The Internal Revenue Service (IRS) has rolled out a new tax benefit for the 2026 tax season that could provide a significant financial boost to over 1 million U.S. taxpayers. This new initiative aims to help individuals, particularly those who may be eligible for special credits or deductions that were previously unavailable.

As tax season 2026 approaches, understanding this benefit and how to claim it is essential for millions of American taxpayers. Here’s everything you need to know about the IRS new tax benefit and how you can make the most of it.

IRS New Tax Benefit

| Key Fact | Details |

|---|---|

| Benefit Type | Tax reduction/credit for eligible taxpayers |

| Eligible Group | Up to 1 million U.S. taxpayers, focusing on low-income groups |

| Impact | Lower tax liability, potential refund boost |

| Action Required | Filing tax return as usual, no special forms needed |

| Tax Filing Season | Begins January 2026, with benefits applicable in the 2026 tax year |

The IRS has introduced a new tax benefit in 2026 that could benefit over 1 million taxpayers, with direct financial assistance for eligible individuals. This tax benefit provides new opportunities for tax savings, reducing liability, and potentially increasing refunds. Learn how to qualify for this one‑time benefit and maximize your refund this year.

What Is the New IRS Tax Benefit for 2026?

The IRS new tax benefit for 2026 is a direct effort to ease the financial burden on low and moderate‑income taxpayers by reducing their overall tax liability. This initiative specifically targets individuals with income near or below the federal poverty line, those receiving certain government assistance programs, and those who meet the IRS’ newly set eligibility criteria.

This benefit aims to provide relief through refundable tax credits, meaning that taxpayers who qualify may either lower their tax bill or receive a refund even if they owe no taxes.

The program comes as part of the IRS’ ongoing commitment to provide relief in the aftermath of the economic strains caused by the pandemic and its lingering effects on the financial stability of millions of U.S. residents.

How Does This Benefit Work?

The IRS new tax benefit is designed to provide tax relief directly, with a focus on unclaimed tax credits and deductions that many taxpayers may have previously overlooked. Here’s a closer look at how this benefit works and who will benefit most:

Refundable Tax Credit for Eligible Taxpayers

This tax benefit primarily consists of a refundable tax credit that reduces tax liability or adds to the taxpayer’s refund. The most common form of refundable credits that qualify for this program are:

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Additional Child Tax Credit (ACTC)

Taxpayers eligible for these credits may receive up to a $3,500 refund based on their income level, family size, and filing status. The new IRS benefit adds to the existing pool of tax credits available, creating more opportunities for tax savings or refunds.

The refundable nature of these credits means that even if you owe little or no taxes, you may still receive the full amount of the credit as a direct payment.

Automatic Application of Benefits

For eligible taxpayers, this new tax benefit will be applied automatically when they file their 2026 tax returns. Individuals do not need to take any additional steps to receive this benefit, other than ensuring that they meet the eligibility requirements, which are typically based on income thresholds and the number of dependents claimed.

Unlike other credits or relief programs that require a separate application, this benefit will be calculated directly by the IRS based on the taxpayer’s filing information.

So, once you file your taxes for the 2026 tax year, the IRS will automatically calculate and apply the credit to your tax return, providing the financial boost directly.

Who Qualifies for the IRS New Tax Benefit?

Eligibility for the IRS new tax benefit is based on a few key factors. While the benefit is expected to apply to up to 1 million taxpayers, not everyone will automatically qualify. Below are the main eligibility criteria:

1. Income Level

The new benefit is targeted at low to moderate-income earners. Typically, this means households earning near or below the federal poverty level (FPL) or 120% of the FPL will be eligible for this benefit.

While precise income limits will vary by filing status and number of dependents, the IRS has indicated that the benefit is designed to help those who need it most, particularly single filers and married couples with children.

2. Dependents

Having dependents plays a significant role in eligibility. Families with children are particularly well-positioned to benefit from this tax relief. For example, households that qualify for the Child Tax Credit (CTC) will receive this benefit, which is also designed to support parents with children under 17 years of age. Furthermore, the more dependents a filer has, the greater the tax relief they will likely receive.

3. Filing Status

While there is no special filing status required, those who file their taxes as Head of Household or Married Filing Jointly will have a higher threshold for eligibility. For example, single filers with children and those filing jointly with a spouse may qualify for higher credits due to their family structure. Individuals who do not have dependents or file as single may still qualify based on income levels.

