In 2026, millions of Americans will see an increase in their Social Security benefits thanks to the annual cost-of-living adjustment (COLA). This adjustment, based on inflation, is designed to help Social Security recipients keep up with rising costs.

For many, this COLA increase is a crucial source of financial relief in an era of rising costs. But how much can beneficiaries expect, and how is the 2026 Social Security increase calculated? This article breaks down everything you need to know, including how much more you’ll receive per month, how the increase is determined, and the impact of changes such as Medicare premiums.

The 2026 Social Security Increase – A 2.8% Boost

The 2026 Social Security COLA is set at 2.8%, based on data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation. The increase will affect approximately 75 million beneficiaries across the United States, including retirees, survivors, and disabled individuals, as well as Supplemental Security Income (SSI) recipients.

While this is a positive adjustment, it’s important to note that Medicare premiums will likely reduce the net increase for many recipients.

For example, the average retiree will see an additional $56 per month in benefits. This increase helps to offset rising costs of goods and services, including healthcare, housing, and food, though the overall effectiveness of the adjustment depends on each individual’s unique financial situation.

How Much Extra Will You Receive in 2026?

Average Benefit Increases

Based on the 2.8% COLA, the increase in benefits will vary based on the recipient’s monthly Social Security payment. Here’s a breakdown of how much extra income retirees and other beneficiaries can expect:

- For a retired worker receiving an average benefit of $2,015 in 2025, their monthly benefit will rise to $2,071 in 2026 — a $56 increase.

- For a disabled worker receiving $1,700 per month in 2025, the increase will be about $47.60, bringing the total to $1,747.60 in 2026.

- For SSI recipients, who generally receive a lower payment, the 2026 increase will vary, but the maximum SSI benefit will rise to $1,091 per month for individuals and $1,641 for couples, reflecting a slight increase over previous years.

These increases are critical for those who rely on Social Security as their primary income source, particularly given that costs for essentials such as healthcare and groceries have been rising steadily.

Medicare Premium Deductions

One important factor to consider is the Medicare Part B premium increase. In 2026, Medicare Part B premiums will rise to $202.90 per month from $185.50 in 2025. This means that some of the additional Social Security income will be offset by the higher premium costs, especially for beneficiaries with higher healthcare expenses.

For those who are enrolled in Medicare Part D (prescription drug coverage), those premiums may also increase, further reducing the net gain from the COLA.

Historical Comparison of Social Security COLAs

The COLA adjustment is an annual event that helps beneficiaries keep up with inflation. Historically, the Social Security COLA has fluctuated significantly depending on inflation rates. In recent years, especially after the COVID-19 pandemic, the COLA increases have been larger than usual due to rapid inflation.

For example:

- In 2022, the COLA was a record 5.9%, the largest increase in four decades, due to the sharp rise in prices driven by supply chain disruptions.

- In 2023, the COLA was 8.7%, a historic surge driven by persistent inflation, particularly in energy and food prices.

- In 2024, the COLA was 3.2%, a more moderate adjustment in response to stabilizing inflation.

Now, in 2026, the 2.8% COLA increase represents a slight moderation but still helps beneficiaries maintain their purchasing power as inflation remains a concern.

Impact on Low-Income Social Security Recipients

Low-income recipients, particularly those on Supplemental Security Income (SSI), may see a slightly more significant impact from the COLA, as the increase helps them manage the rising costs of essentials. SSI is a crucial program for disabled individuals and the elderly who have limited resources.

In 2026, SSI recipients will see their maximum monthly benefits rise to $1,091 for individuals, up from the 2025 figure of $1,070.

Although this increase helps with basic living expenses, it is still modest compared to the rising costs of healthcare, housing, and food. For many, even with the increase, there may still be financial strain.

State-Specific Differences in Social Security Benefits

It is also important to note that some states offer additional benefits or adjustments for Social Security recipients. For example, in Alabama, Mississippi, and other states, certain types of Social Security benefits are not taxed, which can provide some relief to beneficiaries.

