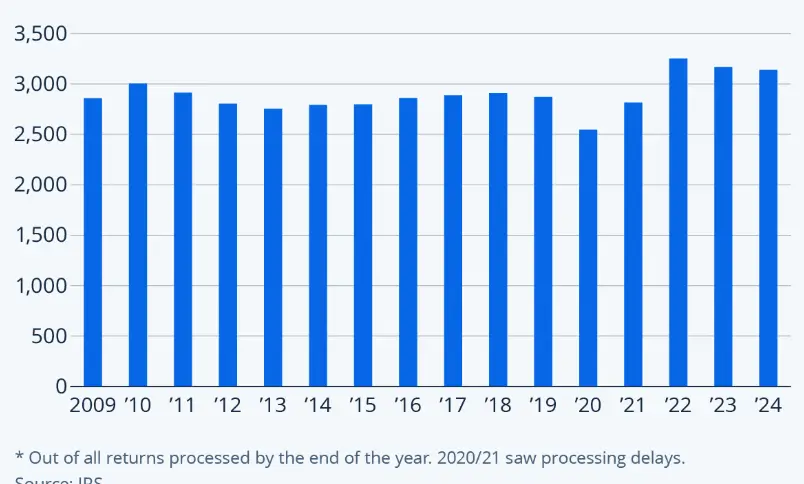

A new federal tax law enacted in 2025 could push average U.S. tax refunds higher in 2026, not because Americans are suddenly paying far less in taxes, but because withholding systems have lagged behind changes in tax liability.

The effect, which will appear when taxpayers file 2025 returns, reflects a recurring feature of the U.S. tax system following major legislative changes.

Average Tax Refunds Higher in 2026

| Key Fact | Detail |

|---|---|

| Tax year affected | 2025 income, filed in 2026 |

| Primary driver | Over-withholding after tax law changes |

| Most affected taxpayers | Wage earners and families |

| Expected duration | Likely temporary |

What Changed in the Law

The increase in expected refunds stems from a comprehensive federal tax package passed in mid-2025, which altered several pillars of the individual income tax system. The law extended provisions that were scheduled to expire at the end of 2025 and introduced targeted expansions aimed at households.

Among the most consequential changes were adjustments to the standard deduction, modifications to family-related tax credits, and temporary deductions tied to earned income categories. Together, these provisions lowered effective tax liability for many filers.

However, the timing of enactment proved critical. Employers had already set payroll withholding systems based on earlier rules, and updates did not fully propagate through the system during the year. “Tax liability changed faster than withholding,” said a former Treasury Department official familiar with implementation challenges. “That gap shows up later as a refund.”

How Average Tax Refunds Actually Work

A tax refund is not a bonus or government payout. It is the return of money taxpayers already earned but paid in excess during the year.

For most workers, federal income tax is withheld automatically from each paycheck. That withholding is based on IRS tables designed to approximate annual tax liability. When laws change mid-year, those tables can become inaccurate.

If withholding remains too high relative to final tax owed, the taxpayer receives the difference as a refund when filing.

A Familiar Pattern in U.S. Tax History

Refund spikes following tax changes are not new. Similar patterns occurred after major tax legislation in 2001, 2008, and 2017.

In each case, analysts observed a temporary increase in average refunds as payroll systems adjusted with delay. Once withholding caught up, refunds returned closer to historical norms. “This is a timing issue, not a structural windfall,” said a senior economist at a U.S. policy research institute. “We see it almost every time Congress rewrites tax rules.”

Who Is Most Likely to Benefit from Average Tax Refunds

The expected increase in refunds will not be evenly distributed.

Most likely to see higher refunds:

- Wage earners who rely solely on employer withholding

- Families eligible for expanded credits

- Lower- and middle-income households

Less likely to benefit:

- Self-employed taxpayers making estimated payments

- High-income filers who actively manage withholding

- Taxpayers who already adjusted Form W-4 elections

Distributional analyses from nonpartisan tax groups show that refund increases tend to cluster among households with limited flexibility to update withholding during the year.

What Higher Tax Refunds Do—and Do Not—Mean

A larger refund does not necessarily mean a household paid less tax overall. It often means the taxpayer overpaid throughout the year and is receiving the excess later Financial planners caution that while refunds can feel positive, they reduce monthly cash flow.

“A big refund is essentially forced savings,” said a certified public accountant based in New York. “Some households prefer it, others would rather have the money sooner.”

IRS and Employer Challenges

The Internal Revenue Service faces persistent challenges when implementing large tax changes. Updating withholding guidance requires coordination with employers, payroll processors, and software providers.

Agency officials have repeatedly warned lawmakers that late-year tax legislation increases compliance burdens and raises the risk of taxpayer confusion. Former IRS administrators have testified that complexity drives both refund volatility and filing errors, stretching already limited administrative resources.

Broader Economic Effects

Economists say higher refunds could modestly influence consumer spending during the 2026 filing season. Refunds often arrive between February and April, coinciding with seasonal increases in retail activity.

However, analysts stress that refunds are unlikely to meaningfully alter inflation trends or long-term growth. “This is a timing shift in household cash flow,” said a labor economist at a public university. “It’s not new stimulus.”

Political and Policy Debate

Supporters of the law point to higher refunds as evidence of effective tax relief. Critics argue that refund size should not be a benchmark of good tax policy.

Nonpartisan watchdog groups emphasize that predictable withholding, not large refunds, best serves households. “Stability matters more than surprise checks,” said an analyst at a Washington-based think tank.

Related Links

State Tax Refunds Still Being Issued This Winter — Check Which 15 States Are Paying

One Social Security Update in 2026 May Reduce Take-Home Benefits — Here’s Why

What Taxpayers Can Do

Tax experts recommend that households review withholding settings, especially if they prefer smaller refunds and higher take-home pay. The IRS provides online tools to estimate appropriate withholding under current law.

Adjustments are optional, but advisers say awareness is key. “Understanding why your refund changes is more important than the number itself,” said a professor of personal finance.

As the 2026 filing season approaches, early IRS data will determine whether projections hold. Initial refund statistics, typically released in February, will provide the first concrete evidence.

Most experts agree on one point: any increase in average refunds is likely temporary, reflecting the lag between policy change and administrative adjustment rather than a permanent shift in tax burdens.