The state of Alaska is preparing to distribute the 2025 Alaska PFD 2025, issuing $1,000 payments to more than 600,000 eligible residents, according to the state’s Department of Revenue. The payout, funded by the Alaska Permanent Fund Corporation’s (APFC) earnings, comes amid ongoing debates about the state’s fiscal policy, the cost of living and demands for stable funding of public services.

Alaska PFD 2025

| Key Fact | Detail |

|---|---|

| Payment Amount | $1,000 per eligible resident |

| Eligible Population | Over 600,000 residents |

| First Payment Date | 2 October 2025 (Direct Deposit) |

| Program Origin | Earnings from the Alaska Permanent Fund |

| 2025 Cost to State | ~$685.3 million |

Understanding the Alaska PFD 2025 and Its Purpose

The Alaska PFD 2025 refers to the annual payment distributed to Alaska residents based on earnings from the Alaska Permanent Fund. The program seeks to ensure that all residents benefit from the state’s resource wealth, particularly oil revenues, and investment profits.

Created in 1976 and first distributed in 1982, the dividend has become a defining feature of Alaskan economic policy. The APFC invests oil-related proceeds globally across equities, bonds, real estate and alternative assets.

Why the 2025 Payout is $1,000

Legislative Decision

The 2025 dividend level was set under House Bill 53, which allocated a fixed $1,000 payment. The reduced amount follows months of debate on how to balance essential public spending with residents’ expectations of larger dividends.

Budget Pressures

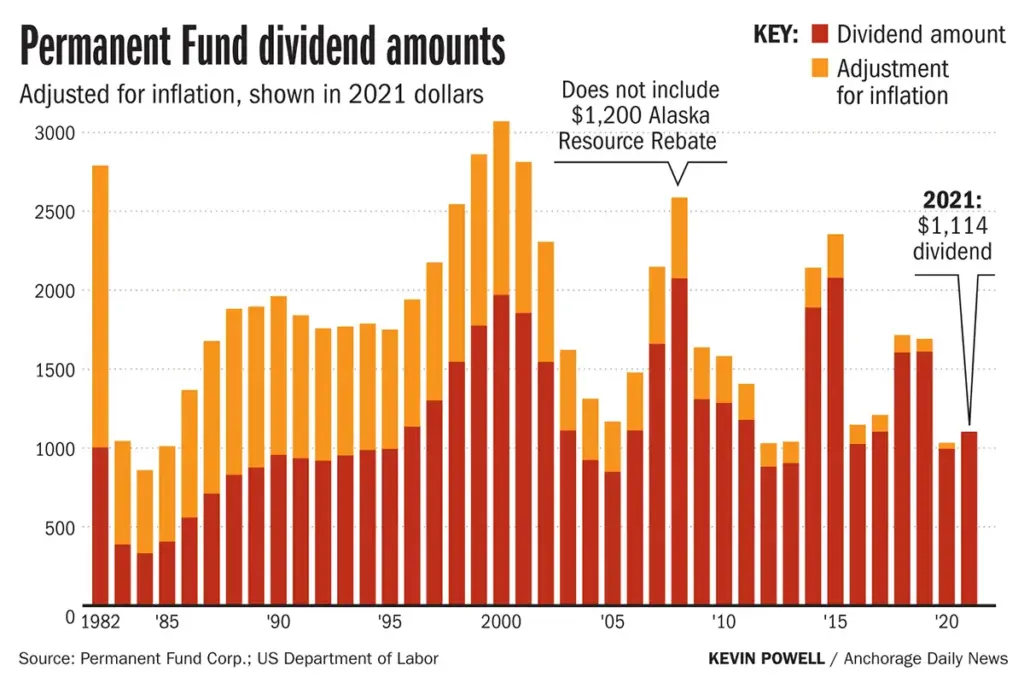

According to the Associated Press, the 2025 payout is “one of the lowest in 20 years.” Legislators opted for a smaller dividend to help fund public schools, healthcare and infrastructure amid constrained revenues.

Decline Compared with Previous Years

The 2024 PFD was $1,702, nearly double this year’s amount. If the state had used the traditional formula, the payout could have reached $3,800 per person, according to multiple policy analysts.

Eligibility Criteria for the 2025 Alaska PFD 2025

Basic Requirements

To qualify, residents must:

- Live in Alaska for the full 2024 calendar year.

- Intend to stay indefinitely.

- Not claim residency in another state.

- Have no disqualifying absences exceeding 180 days, unless exceptions apply (education, military service, medical care).

