The average Social Security check received by retired Americans varies dramatically depending on where beneficiaries live. New federal data show that retirees in some states receive average monthly payments exceeding $2,300, while others receive closer to $1,800.

These differences, highlighted by the Average Social Security Check, have drawn renewed attention as inflation, healthcare costs, and retirement security remain central public concerns. While the gaps may appear startling, experts stress they do not reflect differences in state generosity or federal favoritism. Social Security is a nationally uniform program.

Instead, the disparities mirror decades of wage inequality, employment patterns, and demographic trends that shape lifetime earnings long before retirement begins.

The Average Social Security Check in Every State

| Key Fact | Detail |

|---|---|

| National average benefit | About $1,900 per month for retired workers |

| Highest state averages | Concentrated in Northeast, Mid-Atlantic |

| Lowest state averages | Predominantly Southern states |

| Benefit calculation | Based on top 35 earning years |

Understanding the Average Social Security Check

The Average Social Security Check refers to the average monthly Social Security retirement benefit paid to beneficiaries residing in each state. The Social Security Administration calculates these figures by dividing total benefit payments to retired workers in a state by the number of recipients.

The data reflect payments after annual cost-of-living adjustments and include only retired workers, not spouses, survivors, or disability beneficiaries unless otherwise specified. Crucially, these figures do not account for cost of living, taxes, or household composition, and they should not be interpreted as a direct measure of retirement comfort.

States With the Highest Average Social Security Checks

States with the highest averages tend to cluster in the Northeast and Mid-Atlantic, regions historically associated with higher wages and stable employment over the past several decades.

Recent SSA data place New Hampshire at the top, with an average monthly benefit exceeding $2,400. Connecticut, New Jersey, Delaware, and Maryland also rank near the top, each with averages above $2,100.

Economists note that these states benefited from long-term concentrations of professional, industrial, and public-sector employment, which historically offered higher and more consistent wages.

States With the Lowest Average Checks

At the lower end, states in the Deep South and parts of Appalachia show average benefits closer to $1,800. Mississippi, Arkansas, Louisiana, Kentucky, and New Mexico consistently rank near the bottom.

Lower averages reflect generations of lower wages, fewer employer-sponsored pensions, and more disrupted work histories, particularly in rural and agricultural economies.

How Social Security Benefits Are Calculated

Social Security benefits are based on a worker’s highest 35 years of inflation-adjusted earnings. Workers with fewer than 35 years of earnings receive zeros for missing years, reducing their average.

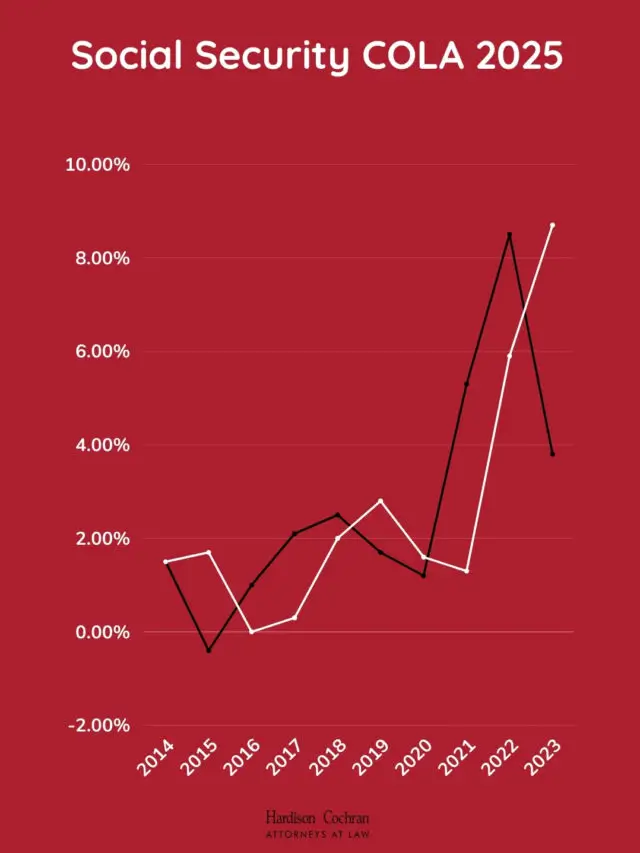

Benefits also depend on claiming age. Workers who claim before full retirement age receive permanently reduced monthly payments, while those who delay past that age receive higher benefits. Because claiming behavior varies by region, it plays a meaningful role in state averages.

