The 2026 IRS filing season brings critical changes to tax laws, the IRS’s operations, and refund processing systems.

This year, new tax credits, modernized payment processing, and a focus on electronic filings will significantly alter how taxpayers experience the filing process. Here’s what you need to know about these updates to ensure a smooth and efficient filing.

IRS 2026 Filing Rules

| Key Change | What It Means for Taxpayers |

|---|---|

| Refund Processing | Electronic refunds prioritized over paper checks |

| Expanded Tax Credits | New and increased credits available (e.g., Child Tax Credit) |

| Filing Deadlines | 2026 filing season opens in January; deadlines remain similar |

| E-filing Encouraged | E-filing encouraged for faster processing and refund delivery |

| Changes to Refund Timelines | Direct deposit refunds processed faster than paper checks |

What’s New for the 2026 Filing Season?

The 2026 filing season sees a number of updates aimed at streamlining the tax filing process. These updates are primarily focused on modernization, with an emphasis on digital filing, faster refunds, and expanded tax benefits. Here’s a breakdown of what to expect this year.

Refund Processing: The Shift to Electronic Payments

One of the most significant changes is the IRS’s push for electronic refunds. The IRS is actively moving away from paper checks and will prioritize direct deposit as part of Executive Order 14247. This transition is designed to make refund processing faster, safer, and more efficient.

- Taxpayers who provide direct deposit information will receive their refunds in as little as 21 days for e-filed returns, as long as no errors or further reviews are required.

- Paper checks, while still available, will take longer to process. The IRS has noted that taxpayers who fail to provide direct deposit details might face delays, particularly if their banking information is outdated or incorrect.

- In cases where direct deposit fails, the IRS will freeze the refund, requiring taxpayers to update their banking details before the refund is released.

Expanded Tax Credits and Deductions in 2026

The 2026 tax year brings expanded tax credits, some of which may benefit taxpayers greatly, including those with children, low income, or childcare expenses. These adjustments are part of One Big Beautiful Bill, which increases credits and adjusts income brackets.

Child Tax Credit (CTC)

- The Child Tax Credit has been increased for children under 6 years of age, rising to $4,000 per child. For children aged 6 to 17, the credit will remain at $2,500. This provides additional relief to families, particularly those with younger children.

- Eligibility for the full credit extends to families earning up to $400,000 (married couples) and $200,000 (individual filers).

- The IRS has also continued the advance payments of the Child Tax Credit, which were first introduced in 2021. This allows eligible families to receive monthly payments ahead of tax season.

Earned Income Tax Credit (EITC)

- The EITC has been expanded for 2026 to include more low-income workers, particularly those without children. Families with up to three children can claim a credit of up to $6,800.

- Eligibility thresholds for the EITC have also been raised, meaning more individuals and families will qualify for this refundable credit.

Child and Dependent Care Credit (CDCC)

- The Child and Dependent Care Credit continues to help parents with childcare expenses. For 2026, taxpayers can claim up to $3,000 per child for childcare costs incurred during the year. This benefit is available to those who use formal childcare providers.

Refund Timelines and Direct Deposit

As part of the IRS’s broader efforts to modernize, the timing for refund processing has become more predictable. With a focus on electronic filings and direct deposit, the IRS has emphasized that taxpayers who file electronically and provide accurate banking information should receive their refunds within 21 days.

However, the IRS has cautioned that errors or missing information can slow the process. For taxpayers filing paper returns or missing direct deposit information, the IRS suggests that they may have to wait up to 6 weeks or longer for refunds to be processed.

The Impact of Inflation Adjustments on Filing

As part of ongoing tax code adjustments, the IRS has made inflationary adjustments for 2026 to tax brackets, the standard deduction, and credits.