4. Military Service Members and Veterans

The IRS has extended some tax breaks specifically for military service members who might also qualify for this new tax benefit. These individuals can expect further reductions in their tax liabilities if they meet the eligibility guidelines, making it easier for them to get additional relief.

Apply and Receive the Benefit

To receive the IRS new tax benefit, taxpayers must simply file their 2026 tax returns as usual. The benefit is automatically applied if the taxpayer meets the eligibility criteria, meaning no special forms are required beyond the standard tax filing process.

Here’s what you need to do:

- File your taxes for the 2026 tax year before the filing deadline (typically April 15, 2027).

- Include all necessary tax documents: This includes income documentation (e.g., W-2, 1099), information about dependents, and any other relevant tax filings.

- The IRS will automatically calculate and apply the benefit during the processing of your tax return.

Why This New Benefit Matters

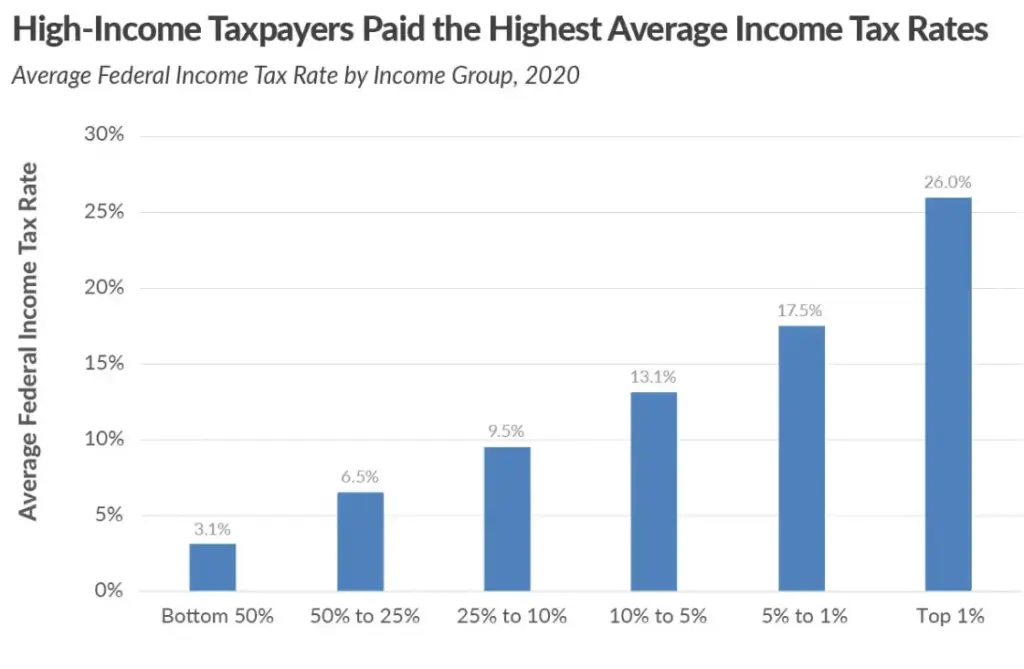

The IRS new tax benefit is part of a broader effort to assist taxpayers who may be facing financial struggles. In a time when inflation and cost of living continue to rise, these tax benefits help to alleviate some of the financial pressures felt by millions of Americans.

By offering refundable tax credits, the IRS aims to increase the disposable income of those most in need, helping them better manage expenses.

In addition to providing immediate financial relief, the new tax benefit has the potential to improve economic equality, allowing those who are typically excluded from financial assistance programs to receive some level of support through their tax filings.

Related Links

SNAP Payment Accuracy Update – How Kansas Is Fixing Errors to Avoid a $41 Million Penalty

Trump $2,000 Tariff Dividend Update – Current Status, Who May Qualify, and How SNAP Fits In

What’s Next for Taxpayers

As the 2026 tax season approaches, this IRS new tax benefit presents an exciting opportunity for millions of American taxpayers to reduce their tax burden or increase their refunds.

With no additional steps required beyond standard filing, this benefit is set to assist low and moderate‑income families in making ends meet during a challenging financial period. Taxpayers should carefully review their eligibility and ensure they file their taxes on time to maximize this benefit.

For those unsure about their eligibility, it may be helpful to consult a tax professional or use IRS tools to confirm how this benefit will apply to their specific circumstances.