Regional Claiming Patterns Matter

Data from the SSA show that workers in lower-income states are more likely to claim benefits early, often at age 62, due to health issues or limited job opportunities. Early claiming reduces monthly checks for life.

In higher-income states, workers are more likely to delay claiming, either because they can afford to wait or continue working longer. This difference alone can account for hundreds of dollars per month in average benefits.

Urban–Rural Divides Often Exceed State Gaps

Within many states, urban retirees receive significantly higher average benefits than rural retirees. Metropolitan areas typically offer higher wages, longer careers, and more employer-sponsored retirement plans.

In large states such as Texas, California, and New York, the gap between urban and rural average benefits can exceed the difference between two neighboring states. This internal variation means state averages often mask deeper local disparities.

Gender and Racial Inequities Reflected in the Data

State averages also reflect persistent gender and racial wage gaps. Women, on average, receive lower Social Security benefits than men because they earn less over their lifetimes and are more likely to take time out of the workforce for caregiving.

Similarly, Black and Hispanic workers, who have historically faced lower wages and higher unemployment, are overrepresented in states with lower average benefits. Experts emphasize that Social Security partially offsets these disparities through its progressive formula, but it does not eliminate them.

Historical Perspective: Gaps Have Widened

Two decades ago, the difference between the highest- and lowest-paying states was significantly smaller. Since then, wage growth has accelerated faster in high-income regions, widening disparities in lifetime earnings and retirement benefits.

This trend suggests that state-level differences in average Social Security checks are likely to persist unless broader wage inequality narrows.

How the U.S. Compares Internationally

Internationally, the United States is unusual in how much regional variation exists in public retirement benefits. Many European countries have national pension systems with flatter benefit structures.

Analysts say this reflects the U.S. system’s strong link between benefits and individual earnings, rather than residence or need.

What the Numbers Do—and Do Not—Mean

Higher average benefits do not necessarily mean retirees are better off. States with higher benefits often have higher housing, healthcare, and tax costs.

Conversely, retirees in lower-benefit states may face lower living expenses, partially offsetting smaller checks. As one retirement economist noted, “Social Security replaces income, not lifestyle.”

Implications for Current and Future Retirees

For workers nearing retirement, the data underscore several realities:

- Lifetime earnings matter more than location at retirement

- Delaying benefits can substantially increase monthly income

- Social Security alone rarely replaces full pre-retirement income

- Regional inequality in wages carries into retirement

Financial planners consistently describe Social Security as a foundation, not a complete solution.

Related Links

One Small Social Security Error Could Reduce Your Entire $2,000 Benefit — What to Avoid

Your First Social Security Check of 2026: Check Which Day It Will Be Sent

What Comes Next

Absent legislative reform, Social Security’s structure and benefit formula will remain unchanged. However, long-term funding challenges and demographic shifts continue to fuel debate about the program’s future.

For now, the state-by-state averages serve as a window into America’s economic past, revealing how decades of work, pay, and opportunity shape retirement outcomes today.

FAQs About The Average Social Security Check in Every State

Does living in a high-paying state increase my benefit?

No. Benefits depend on earnings history, not residence.

Why do Southern states rank lower?

Lower historical wages and earlier claiming ages reduce averages.

Do higher checks mean higher quality of life?

Not necessarily. Cost of living varies widely.

Can policy changes reduce these gaps?

Only indirectly, through wage growth and workforce participation.