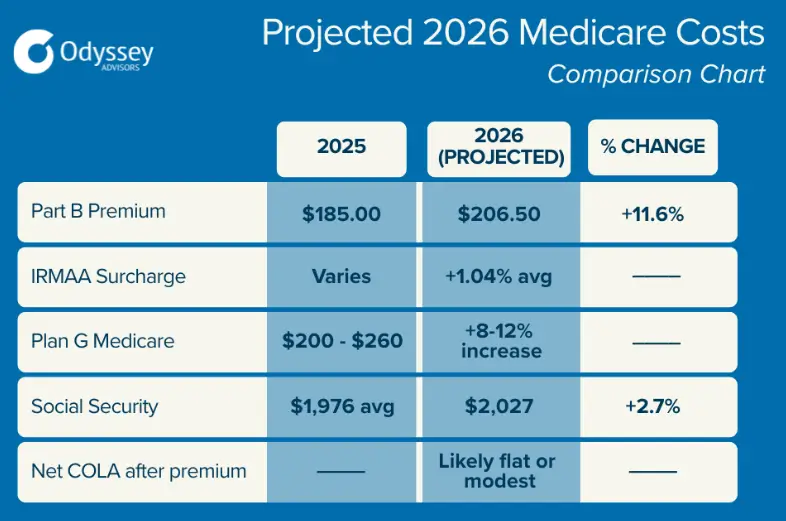

As 2026 approaches, retirees on Medicare face significant changes to their healthcare costs. From increased premiums to higher deductibles, the financial burden of healthcare is becoming more pronounced.

The Centers for Medicare & Medicaid Services (CMS) has announced updates for Part B premiums, Part A deductibles, and Part D costs for the year, reflecting a trend of rising healthcare expenses.

These changes can create financial stress for retirees, especially those on fixed incomes. This article explores the most significant Medicare cost changes for 2026, the specific areas retirees should review, and how to adjust to these new realities to avoid financial strain.

Key Medicare Cost Changes for 2026

1. Part B Premiums and Deductibles Increase

The Part B premium, which covers outpatient services such as doctor visits, will increase for 2026. The standard premium will rise to $202.90, up from $185 in 2025, making this the first time in history the premium exceeds $200 per month. For beneficiaries with higher incomes, Income-Related Monthly Adjustment Amount (IRMAA) surcharges will further increase costs.

- Why the Increase?

The increase is driven by rising healthcare costs and a growing number of retirees requiring outpatient care. The additional costs come as Medicare faces higher demand and the need to support critical healthcare programs.

2. Part A and Part D Cost Increases

Medicare Part A—which covers inpatient hospital care—also sees a rise in deductibles. The hospital deductible for 2026 will be $1,736, up from $1,676 in 2025. Additionally, the daily coinsurance for hospital stays beyond 60 days will increase to $434 (for days 61–90) and $868 for lifetime reserve days.

For Part D (prescription drug coverage), the standard premium is expected to rise to $38.99. The Part D deductible will be $615, a notable increase from $590 in 2025. These changes could significantly affect retirees who rely on prescription medications to manage chronic conditions.

3. Additional Surcharges for High Earners

Beneficiaries with incomes above a certain threshold will face IRMAA surcharges for both Part B and Part D premiums. For example, individuals with modified adjusted gross income (MAGI) over $91,000 (single) or $182,000 (married) will pay additional amounts on top of the standard premiums, significantly increasing their Medicare costs.

Special Considerations for Low-Income Beneficiaries

Medicaid and Extra Help Programs

For low-income retirees, the increasing Medicare costs in 2026 can be especially burdensome. However, there are programs designed to help mitigate these costs:

- Medicaid: If you qualify for Medicaid, you may be able to get additional help with premiums, deductibles, and coinsurance through Medicare Savings Programs.

- Extra Help: If you have limited income and resources, the Extra Help program assists with costs related to Part D prescription drug coverage, including premiums, deductibles, and copayments.

Both of these programs can ease the financial burden of rising Medicare costs, but beneficiaries must meet specific eligibility requirements to qualify.

Steps to Minimize the Impact of Rising Medicare Costs

1. Review Your Medicare Plan Annually

Given the constant changes in Medicare premiums and coverage options, it’s essential for retirees to review their plans every year during the annual open enrollment period (typically from October 15 to December 7). You may want to consider:

- Switching Medicare Advantage plans if it offers a better balance of coverage and cost.

- Reevaluating your Part D plan to ensure it covers your medications at the most affordable rate.

2. Consider Supplemental Coverage (Medigap)

Medicare does not cover all medical expenses. For example, deductibles, coinsurance, and copayments are not covered by Part A and Part B. If you find these out-of-pocket expenses rising, consider Medigap (Medicare Supplement Insurance) to help fill in the gaps.

Medigap policies are sold by private insurers and can help cover additional costs like coinsurance and deductibles.For retirees looking for extra coverage in addition to Original Medicare, reviewing Medigap plans can provide financial peace of mind.

3. Switch to Generic Drugs and Preventive Care

Retirees may find that their prescription drug costs are one of the most significant portions of their healthcare expenses. Part D premiums and out-of-pocket costs can add up, especially for those taking brand-name drugs.

One way to reduce these costs is to switch to generic drugs, which typically cost significantly less than their brand-name counterparts. Your healthcare provider or pharmacist can help you identify generic alternatives.

Additionally, Medicare provides preventive services at no extra cost, including screenings, vaccinations, and wellness visits. Taking advantage of these services can help prevent costly health issues down the road, reducing long-term healthcare expenses.

The Potential for Medicare Reform and Future Cost Changes

Drug Price Negotiations

One of the most talked-about changes in Medicare is the ongoing effort to negotiate drug prices. Under the Inflation Reduction Act, Medicare now has the power to negotiate prices for certain high-cost prescription drugs.

This change is expected to reduce out-of-pocket costs for beneficiaries who need expensive medications, especially for conditions like cancer and diabetes. While the full impact won’t be realized until later years, 2026 will see the first round of negotiated prices affecting a select group of drugs.

The Possibility of Future Medicare Reforms

The U.S. Congress has long discussed the need for Medicare reforms, including raising the eligibility age and adjusting the income thresholds for IRMAA surcharges.

While no major reforms have been finalized for 2026, ongoing discussions and legislative proposals could alter Medicare’s cost structure in the years ahead. Retirees should stay informed about proposed changes and how they could affect future Medicare costs.

Related Links

Chapter 35 Benefits 2026 – What February’s Changes Mean for Your GI Bill Timeline

IRS Refund Tracker 2026 – How to Find Your Refund Status in Minutes

The Medicare cost changes in 2026 reflect rising healthcare expenses that will impact most retirees, especially those on fixed incomes. With increased Part B premiums, Part A deductibles, and Part D prescription drug costs, retirees need to carefully review their Medicare coverage and consider alternatives such as Medigap insurance or Medicare Advantage plans.

Additionally, understanding programs like Medicaid and Extra Help for low-income beneficiaries can help mitigate the rising costs.

By staying informed and proactive, retirees can manage their healthcare expenses effectively and continue to access the care they need without unnecessary financial strain.