The IRS has announced new minimum tax payment thresholds for the 2026 tax year, adjusting figures to account for inflation and tax code changes. Understanding these new guidelines is essential for taxpayers to determine if they need to file or pay taxes.

As we move into the 2026 tax season, the Internal Revenue Service (IRS) has set new thresholds for tax payments that could impact millions of American taxpayers. These updates, which include increased deductions and adjusted filing requirements, reflect inflation adjustments and recent tax law changes.

This article explains the key updates, what taxpayers must pay, and how these changes could affect your tax filing obligations in 2026.

What Are the New Minimum Tax Payment Thresholds for 2026?

Updated Income Requirements for Filing Taxes

The IRS sets minimum income thresholds for filing taxes, which determine when a taxpayer is required to file a return and pay any owed taxes. These thresholds vary based on the taxpayer’s filing status, age, and income level. For 2026, the IRS has made adjustments to these filing requirements to account for inflation and changes in tax law.

- Single Filers:

- The minimum income required to file as a single filer for 2026 is $15,750. This threshold reflects an increase from the previous year’s $15,250 minimum.

- Filing Status: Single filers under age 65 must file if they earn more than the standard deduction, which has also increased in 2026 to $16,100. This means that anyone making more than $15,750 will need to file a tax return.

- Married Filing Jointly:

- For married couples filing jointly, the threshold has been raised to $31,500. This increase accounts for inflation adjustments and ensures that couples will only need to file if their combined income exceeds the adjusted minimum.

- Head of Household:

- The threshold for head of household filers will now begin at $23,625, up from $23,000 in the previous year. Head of household status typically applies to unmarried individuals who support a dependent, such as children or elderly parents.

These adjustments ensure that taxpayers who earn modest income or who benefit from significant deductions do not need to file a tax return if their income is below the updated thresholds.

The IRS also allows those below the filing threshold to submit returns if they wish to claim certain credits, such as the Earned Income Tax Credit (EITC).

Key Changes to the Standard Deduction and Tax Brackets

The standard deduction is one of the most significant adjustments for taxpayers in 2026. The IRS has raised the standard deduction amounts across filing statuses, which will affect how much income is taxed:

- Single Filers: The standard deduction for single filers in 2026 is $16,100, up from $15,500 in 2025. This means taxpayers can deduct this amount from their taxable income before taxes are assessed.

- Married Filing Jointly: Married couples who file jointly will benefit from a higher standard deduction of $32,200, up from $31,000 in 2025. This increase helps offset inflationary pressures and supports higher-earning households in reducing their taxable income.

- Head of Household: For heads of household, the standard deduction has increased to $24,150, from $23,000 in 2025.

These increases in the standard deduction mean that more taxpayers will not owe taxes unless their income exceeds these higher thresholds. For many low-to-middle-income households, these increases provide significant relief.

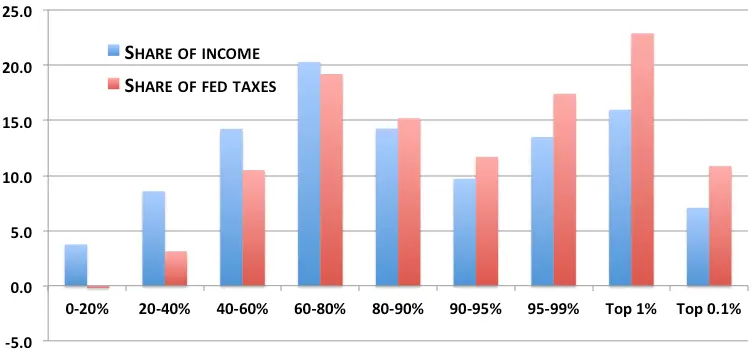

In addition, tax brackets remain unchanged for the 2026 tax year, ranging from 10% to 37%, but inflation adjustments to the income thresholds that trigger each rate are key for determining how much tax will be owed.

The Impact of Inflation Adjustments on Taxes

One of the main reasons the IRS adjusts tax thresholds annually is to keep pace with inflation. Without these adjustments, taxpayers could be pushed into higher tax brackets simply due to inflation, which would erode their purchasing power.

