Thousands of Americans are eligible for a $1,423 stimulus payment, but not all individuals will qualify. These payments are part of state-level relief programs, not federal stimulus checks.

Read on to discover how to check your eligibility, apply for the payment, and understand how these state-based programs are helping struggling families.

Claim $1,423 Stimulus Payment

| Key Fact | Detail/Statistic |

|---|---|

| Program | State-level benefit programs for eligible individuals. |

| Maximum Payment | Up to $1,423 for qualifying individuals. |

| Eligibility | Income-based, dependent on state or federal relief measures. |

| Application Deadline | Ongoing until funding is exhausted or programs end. |

$1,423 Stimulus Payment: What It Is and Who Can Claim It

In response to continued economic challenges stemming from the COVID-19 pandemic, several states have introduced relief programs offering financial aid to residents. Among these is the $1,423 stimulus payment, which is part of various state-level assistance programs designed to help individuals and families experiencing financial hardship.

However, it is crucial to note that these $1,423 payments are not part of a federal stimulus check. Instead, they are specific to certain states that have introduced their own relief packages. Some states, like California, New York, and Minnesota, are offering residents the opportunity to claim this amount or similar sums, based on specific eligibility requirements.

This article will explain how to determine if you qualify for this payment, provide guidance on how to claim it, and detail the state programs that offer this relief.

What Is the $1,423 Stimulus Payment?

The $1,423 stimulus payment refers to financial assistance provided by certain state governments to help residents recover from the economic strain caused by the pandemic. These payments are typically a percentage of an individual’s regular income or a fixed amount determined by the state’s budget and eligibility criteria.

In states like California, Minnesota, and Florida, the $1,423 is the maximum payment available under specific relief programs, such as paid medical or family leave, unemployment benefits, or other state-backed emergency assistance.

While the federal government provided COVID-19 relief stimulus checks to Americans in 2020 and 2021, state-level programs like these continue to offer ongoing support. However, these are not universal — they are based on individual state policies and eligibility requirements, meaning not everyone across the country will receive the same assistance.

Who Is Eligible for the $1,423 Stimulus Payment?

Eligibility for the $1,423 payment varies depending on the state and the specific relief program. Below are common eligibility factors:

Federal vs. State Relief Programs

While federal stimulus checks were sent to qualified individuals across the country based on income and tax returns, state-level payments like the $1,423 are often targeted at specific groups.

The $1,423 payments are typically available under the following state-specific conditions:

- Income requirements: Eligibility may be based on household income or previous tax returns.

- Qualifying event: Some states only provide benefits for individuals who experienced job loss, health-related issues, or family care needs.

- State residency: You must be a resident of a state with an active relief program, and residency verification may be required.

For instance, Minnesota offers relief through its Paid Family and Medical Leave program, where workers can receive up to $1,423 weekly benefits during family or medical leave. Other states may offer similar programs, but the amount can vary.

Check Your Eligibility for $1,423 Stimulus Payment

The best way to determine eligibility is to visit your state’s Department of Revenue or Social Services website. Additionally, official announcements or state-run applications will outline clear guidelines for who can receive these payments.

Claim the $1,423 Stimulus Payment

The process for claiming the $1,423 stimulus payment will vary by state. However, the following general steps apply to most states offering similar benefits:

- Verify Eligibility: Ensure that you meet your state’s criteria. This often includes income verification and proof of financial hardship or qualifying family needs.

- Submit Your Application: Visit your state’s online portal or government website to submit your claim. You may be asked to provide documentation, such as:

- Proof of income (e.g., tax returns or pay stubs).

- Evidence of state residency.

- Information related to your qualifying event (such as medical leave, caregiving responsibilities, etc.).

- Receive Payment: Once approved, payments are usually distributed via direct deposit, or some states may offer prepaid debit cards. Be sure to check the application process for your state’s specifics.

- Understand the Timeline: Many programs are time-sensitive. Be aware of the deadlines for applying to ensure you don’t miss out.

What Happens If You Don’t Qualify for the $1,423 Payment?

