Canada $2,100 + $1,800 + $550 Triple CPP Payment: As November 2025 rolls in, there’s been a lot of buzz about an upcoming triple Canada Pension Plan (CPP) payment of $2,100 + $1,800 + $550 hitting Canadian bank accounts. But what’s the real deal behind this chatter? If you’re a senior or someone who follows CPP closely, it’s crucial to get the facts straight. This comprehensive guide breaks down everything about the CPP payments for November 2025, including eligibility, payment dates, actual amounts, and debunking the triple payment myth in a way that’s easy to understand — even for a 10-year-old! Plus, it’s packed with practical advice and reliable info for both everyday Canadians and financial pros keen on retirement planning. Whether you’re counting on your CPP for your monthly bills or just curious about how this benefit works, stick around for a clear, straightforward look at what November 2025 has in store.

Canada $2,100 + $1,800 + $550 Triple CPP Payment

While the noise about a triple CPP payment totaling thousands in November 2025 is false, the facts are clear and positive: eligible seniors will receive their regular pension plus a meaningful one-time inflation boost of around $758. With the maximum monthly payment reaching $1,576, CPP continues to be a cornerstone of financial security in retirement. Understanding what CPP offers, who qualifies, and how to optimize your benefits will give you confidence as you plan your golden years.

| Topic | Details |

|---|---|

| Official CPP Maximum Monthly | $1,576 (starting November 2025) |

| Average Monthly CPP Payment | Approx. $844 (for new recipients at age 65 in 2025) |

| Additional One-Time Boost | Roughly $758 added in November 2025 |

| Eligibility | 60+ years old, at least one valid CPP contribution, working/citizen requirements |

| Official Payment Date | November 26, 2025 (direct deposit) |

| Source | Government of Canada Official CPP Info |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan (CPP) is one of Canada’s foundational social insurance programs. Established in 1966, it was designed to provide contributors and their families with financial security during retirement, in case of disability, or upon the death of a contributor. It’s a government-backed plan funded through contributions made by employees, employers, and self-employed Canadians.

This pension replaces a portion of your working income after you retire, helping to keep you afloat financially as you transition out of the workforce. Besides retirement pensions, CPP also offers disability benefits, survivor’s benefits, and provisions for children under certain circumstances. Understanding CPP is key for any Canadian planning for retirement, as it is the second pillar of Canada’s retirement income system, alongside Old Age Security (OAS) and personal savings.

Debunking the Canada $2,100 + $1,800 + $550 Triple CPP Payment Myth

There’s a lot of misinformation floating around about some kind of triple payment in November 2025 totaling $2,100 + $1,800 + $550. Here’s the bottom line: this is a myth.

What seniors will get in November is their regular monthly CPP payment plus a one-time inflationary adjustment bonus to help offset rising living costs due to recent inflation spikes. This boost is typically around $758, not several thousands combined as some rumors falsely claim.

These rumors often arise from confusion with other government programs or misunderstanding of CPP payment components. Some people mistakenly add up multiple payments or mix different government benefits, which causes the numbers to inflate inaccurately.

What to Expect for CPP Payments in November 2025?

In 2025, Canada’s economy is seeing healthy adjustments for retirees with CPP payments. The maximum monthly CPP payment is set to increase to $1,576, a rise due to the government’s ongoing efforts to account for inflation and boost seniors’ purchasing power.

For many Canadians, particularly new retirees aged 65, the average regular CPP pension is approximately $844 per month. In November 2025, all eligible CPP recipients will additionally receive the inflation adjustment boost, which could nearly double that month’s payment for some.

The official payment date for November 2025 CPP deposits is expected to be November 26, 2025, typically the third last business day of the month. Payments are made via direct deposit or mailed cheques if requested. This boost is automatic — there’s no need to fill out extra paperwork to receive it, provided you meet eligibility requirements.

Who Qualifies for CPP Payments and the November Boost?

CPP eligibility boils down to a few simple but critical criteria:

- Age: You must be at least 60 years old as of November 1, 2025.

- Contributions: You need to have contributed to CPP through your employment or self-employment at least once.

- Residency: You should be residing in Canada or meet specified residency rules for pension receipt.

- Income Thresholds: The inflationary boost is aimed at Canadians with adjusted annual incomes below certain government-defined thresholds (around $85,000).

- Tax Compliance: Up-to-date income tax filings are necessary since benefits and boosts can be tied to tax return info.

