As the largest generation in American history continues to exit the workforce, the Baby Boomers’ Social Security Checklist is becoming increasingly urgent.

With 2025 approaching, financial experts say decisions made in the next year—on claiming age, spousal coordination, and taxes—will shape retirement security for millions of households.

Baby Boomers’ Social Security Checklist

| Key Issue | Why It Matters |

|---|---|

| Claiming age | Benefits permanently rise or fall depending on when you claim |

| Spousal planning | Survivor benefits often outlast individual benefits |

| Taxes & Medicare | Benefits may be taxed; Medicare penalties can be permanent |

Why 2025 Represents a Critical Moment

Baby Boomers—defined as Americans born between 1946 and 1964—are now between the ages of 61 and 79. According to the Social Security Administration, nearly all members of the generation will have reached Social Security eligibility by the end of 2025.

That timing matters. Social Security decisions are among the few retirement choices that are largely irreversible. Once benefits are claimed and the limited withdrawal window passes, monthly payments are generally locked in for life.

For many retirees, Social Security is not a supplement but a foundation. Government data show that about 40% of older Americans rely on the program for at least half of their income, and roughly 20% depend on it for nearly all of it.

Smart Move No. 1: Reassess When—and How—to Claim Benefits

Understanding the math behind claiming ages

Social Security benefits are calculated using a worker’s highest 35 years of inflation-adjusted earnings. Claiming before full retirement age—66 or 67, depending on birth year—reduces benefits permanently. Waiting beyond that age increases benefits through delayed retirement credits, which stop at age 70.

Each year of delay after full retirement age raises monthly benefits by roughly 8%. Over a long retirement, that difference can amount to tens of thousands of dollars.

Longevity and break-even considerations

The decision often hinges on life expectancy. Individuals who expect to live into their late 80s or beyond generally benefit from delaying. Those with health concerns or immediate income needs may choose earlier claiming.

Economists describe this as a form of longevity insurance. Higher monthly payments later in life provide protection against outliving savings, particularly as medical costs rise with age.

Smart Move No. 2: Coordinate Spousal, Survivor, and Family Benefits

Why household planning matters more than individual planning

Social Security is structured around households as much as individuals. A lower-earning spouse may qualify for spousal benefits equal to up to 50% of the higher earner’s benefit at full retirement age. These benefits do not reduce the higher earner’s payments.

Survivor benefits are even more consequential. When one spouse dies, the surviving spouse generally keeps the larger of the two benefits. As a result, the claiming strategy of the higher earner often determines the survivor’s financial security.

Divorce, remarriage, and nontraditional households

Divorced individuals may still qualify for spousal or survivor benefits if the marriage lasted at least 10 years. Remarriage after age 60 typically does not affect survivor benefits, a detail often overlooked. Financial advisors note that blended families and long-term unmarried partnerships can complicate planning, making professional guidance more valuable.

Smart Move No. 3: Prepare for Taxes, Medicare, and Health Care Costs

Taxation of benefits

Depending on total income, up to 85% of Social Security benefits may be subject to federal income tax. Combined income includes adjusted gross income, tax-exempt interest, and half of Social Security benefits.

The thresholds that trigger taxation are not indexed to inflation, meaning more retirees are affected over time. According to the Internal Revenue Service, millions of beneficiaries now pay some tax on benefits.

Medicare enrollment pitfalls

Medicare eligibility begins at age 65, regardless of whether Social Security has been claimed. Missing enrollment deadlines can result in lifelong premium penalties, particularly for Medicare Part B. Experts stress that delaying Social Security does not delay Medicare. Confusing the two programs remains a common and costly mistake.

Additional Consideration: Working While Receiving Benefits

Many Baby Boomers continue working part time in retirement. Before full retirement age, earnings above an annual limit can temporarily reduce Social Security payments. However, those reductions are not lost; benefits are recalculated at full retirement age to account for withheld payments.

After reaching full retirement age, there is no earnings limit. Wages earned may even replace lower-earning years in the 35-year calculation, modestly increasing benefits.

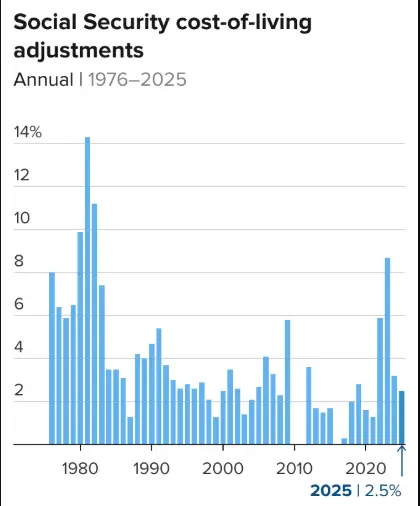

Inflation and Cost-of-Living Adjustments

Social Security benefits are adjusted annually through cost-of-living adjustments, or COLAs, tied to inflation. While COLAs help preserve purchasing power, they may not fully offset rising costs for health care, housing, and long-term care.

This gap reinforces the importance of maximizing base benefits through careful claiming decisions, particularly for retirees with limited savings.

Policy Uncertainty and the Program’s Financial Outlook

Concerns about Social Security’s long-term solvency continue to draw political attention. Trustees project that without legislative changes, trust fund reserves could be depleted in the mid-2030s, after which payroll taxes would still cover most scheduled benefits.

Historically, reforms have spared current retirees and those close to retirement. While no immediate changes are expected, uncertainty adds another reason for Baby Boomers to plan conservatively.

A Practical Timeline: What to Do Before 2025 Ends

By mid-2024:

- Review earnings records for accuracy

- Estimate benefits at multiple claiming ages

By early-2025:

- Coordinate claiming strategies with spouses or ex-spouses

- Assess tax exposure and Medicare enrollment status

By late-2025:

- Finalize claiming decisions if approaching eligibility

- Update retirement income projections

Related Links

Wells Fargo $33 Million Settlement: Check Eligibility Criteria and How it Works

$967 SSI Checks and December Social Security Payments: Check Holiday Timing and Early COLA Effects

What Advisors Are Emphasizing Now

Financial planners report a growing sense of urgency among Baby Boomers. Rising interest rates, market volatility, and inflation have underscored the value of guaranteed income streams. “Social Security is often the only inflation-adjusted income retirees can’t outlive,” said certified financial planner Marguerita Cheng in public commentary. “That makes these decisions especially important.”

As 2025 approaches, Baby Boomers face a narrowing window to make informed Social Security choices. While no strategy fits everyone, careful review of claiming age, household coordination, and tax implications can significantly improve retirement stability in the years ahead.