Social Security benefits have been a fundamental part of retirement planning for millions of Americans, but recent financial projections indicate a potential crisis looming on the horizon. Social Security beneficiaries could face cuts of up to $460 per month starting in the next decade if Congress does not address the program’s financial troubles.

These potential reductions come at a time when many retirees are already struggling with rising living costs, healthcare expenses, and inflation. This article explores the causes of the looming $460 monthly cuts, the broader implications for seniors, and what steps can be taken to secure the future of Social Security.

$460 Monthly Cuts

| Fact | Details |

|---|---|

| Projected Trust Fund Exhaustion | Social Security’s retirement fund could run out by 2033 |

| Projected Cuts | Benefits could be reduced by about 23%, translating to $460 per month |

| Number of People Affected | Nearly 70 million Americans receive Social Security benefits |

| Key Factor for Cuts | Depletion of Social Security Trust Funds |

Why Social Security Faces Cuts: The Trust Fund Crisis

Social Security, designed to provide financial support to retirees, survivors, and people with disabilities, is primarily funded through payroll taxes collected from current workers. However, the system is running into a funding shortfall due to several demographic and economic factors.

The Trust Fund Problem

The Social Security system is supported by two major trust funds:

- Old-Age and Survivors Insurance (OASI)

- Disability Insurance (DI)

The trust funds are meant to cover the gap between what is collected through payroll taxes and what is paid out in benefits. However, due to the aging population and the increasing number of beneficiaries, these funds are expected to be depleted by 2033.

After that, Social Security will only be able to pay out benefits from incoming payroll taxes, which will cover about 77% of the scheduled benefits. This gap could translate into automatic cuts for beneficiaries.

Why Does This Happen?

The key drivers of the funding shortfall include:

- Demographic Changes: The Baby Boomer generation is retiring, which means more people are drawing benefits for longer periods, while fewer workers are contributing payroll taxes. In 1960, there were approximately 5 workers for every retiree. Today, that number is closer to 2.8 workers per retiree.

- Longer Life Expectancy: As life expectancy increases, people are drawing Social Security benefits for a longer period, which further strains the system.

- Lower Birth Rates: The U.S. has seen a decrease in the birth rate, leading to fewer young workers entering the labor force to support the growing number of retirees.

The Impact of a $460 Monthly Cut on Seniors

The $460 monthly cut is expected to be felt most by seniors who rely on Social Security as their primary income. The average monthly Social Security benefit for retired workers in 2025 is about $1,900, so a 23% reduction would leave many retirees with only about $1,440 per month. This could have significant consequences for seniors living on fixed incomes.

Impact on Daily Life

For seniors, Social Security is often the largest or only source of income, and a reduction could force many to make difficult trade-offs, such as:

- Housing: Many retirees rely on their Social Security to cover rent or mortgage payments. A $460 cut could make it more difficult to afford housing.

- Healthcare: Rising healthcare costs are a significant concern for seniors. A reduction in Social Security benefits could force individuals to choose between paying for medications, doctor visits, or other essential healthcare services.

- Basic Living Expenses: Essentials like food, utilities, and transportation could become harder to afford for seniors if their Social Security benefits are reduced.

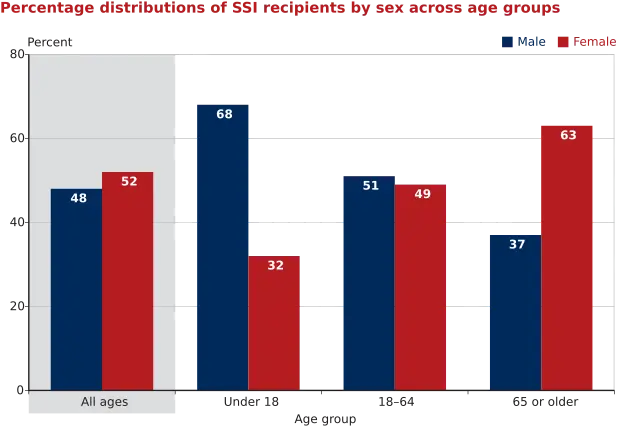

The impact of these cuts would not only hurt individual seniors but could also put increased pressure on public assistance programs like Medicaid and Supplemental Security Income (SSI), which many retirees may be forced to rely on.

What’s Being Done to Address the Shortfall?

While the projected $460 cut is alarming, there are potential solutions being discussed in Congress to prevent such reductions. These solutions aim to strengthen the financial foundation of Social Security and ensure that benefits remain secure for future generations.

1. Raising the Payroll Tax Rate

One potential solution is to increase the payroll tax rate. Currently, the tax rate is 6.2% for employees and employers. By increasing this rate, the Social Security system could receive more funding, which might help avoid cuts. However, increasing taxes is often a contentious issue, with political pushback from both sides.

2. Lifting the Payroll Tax Cap

Currently, only earnings up to $184,500 are subject to the payroll tax, meaning higher earners don’t pay into the system on income above that threshold. One proposal is to remove or raise the cap, which would require high earners to contribute more to the system, potentially increasing revenue by billions of dollars.

3. Raising the Full Retirement Age

Another suggestion is to gradually raise the age at which people can claim full Social Security benefits. This would reduce the number of people eligible for full benefits and delay payouts. However, critics argue that this solution would disproportionately affect people in physically demanding jobs who cannot work longer into their senior years.

4. Means-Testing Benefits

Some proposals suggest means-testing Social Security, which would limit benefits for wealthier individuals while maintaining full benefits for lower-income retirees. This could help preserve the integrity of the system, though it also faces political resistance due to concerns about fairness.

Related Links

Medicare Cost Changes 2026 – What Retirees Should Review Right Now

Social Security Eligibility Rules – Small Mistakes That Can Delay Your Check

The Path Forward: The Need for Action

Despite these potential solutions, there is a sense of urgency. Without reform, the 2033 deadline is rapidly approaching, and the possibility of automatic benefit cuts looms large. Policymakers must take action soon to prevent the $460 cut that could harm millions of retirees.

What Seniors Can Do Now

Seniors should consider diversifying their income sources to ensure that they can weather potential cuts in Social Security. Additionally, it is important to stay informed about proposed reforms and participate in public discussions about the future of Social Security. Meeting with a financial planner to discuss retirement strategies could also provide a safety net if benefits are reduced.

Preparing for Uncertainty

Social Security has been a lifeline for millions of retirees, but with the program facing financial difficulties, future beneficiaries may face reductions unless significant reforms are enacted.

Seniors and soon-to-be retirees must remain vigilant, take proactive steps to secure their financial future, and advocate for long-term fixes to keep Social Security solvent. The potential $460 cut is a wake-up call, urging lawmakers to prioritize reform before the system reaches a tipping point.