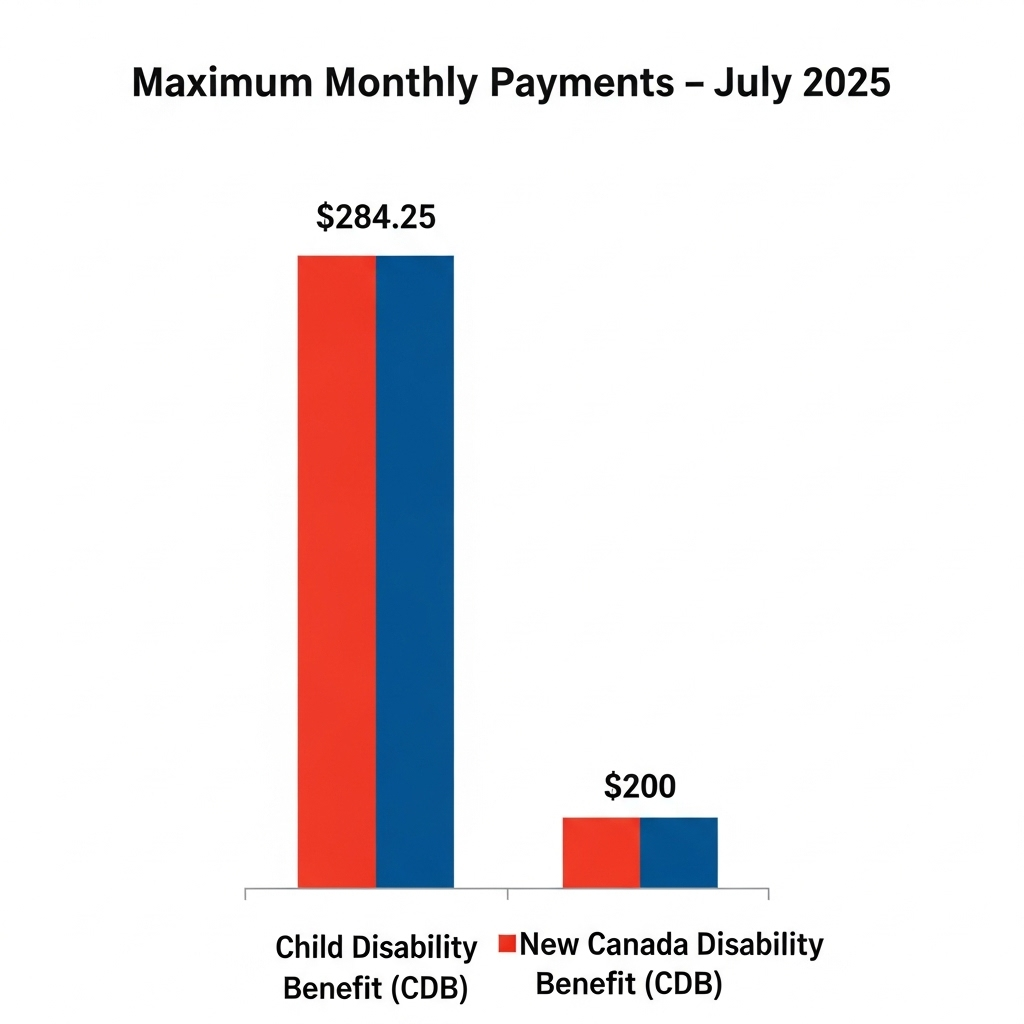

Canadians with disabilities are set to receive monthly payments of up to $284.25 through the Child Disability Benefit (CDB) and up to $200 through the new Canada Disability Benefit (CDB) starting in July 2025. These federal initiatives, administered by the Canada Revenue Agency (CRA) and Service Canada, aim to enhance the financial security of eligible individuals and families. Understanding the deposit dates and specific eligibility criteria is crucial for those who stand to benefit from these vital programs.

The Child Disability Benefit (CDB) is a monthly payment provided to families who are eligible for the Canada Child Benefit (CCB) and care for a child under 18 who qualifies for the Disability Tax Credit (DTC). Payments for the CDB are recalculated annually in July based on the previous year’s adjusted family net income. For the July 2025 to June 2026 benefit year, the maximum CDB payment for one eligible child could reach $284.25 per month, with higher amounts for families with multiple eligible children. The specific deposit date for the Child Disability Benefit in July 2025 is scheduled for July 18, 2025.

Canada Disability Benefit

| Key Fact | Detail/Statistic |

| Child Disability Benefit (CDB) Deposit Date | July 18, 2025 |

| New Canada Disability Benefit (CDB) Deposit Date | July 17, 2025 (for applications approved by June 30, 2025) |

| Maximum Monthly Child Disability Benefit (CDB) | Up to $284.25 (for July 2025 – June 2026 benefit year) |

| Maximum Monthly New Canada Disability Benefit (CDB) | Up to $200 (annual maximum of $2,400) |

| Eligibility for New Canada Disability Benefit | Ages 18-64, approved for Disability Tax Credit, filed 2024 tax return |

The newly introduced Canada Disability Benefit (CDB), distinct from the Child Disability Benefit, is a monthly payment designed to support low-income working-age persons with disabilities. The first payments for this benefit are set to commence in July 2025. The maximum amount an eligible individual could receive is $2,400 per year, equating to $200 per month. The eligibility and payment for this benefit are determined by Service Canada. For those whose applications are received and approved by June 30, 2025, the initial payments are expected to be issued in July 2025.