Application Window

Applications typically open January 1 and close March 31. Late applications are accepted only under strict, documented circumstances.

Status Check

Residents can track their eligibility through the myPFD portal, where real-time updates are provided on approval and payment timelines.

2025 Payment Calendar

- 2 October 2025 — First wave of direct deposits.

- 23 October 2025 — Second payment wave for later approvals.

- 20 November 2025 — Final wave for “Eligible-Not Paid” applicants.

How the Alaska Permanent Fund Works

The APFC manages a portfolio exceeding $84 billion. It consists of two key accounts:

1. The Principal

This portion cannot be spent. It grows through:

- Oil royalties

- Legislative deposits

- Inflation-proofing additions

2. The Earnings Reserve Account (ERA)

This account pays for:

- The yearly dividend

- A portion of the state budget

- Inflation-proofing transfers

Governance and Transparency

The APFC releases quarterly and annual reports outlining investment performance, risk exposure and long-term strategy. Analysts credit it as one of the most effective sovereign wealth funds in the United States.

Tax Implications for Residents

Federal Taxes

The PFD is considered taxable income by the U.S. Internal Revenue Service (IRS). Residents must report it on federal returns.

State Taxes

Alaska has no state income tax, so residents owe no state-level taxes on the dividend.

Impact on Benefits

For some households, the dividend can affect eligibility thresholds for:

- SNAP (food assistance)

- Medicaid

- Housing support

However, certain federal programmes exclude the PFD from income calculations.

Rural and Indigenous Community Impact

Higher Cost of Living

Communities in remote areas, especially Alaska Native villages, face significantly higher prices for fuel, food and transport. In some villages, heating oil prices exceed the national average by three to four times.

Stabilising Local Economies

The dividend provides households a vital cash injection, helping compensate for high logistical costs. For some families, the payment covers:

- Winter heating

- Basic groceries

- Emergency supplies

- School clothing and supplies

A resident from Fairbanks told the Associated Press that the dividend helped cover a $2,600 winter heating bill, illustrating the program’s importance.

Expert Commentary and Analysis

Dr. Andrew Bibbins, economist at the University of Alaska Anchorage (UAA), notes:

“The dividend has become a stabilising force in Alaska’s mixed economy. Even when reduced, it boosts rural purchasing power and supports seasonal cash flow.”

Lydia Trenton, policy analyst at the Brookings Institution, explains:

“Alaska’s challenge is balancing equitable distribution with responsible budgeting. The $1,000 payment reflects caution in a volatile economic landscape.”

Global Comparisons: How Alaska Measures Up

The Alaska model is one of the world’s few long-running universal resource dividends. Comparable examples include:

1. Norway’s Sovereign Wealth Fund

While Norway’s fund is the world’s largest, Norwegians do not receive direct dividends. Instead, returns fund national services and welfare.

2. Mongolia’s Human Development Fund

Mongolia briefly experimented with direct payments funded by mining revenues, but the programme was suspended due to fiscal instability.

3. Gulf States’ Oil Benefits (H3)

Some Gulf nations offer subsidised housing, utilities and education rather than direct cash payments. Alaska remains unique in offering annual unconditional payments to all qualifying residents.

Criticisms and Future Concerns

Lower Payout Dissatisfaction

Opponents argue the 2025 payout is insufficient for families facing record energy costs.

Fluctuating Dividends

Reliance on oil markets and investment returns makes future payouts unpredictable.

Political Disagreements

Lawmakers remain divided on whether to restore the original calculation formula.

Related Links

First ANCHOR $1,750 Payments Rolling Out Soon — Check Whether You’re Eligible

Californians Alert — Last Chance to Qualify for $1,756 in Benefits This Cycle

What Residents Should Do Now

- Ensure application details are correct on myPFD

- Verify banking information

- Keep documentation of residency

- Consider using the payout for essential expenses rather than discretionary spending

Looking Ahead to 2026

Some lawmakers suggest the 2026 dividend may increase if economic conditions improve and the legislature agrees to draw from the state’s Constitutional Budget Reserve.

FAQs About Alaska PFD 2025

1. Is the PFD taxable?

Yes. It must be reported on federal tax returns.

2. Can non-residents apply?

No. The PFD is exclusively for Alaska residents meeting strict criteria.

3. Are children eligible?

Yes. Minors receive a dividend if their household meets eligibility requirements.

4. Does the PFD affect SNAP or Medicaid?

In some cases, it can. Residents should check programme-specific rules.