While some individuals will qualify for the $1,423 payment, many others will not. This may be due to income levels, state-specific program requirements, or other factors. If you do not qualify for this particular payment, it is important to explore other assistance programs available:

- Unemployment benefits: If you’ve lost your job or had your hours reduced, you may qualify for state or federal unemployment benefits.

- Food assistance: Programs like SNAP (Supplemental Nutrition Assistance Program) may provide relief for those struggling to afford groceries.

- Health care assistance: Check if you qualify for Medicaid or Affordable Care Act subsidies if you need medical coverage.

In many cases, your state government offers additional programs for residents in need, such as food banks or housing assistance, which can help you meet basic needs.

Public and Policy Implications: State Stimulus Programs in the Broader Context

While the $1,423 stimulus payment provides immediate relief to those in need, it also reflects a larger debate about the role of state versus federal responsibility in economic recovery efforts.

The federal government’s COVID-19 stimulus checks provided widespread aid, but states like California, New York, and Minnesota have had to step in with additional programs to support residents who may fall outside federal assistance parameters.

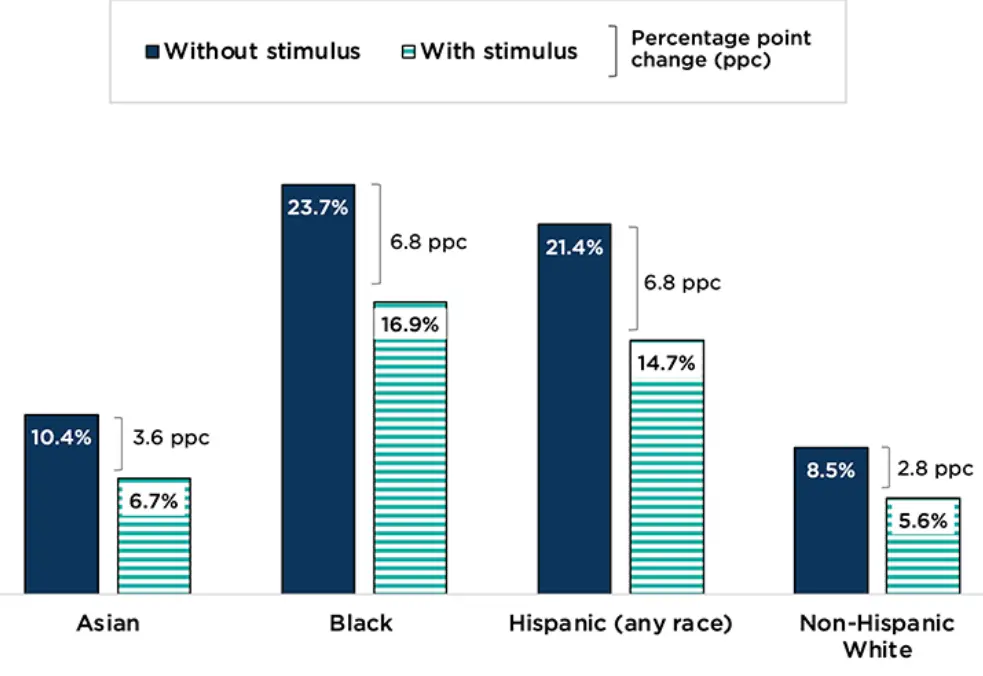

States with larger budgets have been able to offer more substantial relief, raising questions about how to ensure fairness and equity in financial aid programs.

Experts argue that expanded federal support for state programs could help streamline and standardize relief efforts across the country, making recovery efforts more uniform and equitable.

Related Links

$1,776 Warrior Dividend Payment – IRS Confirms Tax-Free Status

IRS 2025 Tax Deadline – Why This Date Matters If You’re Behind on Filing

Ongoing Assistance and Next Steps

The $1,423 stimulus payment offers significant help to those who qualify, but it is important to understand that it’s part of state-run initiatives, not a blanket federal relief program. Be sure to check your state’s eligibility guidelines to see if you qualify for these benefits and follow the application process to claim your payment.

As the nation continues to recover from the effects of the pandemic, these programs remain essential for many Americans.

However, further federal and state collaboration will likely be required to provide consistent relief and ensure that no one is left behind in the recovery process.