The Canada Pension Plan (CPP) has long been a cornerstone of retirement income for Canadians. However, in response to rising living costs and greater financial insecurity in later life, the Canadian government introduced CPP 2.0 — a significant enhancement to the existing pension system.

This phase of improvements aims to increase retirement security by providing Canadians with higher, more predictable retirement income. The new rules were introduced in 2019 and will be fully phased in by 2025.

What is CPP 2.0?

CPP 2.0 refers to the enhancement of the Canada Pension Plan (CPP), designed to provide better retirement security for Canadians. The enhancement adds a second tier of contributions and benefits, providing a larger pension payout for those who contribute under the new rules.

Rather than replacing the existing system, the new CPP builds upon it, increasing retirement income for future retirees. Under the original plan, CPP aimed to replace about 25% of a contributor’s average earnings during their working years.

With the full implementation of CPP 2.0, this figure increases to approximately 33.33% of earnings, ensuring a higher level of support for Canadians during retirement.

Key Enhancements and Timeline For CPP 2.0 Pension

Higher Retirement Income

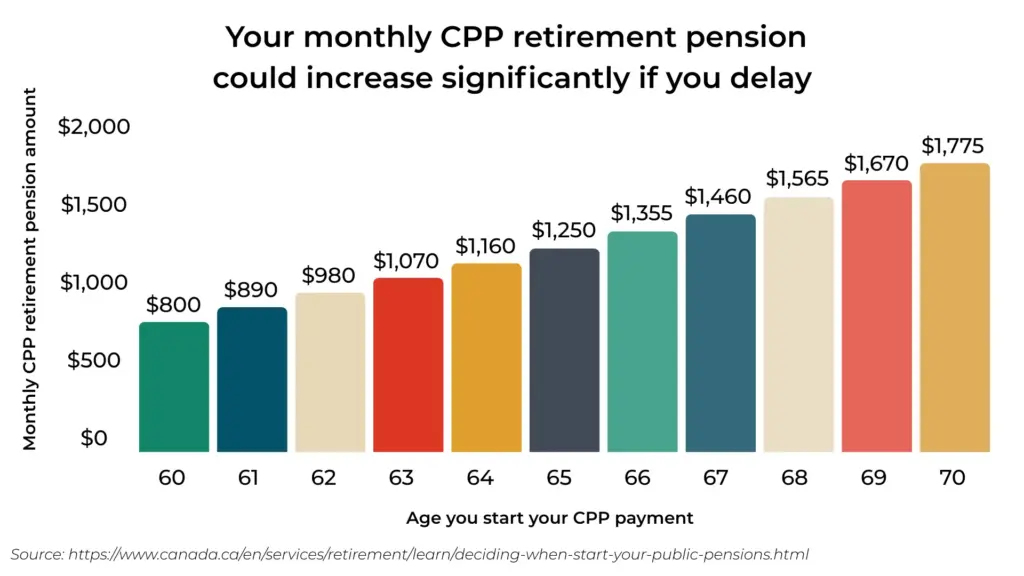

The most immediate impact of CPP 2.0 is the increase in retirement pension amounts. For workers who contribute the maximum amount throughout their careers, the maximum monthly benefit at age 65 is set to rise to approximately $1,433 per month by 2025. This marks a significant increase compared to previous maximums, providing a stronger income base for retirees.

Multi‑Year Implementation

The implementation of CPP 2.0 began on January 1, 2019, with increased contribution rates and new contribution bands. Full benefits from the enhanced plan will start appearing in pension payouts around 2025. To receive the full enhanced benefit, Canadians need to contribute to the plan under the new rules for approximately 40 years.

Canadians who contribute at lower levels will see a proportionate increase, and the amount will depend on their total earnings and contribution history.

