Millions of Americans will experience meaningful changes to retirement income in 2026, as adjustments to Social Security, Medicare, earnings limits, and taxation take effect nationwide.

The Retirement Benefits 2026 reflects a pivotal year in which inflation-linked benefit increases collide with rising healthcare costs, shaping how much retirees ultimately receive each month.

Retirement Benefits 2026

| Key Factor | 2026 Change |

|---|---|

| Social Security COLA | Inflation-based increase |

| Medicare Part B | Premium increase reduces net income |

| Earnings Limits | Higher thresholds for working retirees |

| Payroll Tax Cap | Higher taxable wage base |

| SSI Payments | Adjusted but still below poverty line |

Understanding Retirement Benefits 2026 and Why 2026 Is Different

The Retirement Benefits 2026 refers not to a single policy shift, but to a convergence of adjustments affecting nearly every major source of retirement income. These changes occur against the backdrop of persistent inflation, longer life expectancy, and mounting fiscal pressure on public retirement systems.

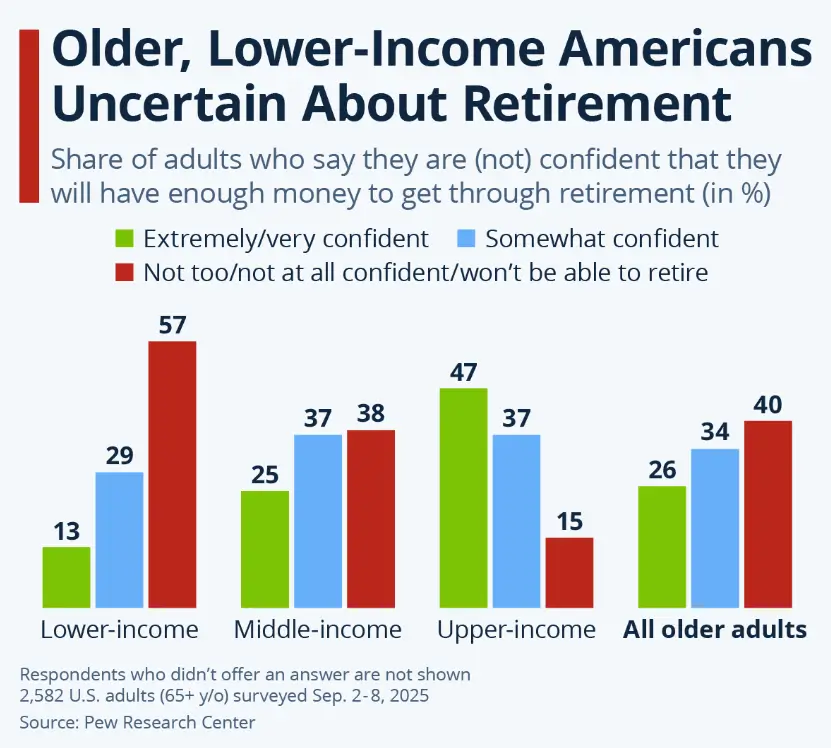

According to the Social Security Administration, more than 72 million Americans receive monthly benefits. For many, these payments represent the majority of household income, leaving little room to absorb rising costs.

Economists note that while annual adjustments are routine, their cumulative effect in 2026 is unusually significant due to simultaneous increases in healthcare costs and taxation exposure.

Social Security Changes Under Retirement Benefits 2026

Cost-of-Living Adjustment (COLA)

Social Security benefits rise annually based on inflation. In 2026, recipients receive a COLA reflecting price growth measured by the Consumer Price Index.

The increase raises gross monthly benefits beginning in January. However, experts caution that COLA does not guarantee improved living standards. “COLAs are defensive, not generous,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “They help retirees tread water, not move ahead.”

Average Monthly Benefits

After the 2026 adjustment, the average retired worker benefit exceeds $2,000 per month. Actual payments vary widely based on lifetime earnings and claiming age.

Workers who delayed retirement receive higher monthly benefits, while early claimers continue to receive permanently reduced amounts.

Working in Retirement: Earnings Limits Explained

For retirees who claim benefits before full retirement age, earnings limits remain a critical consideration under Retirement Benefits 2026.

