Social Security recipients in 2026 will experience a 2.8% cost-of-living adjustment (COLA) on their retirement benefits, Supplemental Security Income (SSI), and Social Security Disability Insurance (SSDI) checks.

This increase, effective starting January 2026 and for SSI payments on December 31, 2025, aims to help beneficiaries keep up with rising costs. However, Medicare premiums and other factors may reduce the net effect of the COLA for many recipients. Here’s an in-depth look at how the changes will impact your payments.

Social Security Changes in 2026

| Key Change | 2026 Update |

|---|---|

| COLA Increase | Social Security benefits rise 2.8% starting January 2026. |

| Average Retirement Payment | The average monthly retirement payment increases to $2,071. |

| SSI Payment Adjustment | Maximum SSI payment increases to $994 for individuals. |

| Medicare Part B Premium | Medicare Part B premium rises to $202.90 per month. |

| Impact on Net Benefit | Medicare premiums could absorb more than 25% of COLA gains. |

What Is the 2.8% COLA and How Does It Affect You?

The COLA (cost-of-living adjustment) is an annual increase designed to help Social Security benefits keep up with inflation. It is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the rise in prices for everyday goods and services.

For 2026, the COLA will increase benefits by 2.8%, a response to inflationary pressures in sectors like food, housing, and healthcare. This COLA applies to retirement, SSI, and SSDI benefits, and will be reflected in checks beginning in January 2026 for Social Security beneficiaries and December 31, 2025 for SSI recipients.

This increase aims to prevent recipients’ purchasing power from eroding, especially as living costs continue to rise.

While the increase helps many beneficiaries, experts warn that Medicare premium hikes and other cost pressures, like housing and prescription costs, could offset the net benefit for many Social Security recipients.

How the 2026 COLA Affects Retirement Benefits

Gross Benefit Increase

Social Security retirement beneficiaries will see their monthly payments rise by 2.8% in 2026. For most recipients, this will mean an increase of around $56 per month. Specifically:

- The average monthly retirement benefit will rise to $2,071 in 2026, up from $2,015 in 2025.

- For those with higher lifetime earnings, monthly checks can exceed $5,000 per month.

Impact of Medicare Premiums on Net Benefit

While the 2.8% COLA increase provides more money in the hands of beneficiaries, it will be partially offset by higher Medicare premiums. For 2026, the standard Part B premium for Medicare is expected to rise to $202.90 per month, which is an increase of around $18 from 2025.

This means many retirees will see their net COLA increase reduced by these rising premiums. For example, a retiree with a $56 COLA increase might find that $20–$30 of that increase is swallowed by higher Medicare premiums, leaving them with less additional income.

This impact is particularly significant for older adults and those living on fixed incomes, as the rise in healthcare costs often outpaces wage increases.

How the 2026 COLA Affects SSI Payments

SSI Adjustments for Low-Income Beneficiaries

The 2.8% COLA will also affect Supplemental Security Income (SSI), which is designed to support low-income individuals aged 65 or older and those with disabilities. The maximum federal SSI payment will rise in 2026:

- $994 per month for individuals (up from $967 in 2025).

- $1,491 per month for couples (up from $1,436 in 2025).

While these increases provide much-needed relief, the higher Medicare Part B premiums could still significantly reduce the benefit increase for many low-income recipients.

Given that many SSI recipients rely entirely on Social Security benefits for their livelihood, any offset from rising premiums is a considerable concern.

How the 2026 COLA Affects SSDI Benefits

SSDI Recipients and COLA Impact

The 2.8% COLA increase will apply to Social Security Disability Insurance (SSDI) benefits, which assist individuals who are unable to work due to disabilities. For 2026, the average monthly SSDI payment will increase to $1,366 (up from $1,328 in 2025).

Like retirement and SSI benefits, SSDI recipients will be impacted by the higher Medicare Part B premiums, which are deducted from their checks.

For many SSDI recipients, the COLA increase is essential to keeping up with inflation, as they are unable to supplement their income through work. However, as with other benefit categories, the net increase will likely be diminished by rising healthcare costs.

Medicare Costs and Their Impact on Social Security Payments

One of the largest deductions from Social Security benefits is for Medicare premiums. In 2026, Medicare Part B premiums will rise to $202.90 per month. This is a significant increase for many retirees and SSDI recipients.

The Medicare Part B premium covers doctor visits, outpatient services, and preventive care, but the cost is deducted directly from Social Security payments.

For example:

- A retiree with a $2,071 monthly benefit could see their check reduced by $202.90 for Medicare Part B, leaving them with only about $1,868.

- SSI recipients who rely on Social Security as their primary source of income may find that the increase in Medicare premiums offsets a large portion of their COLA adjustment.

This trend highlights the ongoing financial strain on seniors and disabled individuals who depend on Social Security to cover everyday expenses while also managing rising healthcare costs.

Earnings Limits for Working Social Security Beneficiaries

In 2026, Social Security will adjust earnings limits for working beneficiaries. Individuals who are not yet at full retirement age can earn up to $24,480 annually without impacting their benefits. However, if a working beneficiary exceeds this amount, their benefits will be reduced by $1 for every $2 earned above the limit.

For those who reach full retirement age in 2026, the earnings limit increases to $65,160. Once full retirement age is reached, there is no cap on earnings for Social Security beneficiaries, meaning they can continue to work without triggering a reduction in their benefits.

