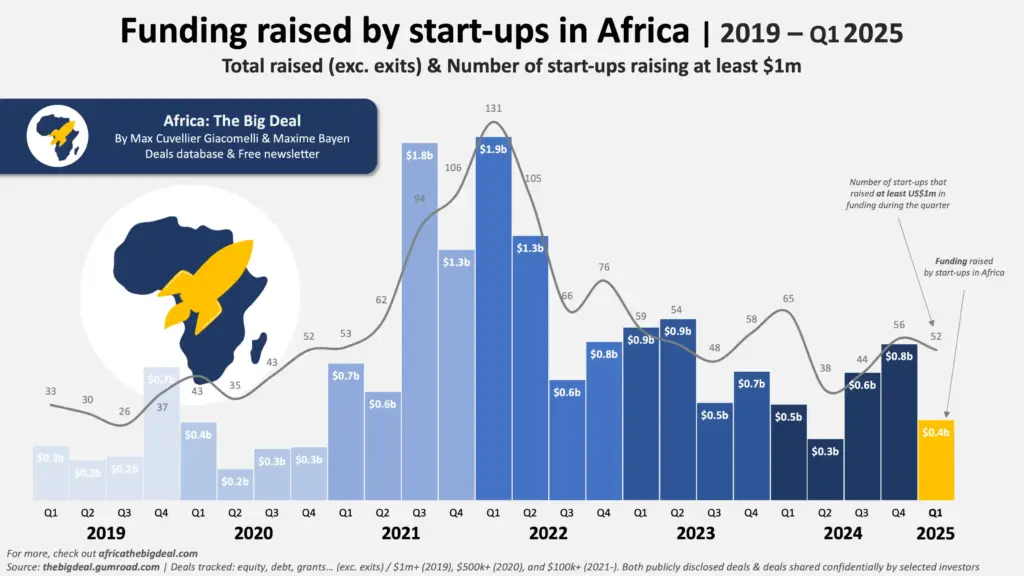

In a significant shift in global investment dynamics, the United States has surpassed China to become Africa’s largest foreign investor. For the first time since 2012, U.S. foreign direct investment (FDI) in Africa outpaced China’s, with U.S. investment in Africa reaching approximately $7.8 billion in 2023, compared to China’s $4 billion.

This development reflects broader economic trends, strategic priorities, and evolving relationships between Africa and its major foreign partners.

Africa’s Largest Foreign Investor

| Key Fact | Detail |

|---|---|

| U.S. Investment in Africa (2023) | $7.8 billion |

| China’s Investment in Africa (2023) | $4 billion |

| First U.S. Lead since 2012 | U.S. overtakes China as Africa’s largest investor |

| Focus of U.S. Investments | Mining, minerals, and infrastructure |

Why the U.S. Overtook China in Africa

Focus on Critical Minerals and Supply Chain Security

One of the main drivers of the shift is the U.S.’s focus on securing critical minerals for its green energy transition and technological industries. Africa is home to vast deposits of minerals like lithium, cobalt, rare earth elements, and tungsten, which are essential for manufacturing electric vehicles, solar panels, and advanced electronics.

As China has long dominated the global supply of these materials, the U.S. is now increasingly investing in Africa’s mining and processing sectors to secure its own supply chains, especially in the context of growing geopolitical tensions between the two powers.

The Role of the U.S. International Development Finance Corporation (DFC)

A pivotal moment in the U.S. investment resurgence was the creation of the U.S. International Development Finance Corporation (DFC) in 2019. With a focus on sustainable development, infrastructure projects, and private sector partnerships, the DFC has become a key tool in shifting investment toward Africa.

The DFC aims to offer an alternative to Chinese state-backed loans, particularly in sectors such as energy, agriculture, and digital infrastructure. Through the DFC, the U.S. has been able to direct capital to African countries with a focus on long-term growth and reducing the risk of unsustainable debt.