In 2026:

- Benefits are temporarily withheld if earnings exceed annual limits.

- A higher limit applies during the year a retiree reaches full retirement age.

- After full retirement age, earnings no longer reduce benefits.

The Social Security Administration emphasizes that withheld benefits are recalculated later, though short-term cash flow can still be affected.

Healthcare Costs: The Biggest Threat to Net Income

Medicare Part B Premium Increases

Medicare premiums continue to rise in 2026, often absorbing much of the COLA increase. Because premiums are deducted directly from Social Security checks, retirees frequently feel the impact immediately.

According to the Centers for Medicare & Medicaid Services, Part B premium growth reflects higher outpatient and physician service costs. “Healthcare inflation is consistently higher than overall inflation,” said Tricia Neuman, executive director of the Kaiser Family Foundation’s Medicare policy program.

Prescription Drugs and Supplemental Insurance

Many retirees also face rising costs for prescription drug coverage and supplemental plans. These expenses vary by geography but increasingly strain fixed incomes.

Low-Income Retirees and SSI Recipients

The Retirement Benefits 2026 has distinct implications for low-income Americans, particularly those receiving Supplemental Security Income (SSI).

While SSI payments rise alongside COLA, advocacy groups note that benefit levels remain below the federal poverty threshold in most regions. According to the Center on Budget and Policy Priorities, housing, utilities, and food costs have risen faster than SSI adjustments, eroding purchasing power for the most vulnerable retirees.

Gender, Longevity, and Retirement Gaps

Women are disproportionately affected by retirement income changes due to longer life expectancy, lower lifetime earnings, and higher caregiving responsibilities.

Data from the Pew Research Center show that women receive smaller average Social Security benefits but rely on them more heavily.

Longer lifespans mean healthcare and long-term care costs loom larger, making the net impact of Retirement Benefits 2026 especially significant for women living alone.

State Taxes and Geographic Differences

Retirement income in 2026 is also shaped by where retirees live. Some states tax Social Security benefits and pensions, while others exempt them entirely. Rising property taxes and insurance costs in certain regions further influence net income.

Policy analysts note that migration patterns among retirees increasingly reflect tax and healthcare cost differences, rather than climate alone.

Survivor and Spousal Benefits

Survivor and spousal benefits adjust alongside Social Security, but household income can still decline sharply following the death of a spouse. Experts stress the importance of understanding benefit coordination rules, especially for widows and widowers whose expenses may not fall proportionately with income.

Taxation of Retirement Benefits

Federal tax rules governing Social Security benefits remain unchanged in 2026. Depending on combined income, up to 85 percent of benefits may be taxable. Because income thresholds are not indexed to inflation, more retirees face taxation each year—a trend that continues under Retirement Benefits 2026.

Planning Considerations for 2026

Financial planners recommend retirees review:

- Claiming strategies

- Healthcare budgeting

- Tax exposure

- Withdrawal timing from savings

“There’s no universal solution,” said Michael Finke, professor at The American College of Financial Services. “But failing to plan almost guarantees unpleasant surprises.”

Related Links

Bank of America Bonus 2026 – How to See If You Qualify for the Surprise $1,000 Payout

VA Health Overhaul 2026 – Inside the $4.8 Billion Plan Transforming Veteran Care

Long-Term Outlook

Beyond 2026, the sustainability of retirement programs remains under debate. Trustees project growing pressure on Social Security and Medicare as the population ages. While no immediate benefit cuts are scheduled, economists broadly agree that future reforms are likely, reinforcing the need for diversified income sources.

The Retirement Benefits 2026 highlights a familiar tension in retirement policy: modest benefit increases offset by rising costs.

In 2026, retirees face incremental changes rather than dramatic shifts, yet their combined effect will shape household budgets nationwide. Staying informed remains the most reliable defense against uncertainty.

FAQs About Retirement Benefits 2026

Will retirees receive less money in 2026?

Gross benefits rise, but higher healthcare and tax costs may reduce net income.

Are benefit cuts coming soon?

No cuts are scheduled for 2026, though long-term funding challenges persist.

Do all retirees benefit equally from COLA?

No. Impact varies by income level, health costs, and tax exposure.