How CPP Contributions Have Changed

The government has implemented several changes to the contribution structure to fund the new, larger benefits:

- Contribution rates: The contribution rate for employees and employers increased to 5.95% for income up to the Year’s Maximum Pensionable Earnings (YMPE). Additionally, a second earnings threshold, known as the Year’s Additional Maximum Pensionable Earnings (YAMPE), was introduced. This provides for 4% additional contributions on earnings above the YMPE (or 8% for self‑employed individuals).

- These increased contributions help fund the enhanced benefits and provide a larger pool for future retirees, ensuring that the plan remains financially sustainable over the long term.

Impact of CPP 2.0 Pension Changes on Retirement Income

Higher Replacement Rate

The most noticeable change under CPP 2.0 is the higher replacement rate, which directly boosts the amount of pension Canadians will receive in retirement:

- Old CPP: Replaced approximately 25% of average lifetime earnings.

- Enhanced CPP: Replaces 33.33% of average lifetime earnings.

This increase means that future retirees will receive a more substantial income from CPP, reducing their reliance on other income sources such as personal savings and employer pension plans.

More Security for the Long Term

While all contributors will see some increase in their monthly CPP benefit, those who have longer career contribution histories or higher lifetime earnings will benefit the most. Additionally, CPP 2.0 ensures a higher level of security for those relying on public pensions for their retirement income.

Disability and Survivor Benefits

The enhancements to CPP extend beyond retirement benefits, also strengthening disability benefits and survivor pensions. Individuals who qualify for these benefits will receive higher payments, reflecting their enhanced contributions.

This broadens the plan’s support to more individuals, offering financial protection to those unable to work or families coping with the loss of a wage earner.

Who Benefits Most From CPP 2.0 Pension Changes?

Younger Workers

Younger workers benefit most from CPP 2.0, as they will contribute to the enhanced system over a longer portion of their careers. This means that, over time, they will accrue larger pension amounts compared to older workers. Those starting their careers in the mid-2020s or later will be able to capitalize on the full benefit.

High Earners

High earners benefit from the YAMPE, which allows individuals earning above the standard YMPE to contribute additional funds. This results in higher benefits, especially for those who will contribute at these higher rates over many years.

Long-Term Contributors

Those who contribute to CPP 2.0 for decades will see the most significant benefits. As the plan accumulates earnings over a lifetime of contributions, it ensures that long-term workers can rely on substantial monthly payments in retirement.

Comparison with Other Countries’ Pension Systems

While the enhanced CPP is designed to support Canadians, it is important to note that pension systems around the world vary widely.

For example, the U.S. Social Security system provides benefits that, like the CPP, are meant to replace only a portion of a worker’s pre-retirement income, often around 40% for average earners. CPP 2.0 stands out because of its relatively higher replacement rate and the automatic indexing to inflation, ensuring that it maintains its purchasing power.

The Role of Employers and Self-Employed Workers

One of the key aspects of CPP 2.0 is its inclusion of self-employed individuals who must contribute both the employee and employer portions of the contributions. This has a significant impact on small business owners and independent contractors, who will see increased payroll taxes but will ultimately benefit from larger pension payouts later in life.

The Future Outlook of CPP

As Canada’s aging population continues to grow, the sustainability of the CPP system becomes an important topic of discussion. However, experts generally agree that the enhanced CPP is well-positioned to remain financially stable, thanks to its gradual contribution increases and broad base of contributors.

Additionally, the Canada Pension Plan Investment Board (CPPIB) invests the funds in a way that ensures they keep pace with inflation and economic growth.

CPP 2.0 represents a transformative shift in Canada’s public pension system. It delivers higher retirement benefits, enhanced disability protections, and larger survivor benefits for those who contribute under the new rules. By providing more income security, particularly for younger and long-term workers, it strengthens Canada’s retirement landscape and improves the financial well-being of future retirees.

While it doesn’t entirely replace the need for personal savings, employer pension plans, or investments, CPP 2.0 offers a stronger foundation for those relying on public pensions. As the system continues to evolve, the enhancement ensures that Canadians will enjoy a more predictable and secure retirement.