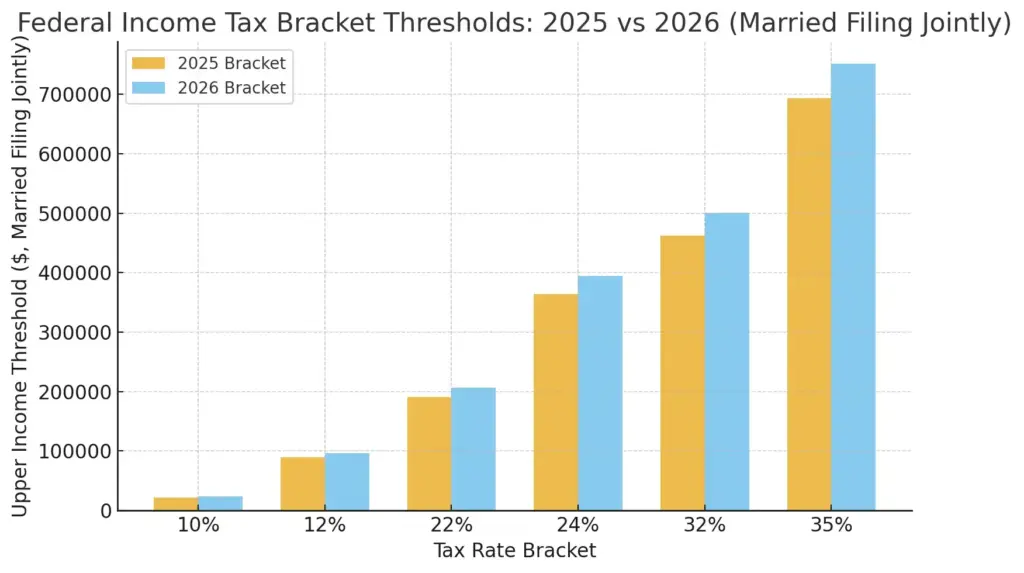

- Tax Brackets: The 2026 tax brackets have been adjusted to account for inflation, increasing the income thresholds for each bracket. This means more income is protected from taxation, potentially lowering the overall tax burden for higher-income earners. For example, the top tax bracket for individuals rises to $550,000, up from $510,000 in previous years.

- Standard Deduction: The standard deduction for single filers is $14,200, and for married couples filing jointly, it has increased to $28,400. These adjustments will help offset inflationary pressures for most taxpayers.

Expanded IRS Assistance Programs

Improved Support for Low-Income Filers

The IRS has expanded assistance programs for low-income filers in 2026. IRS Free File continues to be available for eligible taxpayers who earn $73,000 or less, allowing them to file their federal taxes for free.

Additionally, the IRS has made progress in improving its multilingual support and customer service capabilities to better assist non-English speakers. These updates aim to enhance accessibility for all taxpayers, especially those from vulnerable populations.

Taxpayer Data Security

With the shift to more electronic filings and the increased use of digital payments, the IRS has placed an emphasis on data security. In 2026, the IRS continues to implement multi-factor authentication (MFA) for accessing online accounts and filing.

This is designed to prevent fraud and safeguard taxpayer data. Taxpayers are encouraged to set up IRS online accounts and use strong passwords to protect their sensitive information. The IRS has also launched initiatives to enhance privacy protections, including an ongoing partnership with third-party vendors to help detect and prevent identity theft and fraudulent claims.

Self-Employed and Gig Economy Workers

For self-employed individuals and gig economy workers, the 2026 filing season presents unique challenges. These workers often face complex filing requirements, particularly when it comes to deducting business expenses and calculating self-employment taxes.

In 2026, gig workers will see expanded reporting on income, as new IRS requirements mandate that platforms like Uber, Lyft, and DoorDash issue 1099-K forms to workers who earn over $600. These workers will need to ensure they accurately report income and expenses to avoid potential audits.

State-Level Tax Law Changes and Federal Filings

In 2026, state tax laws in states like California, New York, and Florida are also evolving. For example, California’s tax credits for low-income residents are expected to intersect with federal filings, requiring careful attention to ensure state and federal filings align properly.

This could affect deductions and refund processing for filers living in these states.Taxpayers in states with unique income tax systems should be aware of new deductions and credit eligibility that may not apply at the federal level.

Looking Ahead: The Future of Tax Filing and Refunds

The 2026 tax season represents the IRS’s continued efforts to modernize tax filing and refund processes. With new laws, streamlined electronic filing procedures, and improved customer service initiatives, the filing process for future years promises to be even more efficient.

However, continued funding and staffing issues at the IRS may pose challenges in the years ahead. Taxpayers are encouraged to take full advantage of IRS resources and file early to avoid delays. The 2027 tax season may see even more comprehensive changes, with additional technological updates aimed at reducing processing times and improving the accuracy of tax filings.

Related Links

January 2026 IRS Direct Deposit Schedule Released: Who Qualifies for $2,000 Payments

IRS Sets New Minimum Tax Payment Threshold for 2026: What Taxpayers Must Pay

The 2026 IRS filing season is an important milestone in the IRS’s modernization efforts. By embracing electronic filing, expanding tax credits, and focusing on security, the agency is paving the way for more efficient processing and smoother refunds. Taxpayers who stay informed about the changes and file early will be better positioned to navigate the season successfully.

FAQs About IRS 2026 Filing Rules

Q: What is the most important change for the 2026 filing season?

The most significant change is the shift to electronic refunds, which prioritizes direct deposit over paper checks. This change will help speed up the refund process and reduce fraud risks.

Q: How does the expanded Child Tax Credit affect my filing?

The expanded Child Tax Credit offers up to $4,000 per child under 6 and $2,500 per child under 17, increasing the total tax relief for qualifying families.

Q: Will my refund be delayed if I file a paper return?

Yes, paper returns take significantly longer to process, so e-filing is highly recommended to receive refunds more quickly.