In 2026, the IRS made inflation adjustments to multiple tax elements, including the Alternative Minimum Tax (AMT) exemption, which ensures that high-income earners pay at least a minimum level of tax.

Alternative Minimum Tax (AMT) Threshold

The AMT exemption has been raised to $90,100 for individuals, up from $88,000 in 2025. For married couples filing jointly, the exemption increases to $180,200, from $176,000. The AMT ensures that wealthy taxpayers do not avoid tax obligations through various deductions and credits that lower their tax bills substantially.

Who Must File and Pay Taxes in 2026?

While the new minimum tax payment thresholds clarify who needs to file and pay taxes, there are additional rules to consider:

- Self-Employed and Freelancers: Self-employed individuals and freelancers who earn more than $400 in net self-employment income must file a tax return, even if their income is below the standard filing threshold. They will also need to pay self-employment taxes, which cover Social Security and Medicare.

- Investment Income: Individuals who earn income from investments, such as interest, dividends, or capital gains, may still be required to file a return even if their employment income does not exceed the filing threshold.

- Social Security and Medicare Taxes: Certain taxpayers may also have to pay additional taxes, such as Medicare taxes or the Net Investment Income Tax (NIIT), depending on their income level and sources.

- State and Local Taxes: In addition to federal tax filings, some states and local governments may have their own filing requirements, which may differ from federal guidelines.

Estimated Tax Payments and How They’re Affected

For individuals who don’t have enough tax withheld from their wages, such as self-employed workers, the IRS requires them to make quarterly estimated tax payments.

Key Dates for Estimated Payments in 2026:

- April 15, 2026 (1st quarter)

- June 15, 2026 (2nd quarter)

- September 15, 2026 (3rd quarter)

- January 15, 2027 (4th quarter, due for 2026 income)

These dates ensure that taxpayers don’t owe large sums when they file their returns. Failing to pay estimated taxes may result in penalties and interest.

Expert Opinions: What Tax Professionals Are Saying

John Smith, a tax expert with Smith & Associates Tax Advisors, explains that the 2026 changes offer significant relief to many taxpayers, particularly those in the lower income brackets. “The larger standard deductions and the inflation adjustments mean that many taxpayers will pay less, or no, federal income tax in 2026,” he said.

He also pointed out that for self-employed individuals, the requirement to pay quarterly estimated taxes is still in effect, and failing to make timely payments could lead to unnecessary penalties.

Dr. Laura Jacobs, an economist with the Tax Policy Center, commented, “The IRS’s adjustments are designed to prevent middle-class families from inadvertently facing higher tax liabilities due to inflation. The increased filing thresholds and standard deductions are beneficial, but taxpayers need to understand their specific filing status to avoid unnecessary filings or penalties.”

Stay Compliant and Avoid Penalties

To avoid penalties and ensure compliance, taxpayers should:

- Review income and deductions carefully against the updated filing thresholds.

- Consult a tax professional if unsure about filing requirements, especially for those with mixed income sources (e.g., self‑employment and investments).

- Make estimated tax payments quarterly if necessary.

Related Links

SNAP Payment Accuracy Update – How Kansas Is Fixing Errors to Avoid a $41 Million Penalty

Trump $2,000 Tariff Dividend Update – Current Status, Who May Qualify, and How SNAP Fits In

For the 2026 tax year, the IRS has updated the minimum filing and payment thresholds to reflect inflation and legislative changes. These thresholds — anchored by higher standard deductions and adjusted tax brackets — will determine who must file and potentially pay federal income tax. Understanding these figures and planning ahead for estimated payments can help taxpayers avoid penalties and make informed financial decisions.

With these updates in mind, taxpayers should take the necessary steps to stay compliant and avoid penalties, including considering whether they need to make quarterly estimated payments and consulting a tax professional for advice.

The IRS provides ample resources to help navigate these changes, and staying informed is the best way to ensure smooth tax filing in 2026.