CPP Survivor Benefit Raise: If you’ve been hearing chatter about the CPP Survivor Benefit raise in November 2025 and want to understand what it means for you or your loved ones, you’re in the right spot. Whether you’re new to this topic or looking for the latest updates to your financial planning, this guide breaks everything down—easy enough for a 10-year-old, yet packed with expert insights. November 2025 brings a notable one-time boost of about $758 added to the regular CPP survivor benefits. This payment helps many seniors manage rising inflation and everyday expenses. So whether you’re relying on these benefits or advising someone who is, here’s a detailed, step-by-step guide to what’s changing, who qualifies, and essential tips to navigate your CPP survivor benefits confidently.

CPP Survivor Benefit Raise

The CPP Survivor Benefit raise in November 2025 stands as valuable financial assistance for Canadian seniors aged 60 and above, offering a one-time supplemental payment of approximately $758. This increase helps offset inflation and rising costs impacting fixed incomes. Survivors will see this added to their regular pension payments automatically, without needing extra steps. Understanding eligibility, keeping current on personal information, and coordinating this benefit with other government supports will help you make the most of these resources.

| Topic | Details |

|---|---|

| Raise Date | November 26, 2025 (direct deposit date) |

| Raise Type | One-time supplemental payment added to regular November CPP survivor benefit |

| Raise Amount | Around $758 (one-time boost, not permanent) |

| Eligibility Age | 60 years or older as of November 1, 2025 |

| Eligible Recipients | Surviving spouses or common-law partners already receiving CPP survivor benefits |

| Purpose | Offset inflation and rising cost of living |

| Maximum Monthly Survivor Benefit | Approx. $842.62/month for survivors aged 65+ in 2025 |

| Additional Resources | Official info: Canada Pension Plan – Canada.ca |

What Is the CPP Survivor Benefit?

The Canadian Pension Plan Survivor Benefit is a regular monthly payment given to the surviving spouse or common-law partner of someone who contributed to the CPP but has passed away. This benefit plays a critical role in replacing lost income and helping survivors maintain financial stability.

The amount depends largely on how much the deceased person contributed to the CPP during their working years—the higher the contributions, the larger the benefit. This means that those who paid into CPP consistently over their careers tend to have higher survivor benefits. Additional amounts may be available if there are dependents, such as children under 18 or disabled dependents.

For many survivors, this benefit covers day-to-day expenses such as rent or mortgage payments, groceries, utilities, and healthcare costs. It tends to be a lifeline for those who suddenly face income loss due to a partner’s passing, easing the financial shock during emotionally challenging times. Importantly, survivors continue receiving these benefits as long as they meet eligibility criteria or until certain life events, like reaching a particular age or remarriage, occur.

Why CPP Survivor Benefit Raise in November 2025?

The government adjusts CPP payments annually to keep pace with inflation, ensuring the buying power of these benefits doesn’t erode over time. However, in recent years, inflation has skyrocketed, especially affecting fixed-income earners like seniors.

That’s why in November 2025, alongside the regular inflation adjustment, there’s an exceptional one-time supplemental payment of about $758 for eligible survivors. This boost is intended to provide extra financial relief during a period of higher living costs, including rent, food, medications, and utilities.

Think about it like this: when prices rise but your regular income doesn’t, your money simply doesn’t stretch as far. This supplemental payment is designed to help close that gap just a bit, making the monthly check you receive extra helpful in managing expenses during that critical period.

While this one-time raise might not solve all financial pressures, it reflects the government’s recognition of the challenges that inflation poses to seniors on fixed incomes.

Who Qualifies for This Higher Payment?

Not everyone automatically gets the boost. The criteria to qualify for this November 2025 one-time CPP survivor payment are:

- You must be 60 years or older as of November 1, 2025.

- You need to be already receiving CPP survivor benefits as a spouse or common-law partner of a deceased CPP contributor.

- Partners younger than 60 or those who are not yet receiving survivor benefits do not qualify for the supplemental raise.

- There is no need to apply separately. If you meet the criteria, the one-time increase will be added automatically to your regular CPP survivor benefit in the November 26, 2025, payment.

This approach makes sure the most vulnerable seniors are helped without requiring additional bureaucratic steps, which can sometimes complicate timely access to benefits.

How Much Is the CPP Survivor Benefit Raise?

Your monthly survivor benefit is determined through two main factors—how much the deceased contributed to the CPP during their working life, and your age.

- The maximum survivor pension for those aged 65 or older in 2025 is approximately $842.62 per month.

- Survivors under 65 receive a flat-rate portion plus a percentage (up to 37.5%) of their deceased partner’s retirement pension.

- If you have dependent or disabled children, additional amounts are available under the Children’s Benefit.

- This month’s November 2025 payment will include your standard survivor pension amount, plus the extra one-time $758 raise if you’re eligible.

Remember, the CPP survivor pension is designed to assist in maintaining your financial independence. So this one-time payment effectively provides a financial cushion, which is especially helpful for seniors facing the pressures of rising costs.

A Look Back: The Evolution of CPP Survivor Benefits

To appreciate this 2025 raise, it’s valuable to know how the CPP survivor benefit has evolved over time.