Understanding the Child Disability Benefit (CDB)

The Child Disability Benefit (CDB) is an integral component of Canada’s social safety net for families raising children with severe and prolonged mental or physical impairments. It is not a standalone application but rather an automatic supplement to the Canada Child Benefit (CCB) for families whose child is approved for the Disability Tax Credit (DTC).

Eligibility for Child Disability Benefit

To be eligible for the Child Disability Benefit:

- You must be eligible for the Canada Child Benefit (CCB).

- Your child must be under 18 years of age.

- Your child must be eligible for the Disability Tax Credit (DTC).

If a family is already receiving the CCB for a child who qualifies for the DTC, the CDB will be automatically included in their CCB payments. The amount received is based on the adjusted family net income (AFNI) from the previous tax year. For the benefit period spanning July 2025 to June 2026, payments are calculated using the AFNI from the 2024 tax return. The benefit amount begins to be reduced when the AFNI exceeds $81,222 for one eligible child, with different thresholds for families with multiple children.

The New Canada Disability Benefit (CDB)

The Canada Disability Benefit (CDB) represents a significant new federal investment aimed at reducing poverty among working-age persons with disabilities. This benefit, established through the Canada Disability Benefit Act, which came into force on June 22, 2024, is administered by Service Canada. The associated regulations, which define the specific details of the benefit, were finalized and came into force on May 15, 2025, following extensive public consultations.

Eligibility for the Canada Disability Benefit

To qualify for the new Canada Disability Benefit:

- You must be between 18 and 64 years old.

- You must have been approved for the Disability Tax Credit (DTC).

- You and your spouse or common-law partner (if applicable) must have filed your 2024 federal income tax return.

- You must be a Canadian resident for income tax filing purposes.

- You must be one of the following: a Canadian citizen, a permanent resident, an individual registered or entitled to be registered under the Indian Act, a protected person, or a temporary resident who has lived in Canada throughout the previous 18 months.

The benefit is income-tested, meaning the amount received will vary based on adjusted family net income. The maximum annual benefit is $2,400, or $200 per month. A working income exemption is applied, where up to $10,000 of working income for a single individual (or $14,000 for a couple) is excluded from the calculation. For single individuals, the maximum benefit is received if the adjusted family net income, after subtracting the working income exemption, is $23,000 or less. Beyond this threshold, the benefit is reduced by $0.20 for every dollar of income.

Application Process and Payment Dates

Applications for the new Canada Disability Benefit officially opened on June 20, 2025.13 Eligible Canadians can apply online, by phone, or in person at a Service Canada office. To ensure direct deposit of payments, applicants will need their Social Insurance Number (SIN) and banking information. Service Canada generally uses direct deposit due to its efficiency and reliability.

For individuals whose applications for the Canada Disability Benefit are received and approved by June 30, 2025, the first payment is anticipated in July 2025. If an application is approved in July 2025 or later, and the individual was entitled to payments in earlier months, back payments may be issued for up to 24 months, though no payments will be made for months prior to July 2025. The general payment date for the new Canada Disability Benefit in July 2025 is scheduled for July 17, 2025.

Provincial Clawbacks and Future Outlook

While the federal government has launched the new Canada Disability Benefit with the intention of improving financial security for persons with disabilities, concerns have been raised by disability advocates and some provincial governments regarding potential “clawbacks” of provincial disability support payments. Some provinces may reduce their existing benefits to individuals receiving the federal CDB, thereby negating the intended financial uplift. Advocacy groups, such as those in Alberta, have actively campaigned against such provincial policies, urging the federal government to implement legislative protections to prevent the Canada Disability Benefit from being used to offset provincial support.

The federal government has stated that the Canada Disability Benefit is designed to supplement existing disability support programs, not replace them. Future reports to Parliament will continue to detail the progress of the benefit’s implementation and any adjustments made in response to ongoing feedback and analyses. The benefit amounts are subject to annual adjustments for inflation, ensuring they continue to reflect changes in the cost of living.

FAQ

Q1: What is the difference between the Child Disability Benefit and the new Canada Disability Benefit?

A1: The Child Disability Benefit (CDB) is a supplement to the Canada Child Benefit for families caring for a child under 18 who is eligible for the Disability Tax Credit.18 The new Canada Disability Benefit (CDB) is a separate, direct monthly payment for low-income working-age persons with disabilities (ages 18-64) who are approved for the Disability Tax Credit.19

Q2: How is the payment amount for the new Canada Disability Benefit calculated?

A2: The payment amount for the new Canada Disability Benefit is income-tested, meaning it depends on your adjusted family net income.20 There is a working income exemption, and the benefit is gradually reduced if your income exceeds certain thresholds.21 The maximum monthly payment is $200.

Q3: Can I receive both the Child Disability Benefit and the new Canada Disability Benefit?

A3: Yes, if you meet the eligibility criteria for both programs, you can receive both the Child Disability Benefit (for an eligible child) and the new Canada Disability Benefit (for yourself, if you are a qualifying working-age person with a disability).

Q4: What if I apply for the new Canada Disability Benefit after June 30, 2025?

A4: If your application is received and approved in July 2025 or later, and you were entitled to payments for earlier months, you may receive back payments for up to 24 months from the date your application is received, but not for any months prior to July 2025.

Q5: Will my provincial disability benefits be affected by the new Canada Disability Benefit?

A5: Concerns have been raised regarding potential provincial clawbacks. While the federal government intends the Canada Disability Benefit to be supplementary, the impact on provincial benefits can vary by province.22 It is advisable to consult your provincial social services department for specific details regarding your provincial benefits.