Future Policy Discussions and Social Security Reform

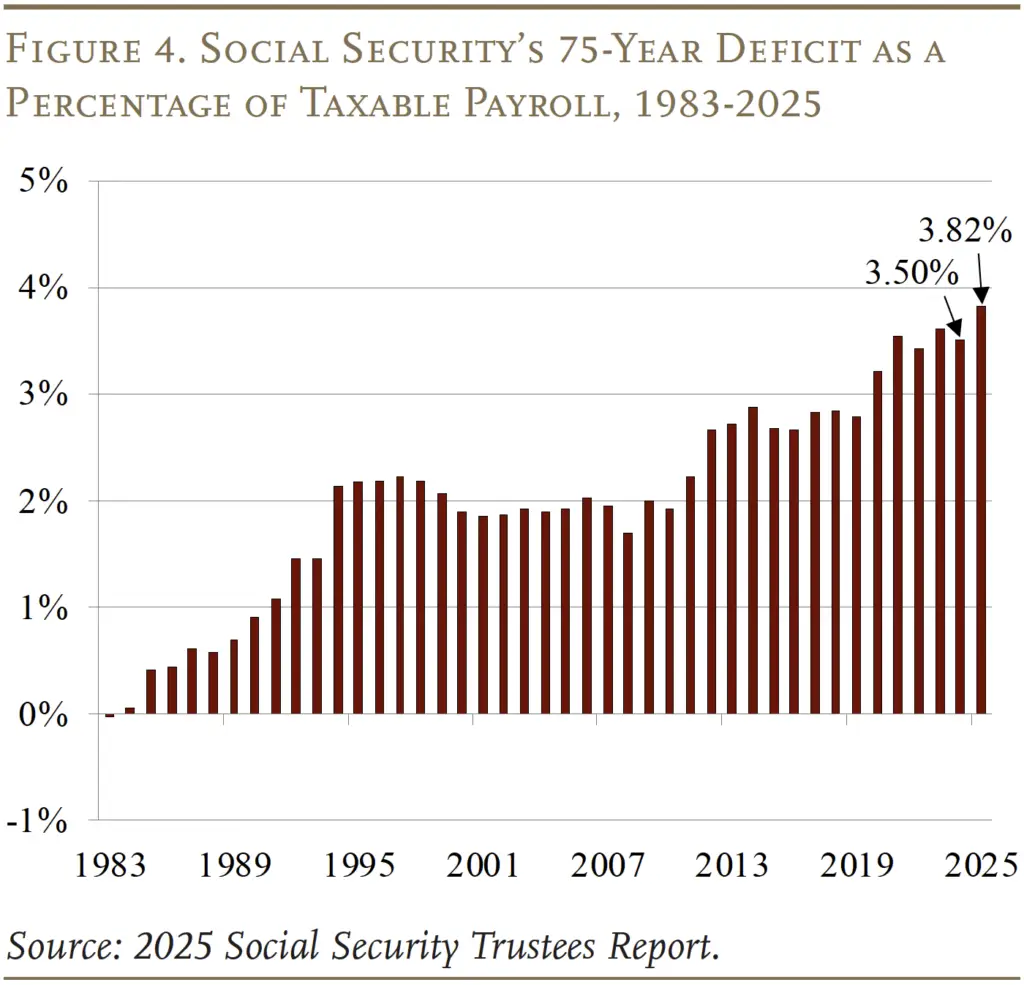

While the 2.8% COLA increase provides immediate relief for many, Social Security faces long-term financial challenges. As the baby boomer generation continues to retire and life expectancy rises, the program is under increasing strain.

Projections show that Social Security funds may run out by the early 2030s, which could impact future beneficiaries. To address this, policymakers are exploring potential reforms, including:

- Raising payroll taxes for higher earners.

- Adjusting the retirement age to account for increased life expectancy.

- Reworking benefit formulas to ensure fairness and sustainability.

These discussions will shape the future of Social Security and its ability to meet the needs of older adults and people with disabilities in the coming decades.

While COLA increases are a positive development, the future of Social Security will depend on long-term financial stability and comprehensive policy solutions.

Related Links

Stimulus Check 2026 Update – What’s Actually Approved and What Is Not

Social Security Eligibility Rules – Small Mistakes That Can Delay Your Check

The 2.8% COLA increase for Social Security in 2026 represents a critical adjustment to help retirees, SSI recipients, and SSDI beneficiaries cope with inflation. While the increase will provide much-needed relief, rising Medicare premiums and other costs may reduce the net benefit.

As beneficiaries navigate the changes, it’s essential to plan for potential financial pressures and monitor Medicare and Social Security updates in the coming years.

The 2026 COLA serves as a reminder of the challenges facing Social Security, and as such, continued policy discussions on funding and sustainability are crucial for securing the future of these benefits for the millions of Americans who rely on them.

FAQs About Social Security Changes in 2026

What is the 2.8% COLA for Social Security in 2026?

The 2.8% COLA is an annual adjustment made to Social Security benefits to keep pace with inflation. For 2026, this will increase retirement, SSI, and SSDI benefits.

How much will my Social Security check increase in 2026?

The average retirement benefit will rise to $2,071 per month, while SSI payments will increase to $994 for individuals.

Will Medicare premiums impact my Social Security increase?

Yes. Medicare Part B premiums are expected to rise, reducing the net benefit of the 2.8% COLA for many recipients.

How does the earnings limit for working beneficiaries change in 2026?

In 2026, the earnings limit for those under full retirement age increases to $24,480. For those reaching full retirement age, the limit rises to $65,160.