries appreciate the annual increase, others argue that it is not enough to meet their needs in the face of rising inflation, particularly for those living on fixed incomes.

AARP and other senior advocacy organizations have repeatedly lobbied for changes to the way COLA increases are calculated, arguing that the current system fails to adequately reflect the economic realities seniors face.

Surveys show broad public support for adjusting the COLA formula, with many advocating for higher and more frequent adjustments.

Related Links

$1,776 Warrior Dividend Payment – IRS Confirms Tax-Free Status

IRS 2025 Tax Deadline – Why This Date Matters If You’re Behind on Filing

What Social Security Recipients Can Do Now

The 2.8% COLA increase in 2026 provides some relief to millions of Social Security beneficiaries, but it is clear that more needs to be done to ensure the long-term viability of the program. As inflation continues to erode purchasing power, Medicare premium hikes and other rising costs are expected to offset much of the increase for many recipients.

Social Security recipients should stay informed about future COLA adjustments, monitor Medicare premiums, and advocate for long-term reforms to ensure that the program remains sustainable and adequately supports those who depend on it.