Rising health care costs are consuming an increasingly large share of Social Security benefits, threatening the financial stability of millions of American retirees.

As Medicare premiums, prescription drug prices, and out-of-pocket medical expenses grow faster than benefit increases, retirees are finding that a program designed to provide income security is covering less of their everyday needs.

For older Americans who rely heavily on Social Security, this shift is becoming one of the most pressing financial challenges of retirement.

Bigger Share of Social Security in Retirement

| Issue | Impact on Retirees |

|---|---|

| Healthcare inflation | Outpaces Social Security COLAs |

| Medicare premiums | Reduce monthly benefit checks |

| Prescription drugs | Rising costs strain fixed incomes |

| Long-term care | Largely uncovered by Medicare |

| Longevity | More years of medical spending |

Why Health Costs and Social Security Are Colliding

Social Security was designed to replace only a portion of pre-retirement income, not to cover all living expenses. However, for nearly half of retirees, it now provides 50% or more of total income, according to federal retirement data.

At the same time, health care expenses are rising faster than general inflation. Annual cost-of-living adjustments (COLAs) applied to Social Security are based on broad consumer prices, not the higher inflation rate experienced specifically by older adults, who spend disproportionately on medical care.

This mismatch means retirees may receive benefit increases on paper while losing purchasing power in practice.

The Medicare Effect: Premiums Reduce Monthly Checks

Medicare plays a central role in this equation. While it provides essential health coverage beginning at age 65, it does not eliminate costs. Medicare Part B premiums—covering outpatient care—are automatically deducted from Social Security payments for most beneficiaries.

As premiums rise, they reduce the net amount retirees receive each month before any other expenses are paid. Prescription drug costs under Medicare Part D, along with deductibles, co-payments, and uncovered services such as dental and vision care, further increase the burden.

Who Is Most Affected by Rising Health Costs

Lower-Income Retirees

Retirees with limited savings are especially vulnerable. Many lack supplemental insurance or financial flexibility, leaving them exposed to even modest increases in medical costs.

Women

Women tend to live longer and often receive smaller Social Security benefits due to lower lifetime earnings. Longer lifespans mean more years of medical expenses, amplifying the financial strain.

Older Seniors (80+)

Healthcare spending rises sharply with age. Seniors over 80 face higher rates of chronic illness, prescription use, and long-term care needs.

Rural and High-Cost Regions

Access to affordable providers varies widely. Retirees in rural areas or high-cost states often face higher out-of-pocket expenses and fewer insurance options.

Long-Term Care: The Largest Uncovered Risk

One of the most significant gaps in retirement planning is long-term care. Medicare does not cover extended nursing home stays or long-term in-home care.

As Americans live longer, the likelihood of needing assistance with daily activities increases. These costs can quickly exceed annual Social Security income, forcing retirees to draw down savings or rely on Medicaid after exhausting personal resources.

Why COLAs Often Fall Short

Social Security COLAs are tied to the Consumer Price Index for Urban Wage Earners (CPI-W). Critics argue this measure does not accurately reflect retiree spending, particularly on healthcare.

