As the 2026 tax season approaches, millions of Americans are asking a basic but critical question: who needs to file taxes for 2025? The answer depends on income, age, filing status, and income type.

The Internal Revenue Service says filing requirements are tied to inflation-adjusted thresholds that determine who must submit a federal return.

File Taxes for 2025

| Item | Details |

|---|---|

| Tax year | 2025 income |

| Filing year | 2026 |

| Primary trigger | Gross income vs. standard deduction |

| Deadline (expected) | April 15, 2026 |

| Major exceptions | Self-employment, dependents, credits |

Who Needs to File Taxes for 2025

Understanding who needs to file taxes for 2025 begins with the IRS concept of gross income and how it compares to the standard deduction. In most cases, taxpayers must file a federal return if their gross income equals or exceeds the standard deduction for their filing status.

The IRS adjusts these thresholds each year for inflation. For 2025, the increases mean some lower-income individuals may no longer be legally required to file. However, income alone does not determine every filing obligation.

2025 Income Thresholds by Filing Status

Taxpayers Under Age 65

- Single: $15,750

- Head of Household: $23,625

- Married Filing Jointly: $31,500

- Qualifying Surviving Spouse: $31,500

- Married Filing Separately: $5

Taxpayers Age 65 or Older

- Single: $17,550

- Head of Household: $25,625

- Married Filing Jointly:

- One spouse 65+: $33,100

- Both spouses 65+: $34,700

- Qualifying Surviving Spouse: $33,100

- Married Filing Separately: $5

These thresholds mirror the 2025 standard deduction amounts.

What Counts as Gross Income

Gross income includes most money received during the year, such as:

- Wages, salaries, and tips

- Self-employment earnings

- Interest and dividends

- Unemployment compensation

- Retirement account withdrawals

- Taxable portions of Social Security

Some income is excluded, but taxpayers should verify exclusions carefully.

When You Must File Even Below the Threshold

Certain situations require filing regardless of income level.

Self-Employed Workers

Anyone with $400 or more in net self-employment income must file due to self-employment taxes.

Owing Special Taxes

You must file if you owe:

- Alternative Minimum Tax

- Household employment taxes

- Penalties on retirement accounts or health savings accounts

Dependents: Children, Students, and Other Family Members

Dependents have separate filing rules. A dependent must file if:

- Earned income exceeds the dependent deduction limit

- Unearned income (interest, dividends) exceeds IRS thresholds

- They owe special taxes

Teenagers with part-time jobs or investment accounts frequently fall into this category.

Social Security and Retirement Income

Social Security benefits may become taxable if combined income exceeds:

- $25,000 (single)

- $32,000 (married filing jointly)

When this happens, filing becomes mandatory even if Social Security is the primary income source.

Cryptocurrency and Digital Assets

Taxpayers who bought, sold, mined, or received cryptocurrency in 2025 may need to file even at lower income levels.

Digital asset transactions can:

- Create taxable capital gains

- Trigger reporting obligations

- Require filing even if net income is small

The IRS continues to expand enforcement in this area.

Affordable Care Act (ACA) Coverage Rules

Taxpayers who received premium tax credits through a health insurance marketplace must file a return to reconcile those credits. Failure to file can:

- Delay refunds

- Trigger repayment obligations

- Affect future ACA eligibility

Foreign Income and Overseas Americans

U.S. citizens and resident aliens must report worldwide income, even if living abroad. Filing may be required if:

- Income exceeds thresholds

- Foreign bank accounts exceed reporting limits

- Foreign tax credits or exclusions are claimed

Filing Even When Not Required: Why It Can Help

Many people file even when not legally required because filing allows them to:

- Claim tax refunds

- Receive refundable credits

- Establish income documentation

The Earned Income Tax Credit and Child Tax Credit require a filed return.

Common Filing Mistakes That Trigger IRS Notices

Tax professionals say IRS notices most often stem from:

- Missing income (W-2s, 1099s)

- Incorrect dependent claims

- Mismatched Social Security numbers

- Crypto reporting omissions

Filing accurately matters as much as filing on time.

Filing Extensions: What They Do and Don’t Do

Taxpayers may request a filing extension, typically until October.

However:

- Extensions apply only to paperwork

- Taxes owed must still be paid by April

- Interest and penalties apply to unpaid balances

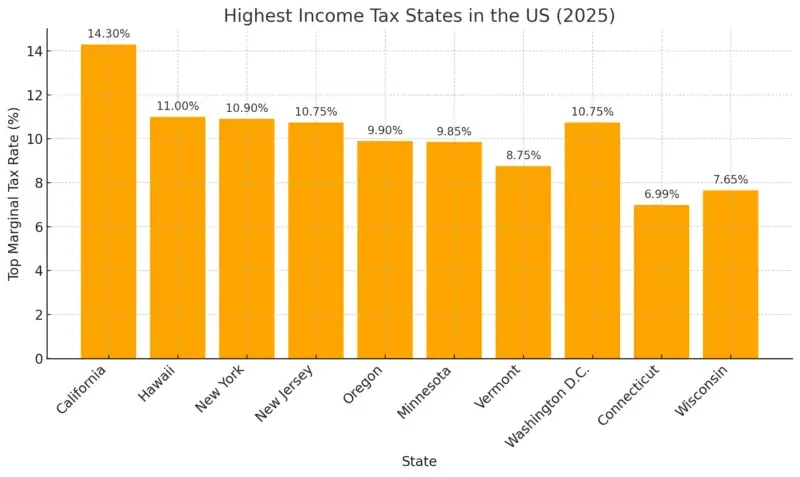

State Taxes Are Separate

Federal filing rules do not determine state requirements.

Some states:

- Have lower income thresholds

- Tax Social Security differently

- Require filing even if no federal return is required

Taxpayers should check state rules separately.

IRS Tools and Free Help

The IRS offers:

- “Do I Need to File?” interactive tool

- IRS Free File for eligible taxpayers

- Volunteer Income Tax Assistance (VITA)

These services aim to reduce filing errors and missed credits.

What to Expect in the 2026 Filing Season

The IRS has signaled continued enforcement focus on:

- Non-filers who owe tax

- Digital asset reporting

- Self-employment income

Officials continue to encourage early filing to avoid delays.

Related Links

IRS Reporting Changes in 2026 — How PayPal and Cash App Payments May Be Tracked

AT&T Settlement Payouts Approach — What the 2026 Schedule Suggests

Understanding who needs to file taxes for 2025 helps taxpayers avoid penalties, claim refunds, and comply with federal law. As inflation adjustments and income sources evolve, filing rules will continue to affect millions of households.

FAQs About File Taxes for 2025

Do I need to file if taxes were withheld?

Yes, if income exceeds thresholds or to claim a refund.

Do students need to file?

Often yes, especially with earned or investment income.

Does unemployment income count?

Yes. It is taxable.