The debate over a new round of stimulus checks has persisted into 2026, with many Americans wondering whether they can expect additional relief payments this year. While online rumors and media reports have suggested a new wave of economic support, the Internal Revenue Service (IRS) and U.S. Treasury have not approved or initiated any new federal stimulus payments for 2026.

Despite various proposals, including ideas for tariff-funded checks, no official legislation has been passed to authorize direct payments to citizens.

What We Know About Stimulus Payments in 2026

No New Federal Stimulus Payments in 2026

As of January 2026, the IRS and Treasury Department have not issued any statements confirming the approval of new federal stimulus checks. Despite ongoing speculation, no official action has been taken by the government to distribute payments similar to the COVID-19 relief checks that were sent in 2020 and 2021.

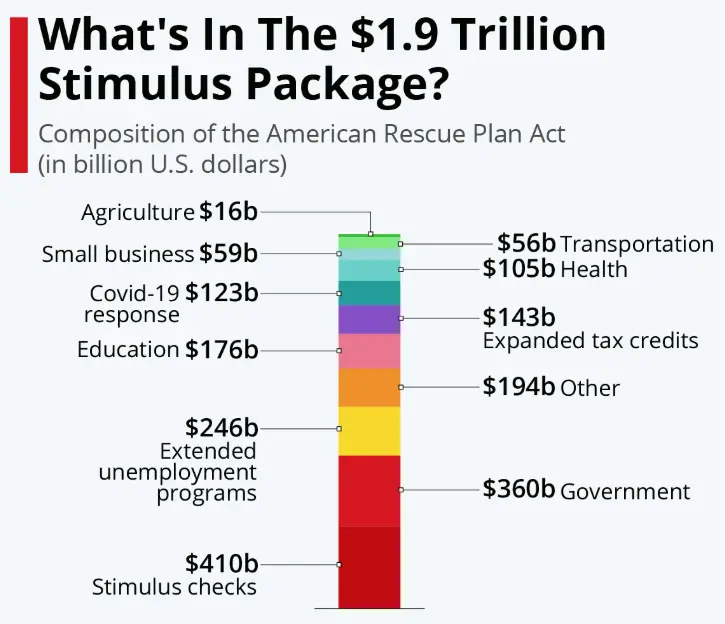

These previous payments were part of emergency measures passed by Congress to stimulate the economy and support individuals during the pandemic.

For any federal stimulus payment to occur, Congress must pass specific legislation to authorize and fund the program. This process involves both houses of Congress and the President’s signature. No such legislation has been enacted as of early 2026.

What Federal Agencies Have Said

The IRS has made it clear that there are no new stimulus payments on the horizon. In statements issued to the public, the agency emphasized that current economic relief payments (if any) are either tied to existing tax refunds or social security payments and not a new form of economic stimulus.

“There are no plans for a new round of direct payments as part of federal stimulus relief,” said an IRS spokesperson. “Any assistance given will be in line with existing relief programs and tax regulations.”

Similarly, the U.S. Treasury has confirmed that while discussions about tariff-funded dividends and other proposals are ongoing, these ideas have not yet resulted in legislation or official plans for direct payments to taxpayers.

Background: Stimulus Checks During the Pandemic

The previous rounds of stimulus checks were authorized through legislation such as the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) passed in March 2020. These payments ranged from $1,200 to $2,000 for eligible individuals, with the goal of providing quick relief to households facing economic hardship due to the pandemic.

Since then, additional payments were made, including economic impact payments in the form of direct deposits and mailed checks. However, as the pandemic has subsided and the economy has recovered in many areas, there has been no further stimulus relief of this nature approved by the federal government.

Proposals for Stimulus Checks in 2026

Tariff-Funded Stimulus: A Proposal, Not Law

One of the more widely discussed ideas in 2025–2026 has been the concept of tariff-funded stimulus checks. This idea revolves around using revenues collected from U.S. tariffs, particularly on goods from China, to provide direct payments to American taxpayers.

Proponents argue that this would allow the government to redistribute some of the funds raised through trade tariffs directly back to U.S. consumers. While this idea has been championed by some lawmakers, including certain members of Congress and former President Donald Trump, it remains a proposal rather than an official program.

No formal legislation has been passed to create such a system. Economic experts caution that tariff revenues alone would not be sufficient to support a broad-based payment plan without careful planning, legislative approval, and adjustments to U.S. trade policy.

Existing Relief Programs for Americans

Tax Refunds and IRS Filing Season

While there are no new stimulus checks, many taxpayers will still receive financial relief in 2026 through tax refunds. The IRS began accepting 2025 tax returns on January 26, 2026, with refunds expected to be issued throughout the spring.

The average tax refund in 2025 was roughly $2,800, though the amount varies based on income, deductions, and credits. It’s important to note that these tax refunds are not the same as stimulus payments, though some may confuse them as such.

Tax refunds are based on income taxes already paid throughout the year, whereas stimulus checks are direct payments intended to boost economic activity and assist individuals during times of crisis.

For those who have filed their tax returns, direct deposits for refunds will be the primary method of delivery, as the IRS continues its transition away from paper checks.

Social Security Benefits and Other Federal Payments

Other forms of federal financial support, such as Social Security benefits, will continue in 2026 on their usual schedules. Monthly Social Security payments are adjusted for cost-of-living increases (COLA) and are made directly to recipients.

As of January 2026, Social Security recipients saw a 5.9% increase in their monthly payments, which is the result of rising inflation over the past year.

Additionally, some states and municipalities may implement their own economic relief programs, including one-time payments or expanded benefits for residents in need. However, these state-level programs are not part of a federal stimulus check initiative.

Understanding the Current Economic Landscape

The economic context of 2026 is quite different from the period when the federal government issued widespread stimulus payments. According to the Bureau of Economic Analysis (BEA), the U.S. economy has seen significant growth in recent years, with employment rates nearing pre-pandemic levels, and GDP expansion returning to a more sustainable pace.

While inflation remains a concern, especially for certain goods and services, many experts believe that the focus for government action should shift from direct stimulus payments to long-term economic growth policies that address underlying issues like workforce development, healthcare affordability, and trade balances.

What Would It Take for New Stimulus Payments in 2026?

If new stimulus checks were to be issued in 2026, it would require multiple steps, including:

- Legislation by Congress: Any new economic relief package would need to be written, debated, and passed by both chambers of Congress. This could involve direct payments, tax relief, or support for specific sectors like small businesses.

- Approval by the President: After passing through Congress, the legislation would need the President’s signature before it could become law.

- Implementation by the IRS: Once a bill is signed into law, the IRS would then be responsible for administering the relief, determining eligibility, and processing payments.

Without clear action from lawmakers, it is unlikely that we will see another round of federal stimulus checks in 2026. Lawmakers have instead turned their attention to economic policies aimed at long-term stability and growth.

Related Links

West Virginia SNAP Budget Update – $13.5 Million Increase Proposed and What It Means for Families

Social Security Age 70 Strategy – How Waiting Can Push Benefits Near $2,500 a Month

As of January 2026, there are no federal stimulus checks approved or planned by the IRS or Treasury. While various proposals continue to surface, including ideas for tariff-funded checks, none have reached the stage of formal legislation.

Americans who are expecting new relief payments will need to rely on existing government programs such as tax refunds or Social Security benefits for financial assistance in the coming months.

As the year progresses, it is important to stay informed through trusted sources like the IRS and official government websites to receive updates on any future economic relief measures.