Millions of renters across the United States may qualify for state tax relief worth as much as $2,720, according to state revenue agencies and housing policy experts. The programs, available in 23 states and Washington, D.C., are designed to offset the rising cost of rent by returning a portion of state taxes to eligible tenants, often in the form of refundable credits.

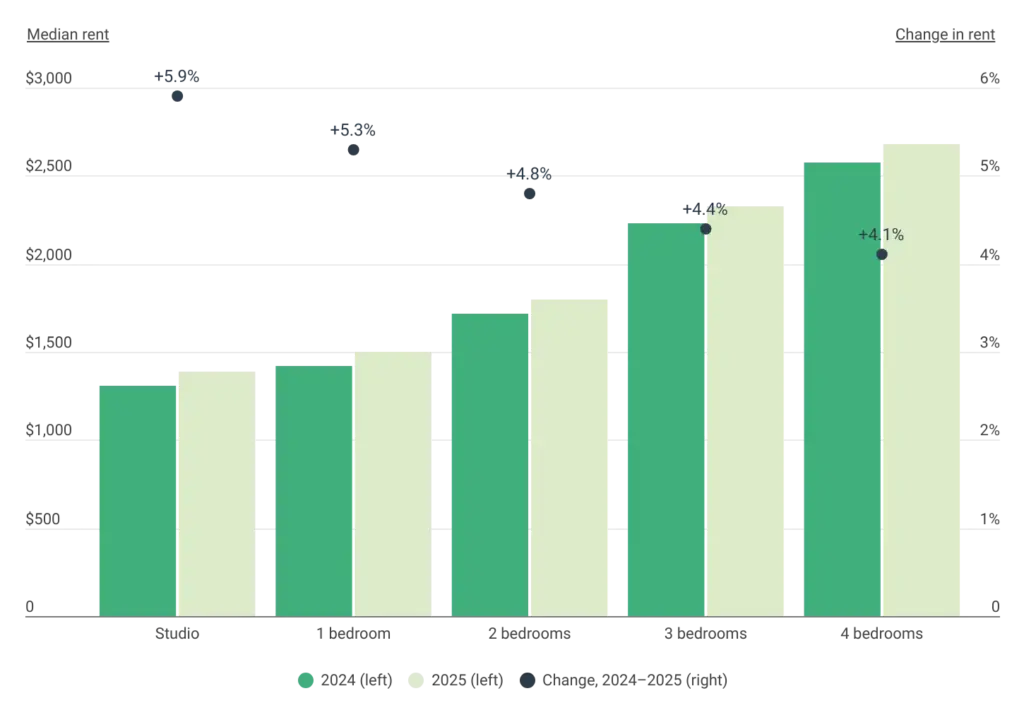

The relief comes as rental affordability remains under pressure nationwide. Median rents remain elevated compared with pre-pandemic levels, and renters now make up more than 35 percent of U.S. households, according to data from the U.S. Census Bureau.

Some Renters Could Get Up to $2,720

| Key Fact | Details |

|---|---|

| Maximum Benefit | Up to $2,720 in Minnesota |

| Eligible Jurisdictions | 23 states + Washington, D.C. |

| Payment Type | Refundable credits or rebates |

| Filing Method | State income tax return |

What Is State Tax Relief for Renters?

State tax relief for renters generally takes the form of renter’s tax credits or rebates, which reduce state income tax liability or provide direct payments to eligible tenants. Unlike federal housing benefits, which primarily assist homeowners through mortgage interest deductions, these programs specifically target renters.

The underlying policy rationale is straightforward. Although renters do not receive property tax bills, economists widely agree that property taxes paid by landlords are passed on to tenants through higher rents. State governments created renter credits to partially rebalance that burden.

“Renters are indirect taxpayers,” said Dr. Sarah Gold, a housing economist at a Midwestern public university. “Renter tax credits are one of the few tools states have to recognize that reality.”

How Much Could Eligible Renters Receive?

The amount varies sharply by state, income, and household size.

- Minnesota offers the largest renter credit, with benefits reaching $2,720 for qualifying households.

