The IRS Tax Refund 2026 Schedule is taking shape as the Internal Revenue Service begins processing millions of federal tax returns across the United States.

While most taxpayers can expect refunds within weeks, payment dates and refund amounts will vary depending on filing method, tax credits claimed, and IRS processing capacity during the 2026 filing season.

IRS Tax Refund 2026 Schedule

| Key Item | Detail |

|---|---|

| Filing season opens | January 26, 2026 |

| Standard filing deadline | April 15, 2026 |

| Fastest refund method | E-file + direct deposit |

| Typical refund timing | 10–21 days |

| Average refund range | $3,000–$4,000 |

Understanding the IRS Tax Refund 2026 Schedule

The IRS does not publish a fixed calendar of refund payment dates. Instead, refunds are issued on a rolling basis once a return is received, verified, and approved. For the 2026 tax season, which covers income earned in 2025, the IRS confirmed it will begin accepting electronic and paper returns on January 26, 2026.

Refunds are typically issued after three stages: return acceptance, processing, and payment authorization. According to the IRS, more than nine in ten individual taxpayers now file electronically, a trend that has significantly shortened refund timelines compared with paper filing.

Refund Timing by Filing Method

E-file with Direct Deposit

Taxpayers who file electronically and select direct deposit generally receive refunds fastest.

- Estimated timeframe: 10 to 21 days after IRS acceptance

- Why it’s faster: Automated verification and electronic payment processing

The IRS continues to emphasize that direct deposit reduces errors, fraud risk, and mailing delays.

E-file with Paper Check

Refunds issued by mailed check take longer due to printing and postal delivery.

- Estimated timeframe: 3 to 4 weeks

Paper Filing

Paper returns require manual processing, which significantly slows refunds.

- Direct deposit: 4 to 8 weeks

- Paper check: 6 to 10 weeks or longer

The IRS has repeatedly warned that paper returns remain vulnerable to seasonal backlogs.

Credits That Delay Refunds

Under federal law, refunds that include the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) cannot be issued before mid-February. This rule, created under the Protecting Americans from Tax Hikes (PATH) Act, is designed to combat fraud and identity theft.

As a result, many early filers who claim these credits will not see refunds until late February or early March 2026, even if they file on the first day of the season. The IRS has stated that this delay applies automatically and does not indicate a problem with a return.

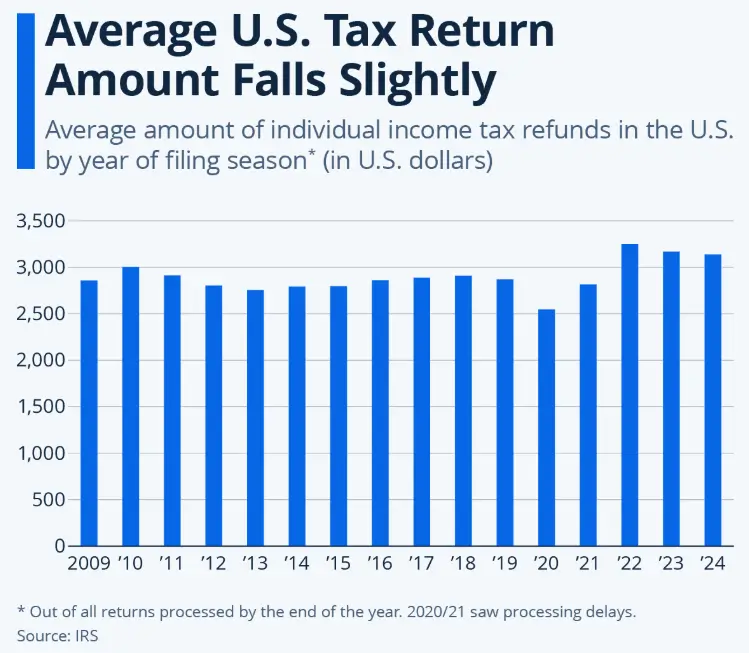

Expected Refund Amounts in 2026

Refund amounts vary widely based on income, withholding, credits, and life changes such as marriage or the birth of a child.

Based on IRS historical data, the average federal refund in recent years has ranged between $3,000 and $4,000, though individual refunds can be significantly higher or lower.

Why Refund Amounts Change Each Year

Tax policy experts note that refund sizes are influenced by:

- Inflation-driven wage growth

- Changes in tax withholding behavior

- Adjustments to credits and deductions

- Employment trends

“Refunds are not a bonus from the government,” said Elaine Maag, a senior fellow at the Urban-Brookings Tax Policy Center. “They reflect how closely tax withholding matched a household’s actual tax liability.”

Refund Offsets: Why Some Taxpayers Receive Less

Some refunds may be partially or fully reduced due to federal or state obligations. These offsets are handled through the Treasury Offset Program.Common reasons for refund reductions include:

- Past-due federal or state taxes

- Unpaid child support

- Defaulted federal student loans

- Certain unemployment benefit overpayments

Taxpayers affected by offsets typically receive a notice explaining the adjustment.

IRS Staffing, Backlogs, and Modernization

While IRS processing has improved since pandemic-era disruptions, challenges remain. The agency has expanded staffing and digital services using funding from recent federal investments. According to IRS officials, these changes have reduced average processing times and improved phone response rates.

However, watchdog groups caution that high filing volumes and complex returns can still cause delays, particularly during peak weeks in March and April.

Track Your IRS Refund

The IRS recommends using official tools rather than third-party websites.

- Where’s My Refund? (IRS website)

- IRS2Go mobile app

Refund status typically becomes available within 24 hours of e-file acceptance or four weeks after mailing a paper return.

Related Links

IRS Announces $2,000 Direct Deposit Payments in January 2026 – Are You on the List?

Social Security COLA Estimates: What’s Next for Beneficiaries

What Comes Next

As the 2026 tax season progresses, the IRS is expected to issue periodic updates on processing volumes and refund timing. Tax professionals advise filers to monitor official IRS communications and avoid refund-related scams, which typically increase during filing season.

For now, taxpayers who file electronically, claim credits accurately, and choose direct deposit remain best positioned to receive refunds with minimal delay.

FAQs About IRS Tax Refund 2026 Schedule

When is the latest I can file and still get a refund?

You generally have up to three years to claim a refund by filing a return.

Does filing early guarantee a faster refund?

Early filing helps, but refund timing also depends on credits claimed and return accuracy.

Can my refund be delayed for identity verification?

Yes. Some returns are flagged for additional identity checks as part of fraud prevention efforts.

Is direct deposit safe?

The IRS considers direct deposit the most secure refund method available.