Understanding these conditions can help seniors prepare and maximize their pension benefits.

How Are CPP Payments Calculated?

The amount you receive from CPP depends on several factors:

- Your average lifetime earnings overall, adjusted for inflation.

- The number of years you contributed to CPP.

- Any allowed exclusions for low or zero earnings years (up to 8 years can be dropped from the calculation to minimize impacts from low income or career breaks).

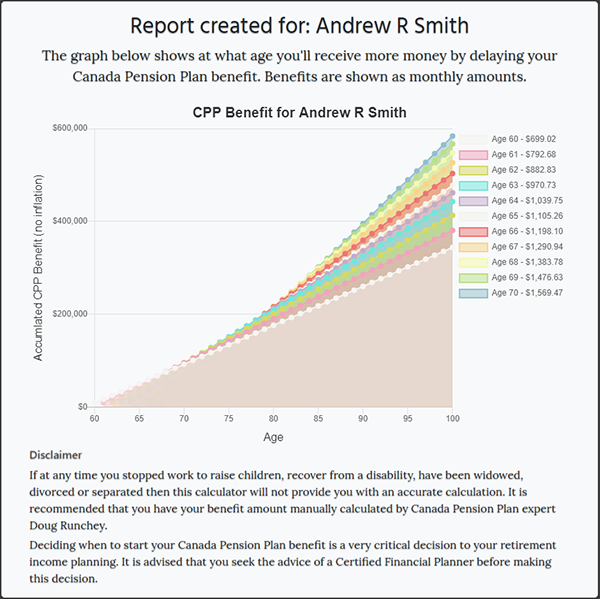

- The age you choose to start receiving CPP (from 60 to 70). Early collection means reduced payments; delaying boosts your monthly amount significantly (up to 42% more if started at 70).

The yearly Year’s Maximum Pensionable Earnings (YMPE) sets the top limit for contribution and pension calculation. For 2025, the YMPE is $71,300.

To receive the maximum CPP pension of $1,576 starting in November 2025, an individual would have had to contribute on earnings close to the YMPE for around 39 years.

How to Apply for Canada $2,100 + $1,800 + $550 Triple CPP Payment?

Applying for CPP is user-friendly with online and paper options.

- The easiest way is online through the My Service Canada Account. This portal lets you apply, track application status, and manage your info.

- Paper applications can be downloaded and mailed in, but this takes longer.

- Generally, apply up to 12 months in advance of your desired start date.

- Processing can take approximately 28 days, so plan accordingly.

- If applied early (ages 60-65), be mindful of payment reductions. Delayed applications past 65 increase monthly amounts until age 70.

Tips to Maximize Your CPP Benefits

If you’re still working or planning retirement, keep in mind these expert tips:

- Max out your contributions. Earning and contributing at or near the YMPE earns you higher future benefits.

- Delay CPP if possible. Waiting to apply until age 70 increases monthly payments by 42%.

- Stay on top of tax filings every year to ensure you don’t miss out on boosts.

- Track your contributions annually via your statement from Service Canada to catch errors early.

- Combine CPP with other sources like OAS, private pensions, and personal savings for a stronger overall retirement strategy.

The Evolution and History of CPP

To appreciate the current CPP, it helps to understand its origins and evolution:

- Established in 1966 and effective from 1966-67, CPP was Canada’s answer to growing needs for social security in an aging population.

- Originally operating on a “pay-as-you-go” basis — where current workers’ contributions paid current retirees — the system faced sustainability challenges as demographics changed.

- The 1990s saw major reforms: contribution rates rose from a combined 6% in 1997 to 9.9% by 2003. These changes included creating the Canada Pension Plan Investment Board (CPPIB) to professionally manage CPP assets.

- The result: CPP now enjoys a substantial fund, valued at over $731 billion as of mid-2025, invested globally to ensure long-term sustainability for future generations.

- The plan now aims to be about 30% funded by reserves, balancing intergenerational fairness and fiscal responsibility.

This historical perspective shows how CPP has adapted and will continue evolving to meet Canadians’ retirement needs.

How to Avoid CPP Scams?

Unfortunately, scammers know CPP is a hot topic:

- Never provide personal information, social insurance numbers, or banking details to unsolicited calls or emails.

- Official institutions like Service Canada never ask for information via email.

- Use only official government websites to verify facts.

- Report suspicious activity immediately.