In states with higher living costs, like California and New York, the increase in Social Security benefits, while helpful, may still not be enough to fully cover the higher cost of living. This has sparked discussions around the need for more tailored support for these populations.

Check Your New Social Security Benefit

Once the COLA increase is applied, recipients will receive an official Notice of Social Security Benefits, detailing their new benefit amount. This document is typically sent in December 2025.

In addition, recipients can log into their My Social Security account, available on the SSA website, to access the most up-to-date information regarding their payments and adjustments. The portal also allows users to track their benefit history, update personal information, and access other relevant services.

Tax Implications of the 2026 Social Security Increase

As Social Security payments increase, there may also be tax implications for higher-income beneficiaries. The Social Security tax threshold means that some recipients may see a portion of their benefits taxed, especially those with income from other sources like pensions, investments, or earnings from work.

In 2026, the Social Security Administration will continue to apply the earnings test, meaning individuals who earn more than a certain amount may see their benefits temporarily reduced.

Additionally, Social Security benefits are subject to federal income tax for individuals with income above certain thresholds. For single individuals earning over $25,000 per year and couples earning over $32,000, a portion of benefits may be taxable.

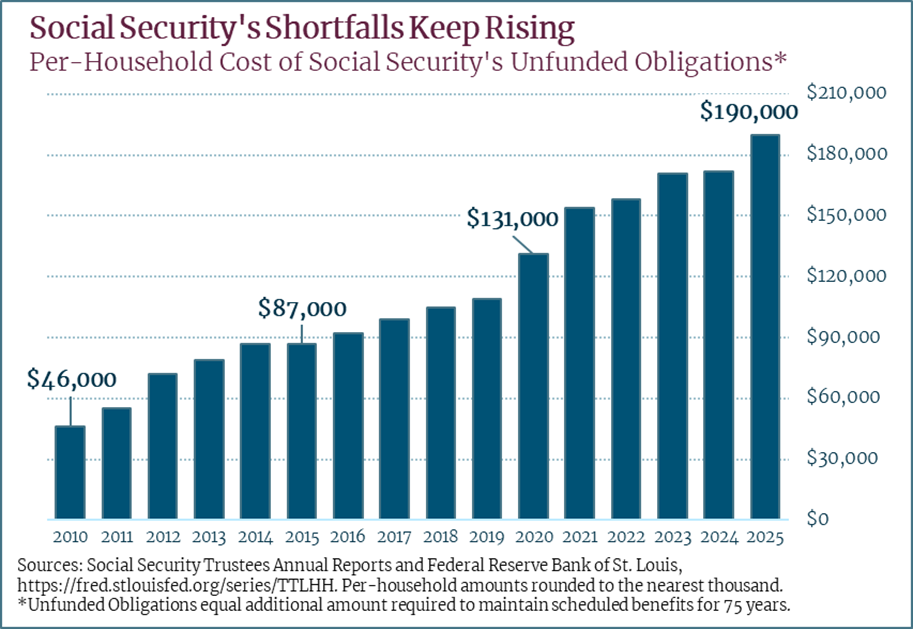

What This Means for Future Social Security Adjustments

While the 2.8% increase is a welcome adjustment, many experts point out that it may not be sufficient to keep pace with long-term inflation. The rising costs of healthcare and housing continue to outpace the COLA, making it harder for beneficiaries to maintain their purchasing power over time.

Looking ahead, the Social Security Administration may have to adjust its COLA calculation to reflect ongoing economic conditions. As the nation faces uncertainties surrounding inflation and economic recovery, recipients may see future COLA increases that vary significantly from 2026’s 2.8% adjustment.

Related Links

IRS Refund Tracker 2026 – How to Find Your Refund Status in Minutes

IRS 2026 Filing Rules – What’s New This Year and How Refund Processing Is Changing

The 2026 Social Security increase will offer much-needed financial relief to millions of Americans, adding an average of $56 per month to retirement, disability, and SSI benefits. While this increase helps offset inflation, especially for low-income recipients, it is important to consider other financial factors, such as the rise in Medicare premiums and taxes.

Beneficiaries should remain aware of the adjustments and how they might impact their monthly budgets.