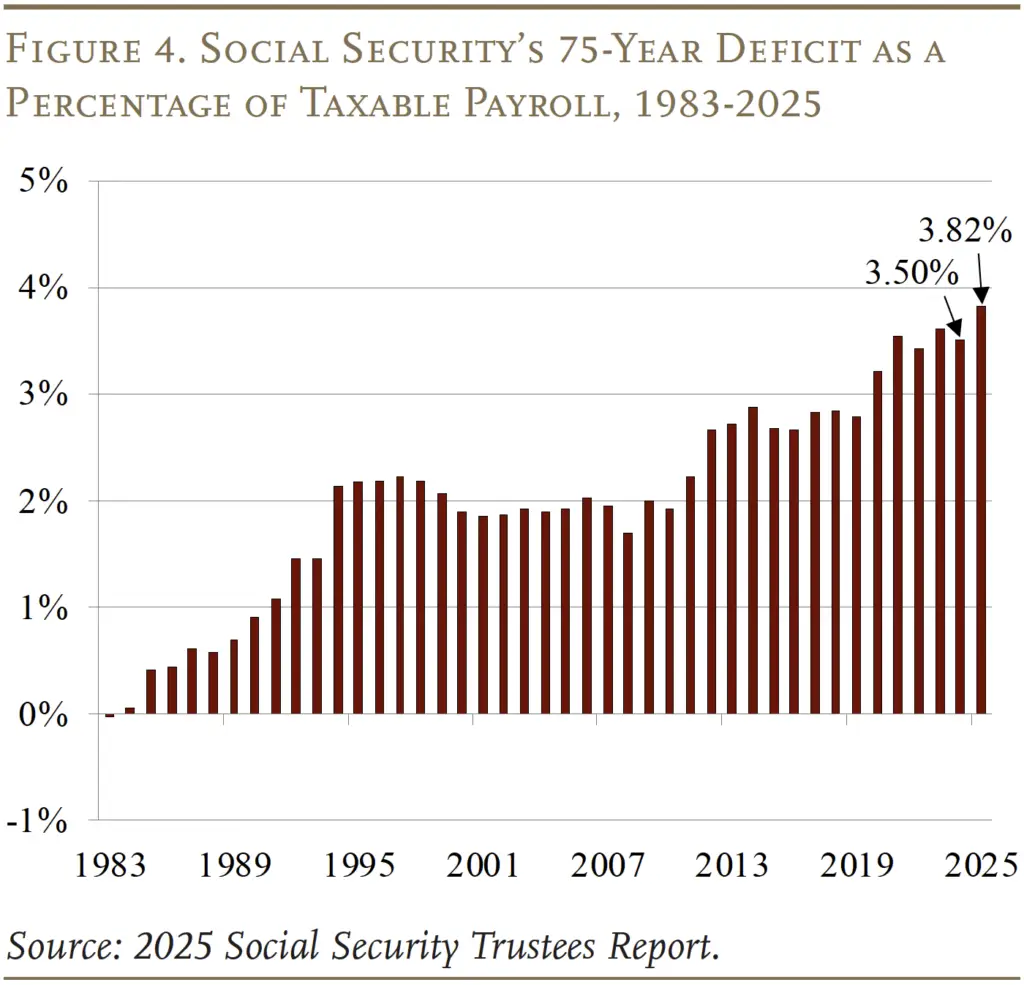

Some economists and advocacy groups support adopting an alternative index that weights medical costs more heavily. Others caution that higher COLAs could accelerate funding challenges for the Social Security program.The debate highlights a fundamental tension between benefit adequacy and long-term sustainability.

How the U.S. Compares Internationally

In many developed countries, retirees face lower out-of-pocket healthcare costs due to broader public coverage. Nations such as Canada, Germany, and the United Kingdom integrate healthcare more fully into their retirement safety nets.

In contrast, the U.S. system relies heavily on individual planning, supplemental insurance, and personal savings to manage healthcare risks in old age.

Planning Strategies for Retirees and Near-Retirees

Financial planners recommend several steps to reduce healthcare pressure on Social Security income:

- Maximize Health Savings Accounts (HSAs) before retirement

- Review Medicare options annually, including Advantage and Medigap plans

- Budget conservatively for future medical inflation

- Plan for long-term care, whether through insurance or designated savings

- Delay Social Security when possible, increasing monthly benefits

No single strategy fits all households, but proactive planning can reduce exposure to rising costs.

Policy Questions and Future Outlook

As healthcare consumes a growing share of retirement income, policymakers face increasing pressure to address the issue. Proposals range from adjusting COLA calculations to expanding Medicare benefits or strengthening supplemental assistance for low-income seniors.

Absent reforms, analysts warn that healthcare costs could further erode the real value of Social Security benefits over the coming decades.

Related Links

February 2026 Payments — Sorting Stimulus Claims From Tax Refund Facts

Upcoming Student Loan Deadlines Could Affect Payments and Relief Options – Check Details

What Retirees Should Watch Going Forward

Healthcare costs are likely to remain one of the fastest-growing expenses in retirement. As life expectancy increases and medical innovation advances, managing health expenses will play an even larger role in retirement security.

For retirees and future beneficiaries alike, understanding how rising health costs interact with Social Security is no longer optional—it is central to financial survival in later life.

FAQs About Bigger Share of Social Security in Retirement

Does Medicare fully cover retirement healthcare costs?

No. Premiums, deductibles, co-payments, and many services remain uncovered.

Will Social Security COLAs keep up with healthcare inflation?

Historically, they have not fully matched medical cost growth.

Can delaying Social Security help offset health costs?

Yes. Higher monthly benefits can provide more flexibility to absorb medical expenses.

Is long-term care insurance necessary?

It depends on personal finances, health outlook, and family support, but it addresses a major coverage gap.