- Vermont provides refundable renter credits that can approach $2,500 for lower-income tenants.

- Connecticut issues renter rebates of up to $900 for married couples and $700 for individuals, including those with no state tax liability.

Most other states offer smaller credits, typically ranging from $300 to $1,500, according to state revenue data.

Why These Programs Exist

Renter tax credits date back several decades, emerging in the 1970s and 1980s as states sought to address housing inequities. At the time, homeowners benefited disproportionately from tax deductions tied to property ownership, while renters received little direct support.

“These programs were designed to level the playing field,” said Michael Harper, a former state tax commissioner. “They’re not subsidies in the traditional sense. They’re partial refunds of taxes renters effectively pay through rent.”

Eligibility Requirements: Common Rules Across States

While each state sets its own criteria, most programs share several baseline requirements.

Primary Residence

Rent must have been paid on a primary residence, not a vacation property or short-term rental.

Income Limits

Eligibility is income-based. Limits often range between $35,000 and $75,000, with higher thresholds for seniors, people with disabilities, or families with dependents.

Proof of Rent Paid

Most states require documentation, commonly a Certificate of Rent Paid (CRP) or a landlord-signed statement detailing total rent paid during the tax year.

Residency Duration

Some programs require residents to have lived in the state for at least six months of the tax year.

Refundable vs. Non-Refundable Credits

Understanding this distinction is critical.

- Refundable credits result in a payment even if no state income tax is owed.

- Non-refundable credits only reduce taxes owed and provide no cash refund beyond that.

Most renter programs are refundable, making them particularly valuable for low-income households.

“This is real money back, not just a line on a tax return,” said Angela Morris, a certified public accountant who works with low-income filers.

Administrative Challenges and Barriers

Despite their value, renter credits remain underclaimed.

State officials cite several reasons:

- Lack of public awareness

- Missing or delayed landlord documentation

- Confusion over eligibility rules

- Failure to file a state tax return at all

In Minnesota alone, tax officials estimate tens of thousands of eligible renters fail to claim the credit each year.

What to Do if a Landlord Does Not Cooperate

Some renters report difficulty obtaining required documents. In many states, landlords are legally required to provide rent certificates upon request.

If documentation is withheld:

- Renters should contact their state department of revenue

- Alternative records, such as bank statements, may be accepted

- Filing extensions may be available

Fraud and Scam Warnings

Tax agencies warn renters to be cautious of third-party services promising guaranteed refunds. “Renters should never pay upfront fees to claim state tax credits,” said a spokesperson for a northeastern revenue department. “These programs are administered directly through state tax filings.”

Officials advise using state websites, certified tax preparers, or IRS-approved volunteer tax assistance programs.

Equity Concerns and Policy Debate

While renter credits provide meaningful relief, housing advocates argue they do not address underlying supply shortages or rising rents. “These credits help households survive,” said Laura Chen, a policy analyst at a housing nonprofit. “But they don’t fix the structural drivers of housing costs.”

Some lawmakers have proposed expanding renter credits at the federal level, though no nationwide program currently exists.

Related Links

Upcoming Student Loan Deadlines Could Affect Payments and Relief Options – Check Details

Can a $5,000 Monthly Budget Support Retirement in 2026? Check Details

Several states are reviewing whether to increase benefit caps or expand eligibility in future tax years, citing inflation and continued rental pressure.

As tax filing deadlines approach, experts urge renters to review state rules carefully. “Too many people assume renters don’t get tax breaks,” said Morris. “That assumption can cost families thousands of dollars.”

As housing costs continue to strain household budgets, renter tax relief remains one of the most direct ways states support tenants. For eligible renters, the benefit can equal one or two months of rent, making early filing and proper documentation especially important.

FAQs About Some Renters Could Get Up to $2,720

Do I need to owe state tax to qualify?

No. Many renter credits are refundable.

Can roommates each claim the credit?

Often yes, but benefits may be divided based on rent paid.

Does student housing qualify?

It depends on whether the housing is considered taxable property.

Is this federal or state relief?

These are state-level programs, not federal benefits.