As we move into 2026, the topic of stimulus checks is still on the minds of many Americans, especially those facing financial strain due to rising living costs and inflation. However, despite rumors circulating online, no new federal stimulus checks have been approved by Congress or the U.S. Treasury Department for 2026.

Instead, the government’s focus has shifted to state-level programs and other forms of economic relief, such as expanded tax credits. In this article, we’ll break down what’s actually been approved for 2026, debunking common myths, and exploring alternative forms of assistance.

Historical Context of Stimulus Payments

Before we discuss the current landscape, it’s helpful to understand the history of stimulus payments in the United States. Since the Great Recession in 2008, the federal government has occasionally issued economic impact payments to stimulate the economy during tough times.

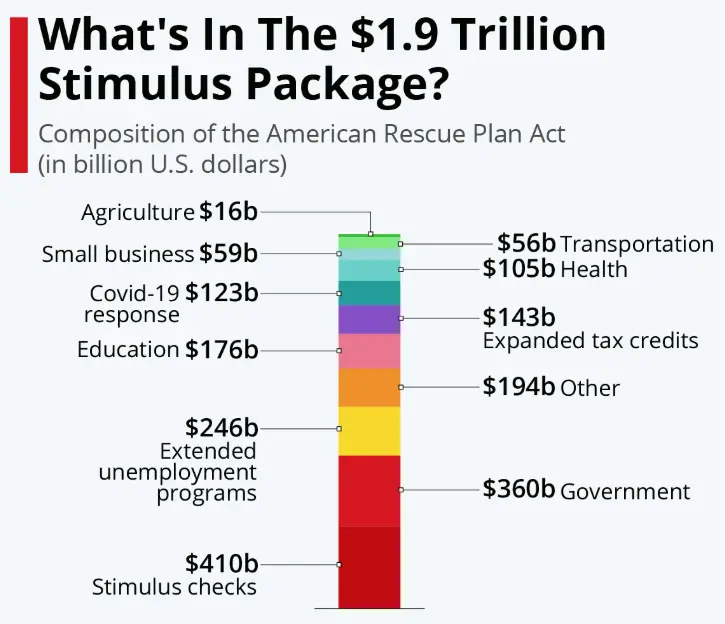

The most significant round of stimulus checks occurred during the COVID-19 pandemic, when the federal government issued three rounds of payments to millions of Americans.

- First Round: Under the CARES Act (2020), eligible individuals received up to $1,200, with payments sent in April 2020.

- Second Round: In 2021, under the Consolidated Appropriations Act, another round of payments up to $600 per individual was distributed.

- Third Round: The American Rescue Plan Act of 2021 authorized payments up to $1,400, issued to most Americans in the first half of 2021.

However, these rounds of payments were emergency measures that were tied to the pandemic’s economic impacts. The economic recovery that followed reduced the perceived need for widespread government handouts. After 2021, federal stimulus checks were effectively phased out.

What’s Actually Approved for 2026?

No Federal Stimulus Checks for 2026

Despite ongoing speculation, there are no new federal stimulus checks slated for distribution in 2026. There has been some talk in Congress about potentially passing new relief packages in response to rising inflation and economic challenges, but no concrete proposals for stimulus checks have made it past the discussion stage.

The federal government’s last round of COVID‑19 relief checks was issued as part of the American Rescue Plan back in 2021. Since then, the focus has shifted to other forms of support, including tax credits, rebates, and state-specific programs designed to alleviate the financial burdens felt by low- and middle-income Americans.

State-Level Stimulus Payments

While there are no federal stimulus checks, state governments continue to offer some form of financial relief. These programs are separate from federal stimulus measures and vary greatly depending on the state’s budget surplus and political climate. Some examples include:

- California: Known for its Middle-Class Tax Refund (MCTR), which provided payments ranging from $200 to $1,050 for qualifying residents in 2025. California is expected to continue its inflation relief payments into 2026.

- Alaska: The Permanent Fund Dividend (PFD) gives Alaskan residents a share of state oil revenues. In 2025, it amounted to $1,114 and will likely continue into 2026.

- Illinois: Illinois issued one-time rebates of $50 per taxpayer in 2025, and similar rebates are expected in 2026.

These payments are not universal and depend on specific eligibility criteria, including income thresholds and residency requirements.

Expanded Tax Credits and Refunds

While stimulus checks may be off the table, expanded tax credits for 2026 offer significant financial relief for eligible individuals. The Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) have been increased for 2026, providing more money for lower- and middle-income families.

- Child Tax Credit (CTC): The CTC for 2026 remains up to $3,600 per child under age 6, with the amount gradually phasing out for higher-income earners.

- Earned Income Tax Credit (EITC): The EITC has been expanded to include more people in higher-income brackets, which means larger refunds for low- to moderate-income working individuals.

These expanded credits are often refundable, meaning if the credits exceed what you owe in taxes, the excess will be refunded to you. Many families and workers will see larger refunds as a result of these changes.

What Proposals Have Been Suggested But Not Approved?

Legislative Push for New Stimulus Payments

Some lawmakers, particularly those in economically struggling regions, have called for a new round of federal stimulus checks in response to rising inflation. These proposals often involve payments of $1,000 or $2,000 per person, but none have advanced to become law as of early 2026.

These proposals face significant partisan resistance and would require both houses of Congress to agree and pass a bill, which is unlikely in the current political environment.

Many lawmakers argue that the economic recovery has been uneven, and more direct payments are needed to help low-income individuals and families facing continued economic hardship. However, opponents argue that issuing more stimulus checks would increase the national debt and lead to further inflation.

Universal Basic Income (UBI) Proposals

Another frequently discussed idea is the Universal Basic Income (UBI), where direct cash payments would be issued regularly to all citizens, regardless of their income or employment status. While UBI has been trialed in a few countries and discussed in various U.S. cities, it has not gained enough political support to become law.

UBI proponents argue it could help alleviate poverty and address income inequality in an economy increasingly reliant on automation. While UBI continues to gain some attention, especially after the success of stimulus payments during the pandemic, its implementation at the federal level remains unlikely in the near future.

Stay Informed and Avoid Stimulus Scams

As the discussions about new stimulus measures continue, it’s crucial to be cautious of scams. Fake stimulus checks, payments, or tax relief offers are common, and fraudsters are often quick to take advantage of confusion surrounding the issue.

The IRS and state governments will never send unsolicited emails or texts asking for personal information or payment details. Always verify any communications through official channels such as IRS.gov or your state’s revenue department website.

Related Links

Chapter 35 Benefits 2026 – What February’s Changes Mean for Your GI Bill Timeline

IRS Refund Tracker 2026 – How to Find Your Refund Status in Minutes

In 2026, there are no new federal stimulus checks on the horizon despite some online rumors and media buzz. While state-level relief programs, expanded tax credits, and one-time rebates are available in various regions, federal economic impact payments remain absent unless new legislation is passed.

Moving forward, the focus will likely be on targeted assistance through programs like tax refunds and direct credits, with discussions about future relief packages continuing in the political sphere.

If you are hoping for federal stimulus payments, it’s important to stay informed through credible sources and be cautious of misinformation or scams. In the meantime, taking advantage of available tax credits and monitoring state-level programs can provide relief.