Changing Chinese Engagement and African Preferences

While China remains a major player in Africa, its debt-driven model of investment has come under increasing scrutiny. Projects funded by Chinese loans, particularly in infrastructure, have faced criticism for creating debt traps and failing to create sufficient local employment or value-added industries.

Many African governments are now looking to diversify their foreign investment sources, favoring partners like the U.S. that are more aligned with their goals for economic sustainability and industrialization.

In recent years, African countries have increasingly demanded that foreign investors contribute to the local economy by establishing manufacturing facilities and providing technology transfer, areas where U.S. firms have been making inroads.

Specific U.S. Investments and Impacts Across Africa

Mining and Mineral Processing: Key U.S. Focus Areas

A significant portion of U.S. investment has been funneled into the mining and mineral processing industries. For example, U.S. companies are now involved in the processing of cobalt and lithium in Zambia and the Democratic Republic of Congo (DRC), which are critical for the global battery market.

In countries like Rwanda, U.S. investors are funding processing plants that add value to raw materials, turning them into high-value products ready for export.

In South Africa, U.S. companies are investing in platinum-group metal (PGM) mines, which are vital for clean energy technologies. This approach contrasts with the Chinese model, which focuses more on direct mining operations with less emphasis on processing and local industrial development.

Technology and Infrastructure: Investments Beyond Mining

The U.S. is also investing in technology infrastructure in African countries. Silicon Valley-backed companies are expanding into the digital economy, particularly in Kenya and Nigeria, where mobile financial services are booming.

American companies are helping to build data centers, mobile platforms, and e-commerce infrastructure that will help African economies integrate into global supply chains.

What This Means for Africa

The U.S. overtaking China as Africa’s largest foreign investor brings new opportunities but also new challenges.

Positive Outcomes for African Economies

U.S. investments are more likely to lead to job creation, technology transfer, and long-term development, especially in sectors like energy, mining, and telecommunications. For example, a U.S.-backed company in Ghana is helping to develop the country’s oil and gas industry, creating thousands of jobs while also transferring important technology to local workers.

Additionally, African countries stand to benefit from U.S. investments in renewable energy and infrastructure, which could help them diversify their economies and reduce dependence on raw material exports.

Risks and Considerations

However, experts warn that Africa must ensure these foreign investments lead to local value addition rather than simply exploiting resources for export. Professor David Chikadze, an economic advisor to the African Union, cautions that “Africa must seize this opportunity to create policies that ensure these investments benefit its people, not just foreign investors.”

Related Links

Hidden Heat Beneath Earth’s Crust — Scientists Uncover a New Trigger for Global Warming

Popular Dietary Supplement Linked to Increased Risk of Heart Failure — What You Should Know

The Future Outlook for U.S.-Africa Relations

Looking ahead, U.S. investment in Africa is expected to grow as both governments and private sector players increase their commitments to sustainable development and economic resilience.

However, the key challenge will be ensuring that investments do not just benefit corporations but contribute to building local capacity, infrastructure, and human capital in African nations.

The Geopolitical Landscape

As the U.S. surpasses China, it is likely to become more engaged in African diplomatic and trade agreements, further solidifying its position as a strategic partner for the continent. This could lead to stronger political ties between African nations and the U.S., but it will also likely lead to heightened competition between China and the U.S. for influence in key African regions.

The Role of African Governments

African leaders will need to navigate this changing landscape by securing favorable terms for their countries, ensuring that investments contribute to long-term economic development and job creation. As global powers vie for influence, Africa’s ability to negotiate better deals and control its natural resources will be crucial for its future.

The U.S. overtaking China as Africa’s largest foreign investor is a significant shift in the continent’s investment patterns. With an increasing focus on critical minerals, infrastructure, and technology, the U.S. is positioning itself as a strategic partner for African nations looking to diversify and industrialize their economies.

However, the challenge will be to ensure these investments lead to sustainable, equitable development across the continent.