The Internal Revenue Service has confirmed that an online filing step could substantially reduce federal tax bills for some taxpayers, in certain cases by as much as 50%.

The development, tied to recent tax law changes and IRS digital filing systems, highlights how IRS Confirms an Online Step may reshape how eligible Americans reduce taxable income when filing electronically.

IRS Confirms an Online Step

| Key Fact | Detail / Statistic |

|---|---|

| Maximum potential reduction | Up to 50% for limited cases |

| Required action | Electronic filing through IRS-approved platforms |

| Key drivers | New deductions and expanded credits |

| Primary beneficiaries | Workers with qualifying income and dependents |

What the IRS Confirmed

The Internal Revenue Service (IRS) has confirmed that taxpayers who file their federal returns electronically may unlock deductions and credits that are either unavailable or more easily missed on paper returns.

According to IRS guidance, electronic filing systems automatically apply updated tax law provisions once qualifying information is entered. This confirmation follows recent tax code changes that expanded deductions for certain income types and increased the value of several credits.

While the IRS has not guaranteed savings for all filers, it has acknowledged that eligible taxpayers who properly claim these benefits may see dramatic reductions in tax liability. Officials stress that the phrase “up to 50%” reflects the upper boundary of possible savings, not an average outcome.

How IRS Confirms an Online Step Works in Practice

Automatic Application of New Tax Rules

When taxpayers file electronically using IRS-authorized software, the system automatically evaluates eligibility for newly enacted deductions and credits. These include adjustments tied to specific income categories, family status, and filing status.

The IRS says this automation reduces both errors and omissions. Manual calculations, common in paper filing, increase the risk that taxpayers fail to claim benefits they are legally entitled to receive.

Where the Largest Savings Come From

Stacking Deductions and Credits

Tax professionals say large reductions typically occur when multiple provisions apply simultaneously. These may include:

- Newly expanded income deductions

- A higher standard deduction

- Refundable or partially refundable tax credits

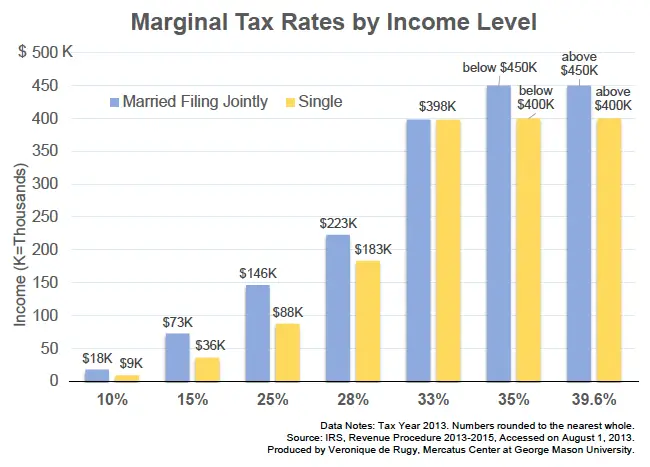

- Reduced marginal tax rates after deductions

When combined, these elements can significantly lower adjusted gross income (AGI), sometimes pushing a taxpayer into a lower tax bracket. In such cases, the total tax owed may fall by half or more compared with a return that fails to apply those provisions correctly.

Why Filing Online Is Critical

The IRS emphasizes that online filing is not mandatory, but it is the most reliable way to ensure correct application of the law. Electronic systems incorporate real-time updates and IRS-approved calculation logic.

Paper filers must manually interpret complex rules and attach the correct schedules, increasing the likelihood of mistakes. The IRS reports that electronic returns consistently show lower error rates and faster processing times.

Who Benefits Most From IRS Confirms an Online Step

Lower- and Middle-Income Filers

Tax analysts say the largest proportional reductions tend to benefit taxpayers with moderate incomes who qualify for multiple deductions or credits. These filers often see their taxable income reduced enough to meaningfully change their tax outcome.

Families With Dependents

Expanded credits for children and dependents can sharply reduce liability, particularly when combined with deductions that lower AGI. In some cases, credits exceed taxes owed, resulting in refunds.

Workers With Qualifying Income Adjustments

Taxpayers whose earnings qualify for newly deductible categories see the most direct impact, especially when such income previously pushed them into higher tax brackets.

Who Is Unlikely to See Large Reductions

High-income filers whose earnings exceed phase-out thresholds are less likely to see dramatic savings. Many credits and deductions are reduced or eliminated entirely once income rises above certain levels.

Tax experts caution that salaried workers without qualifying adjustments may see little or no benefit beyond standard changes already reflected in the tax code.

IRS Safeguards and Compliance Warnings

The IRS has stressed that deductions and credits must be claimed accurately and supported by documentation. Electronic filing systems reduce mistakes but do not eliminate audit risk.

Officials warn that misclassifying income or claiming deductions without eligibility could trigger penalties. The IRS says compliance reviews will continue, particularly as new provisions are implemented.

“Taxpayers should claim only what they qualify for,” an IRS spokesperson said in guidance accompanying the changes.

Historical Context: IRS Digital Shifts

The current development fits into a broader pattern of IRS modernization. Over the past decade, the agency has increasingly shifted toward digital administration to improve accuracy and reduce processing backlogs.

Past initiatives, such as expanded e-file access and online account tools, also improved compliance and reduced errors. Experts say the latest step represents an acceleration of that trend rather than a departure from past policy.

Policy Debate and Equity Considerations

Supporters’ View

Proponents argue that digital filing promotes fairness by ensuring eligible taxpayers receive the benefits Congress intended. They note that low-income filers historically miss credits at higher rates due to complexity.

Critics’ Concerns

Some fiscal watchdogs caution that heavy reliance on software may disadvantage taxpayers without reliable internet access or digital literacy. They urge continued investment in free filing assistance and outreach.

What This Means for the 2026 Filing Season

Tax preparers expect increased attention to electronic filing as taxpayers seek to maximize savings. The IRS has indicated it will continue refining digital tools and updating guidance as additional provisions take effect.

Experts advise taxpayers to review eligibility carefully and retain documentation, particularly when claiming newly expanded benefits.

Related Links

$100M Verizon Settlement 2026 — Who Still Gets Paid and Why Claims Are Closed

New Senior Driving License Rules Start in 2026 — What Drivers Over 70 Should Know

As tax administration becomes increasingly digital, the IRS says online filing will play a growing role in ensuring compliance and accuracy. Future reforms are likely to further integrate policy changes directly into electronic systems.

For now, the agency says eligible taxpayers who take advantage of IRS Confirms an Online Step may see meaningful reductions — but only if they file correctly and qualify under the law.

FAQs About IRS Confirms an Online Step That Could Cut Some Tax Bills by Up to 50%

Does IRS Confirms an Online Step guarantee a 50% tax cut?

No. The figure represents a maximum outcome in limited situations.

Can paper filers still claim these benefits?

Yes, but electronic filing reduces the risk of missing or miscalculating them.

Will the IRS review claims more closely?

Yes. New deductions remain subject to standard compliance checks.