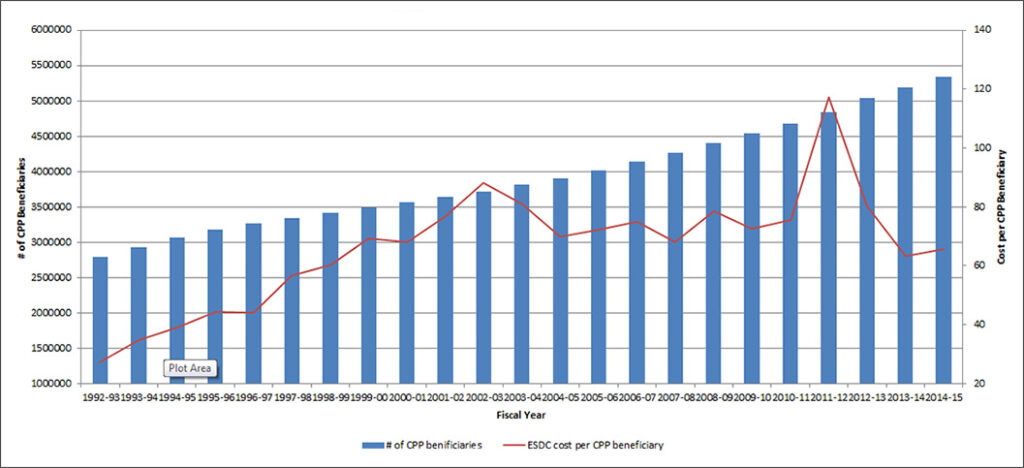

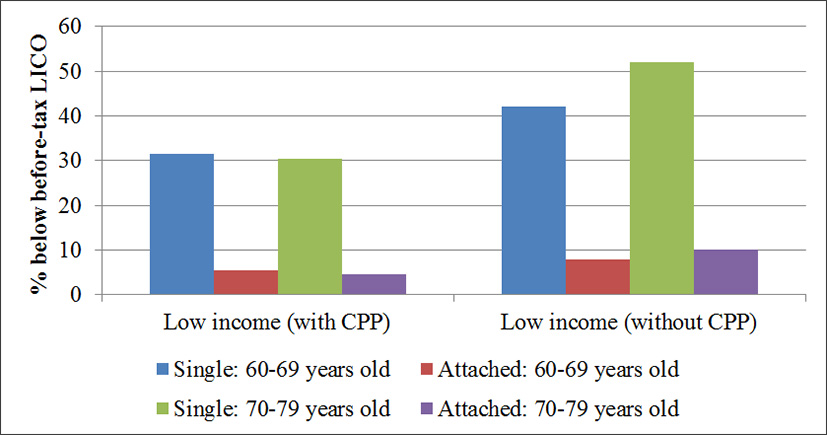

Launched in 1966, the CPP was created as a contributory, earnings-related social insurance program aimed at providing modest income replacement for Canadian workers in retirement or in case of disability, death, or survivorship. Initially, survivor benefits were mainly aimed at widows and dependent children of male contributors, reflecting social trends of the time where women had minimal paid employment.

Over the decades, Canadian society transformed: more women joined the workforce, family structures diversified, and life expectancy increased. These shifts led to important changes in CPP rules, including:

- Extending survivor benefits to include surviving spouses regardless of gender, starting in 1974. Before that, male survivors had limited eligibility.

- Allowing survivor benefits to continue after remarriage or reestablishing benefits for those who had lost them due to remarriage.

- Periodic cost-of-living adjustments and reforms to ensure the long-term sustainability of CPP funds.

In 1997, the CPP underwent a major overhaul with increased contribution rates and the creation of the Canada Pension Plan Investment Board (CPPIB), focused on growing the fund prudently for future beneficiaries.

Today, the CPP survivor benefit stands as a crucial pillar, offering financial security to millions of Canadian families during difficult times.

Coordinating CPP Survivor Benefits With Other Government Programs

Did you know that CPP survivor benefits often roll alongside other valuable government pensions? Making the most of your overall income means understanding how various programs interplay:

- Old Age Security (OAS): A monthly payment for Canadian seniors 65 and older based on residency.

- Guaranteed Income Supplement (GIS): Provides extra income support for low-income seniors receiving OAS.

- Allowance and Allowance for the Survivor: Temporary benefits for those aged 60 to 64 who aren’t yet eligible for OAS.

- Provincial Social Assistance or Disability Benefits: Sometimes available in addition to federal CPP programs.

If you qualify, stacking these supports is a smart way to supplement your monthly income. For example, combining the CPP survivor benefit with GIS could vastly improve your financial standing.

Always check with Service Canada or consult a trusted financial advisor to identify what programs suit your circumstances best. Doing so helps you navigate your options to secure the greatest financial comfort.

Practical Tips for CPP Survivors in 2025

Maximize your benefits and stay ahead of the game with these tips:

1. Keep Your Information Updated

Ensure your banking details and contact info with Service Canada are accurate. Enrollment in Direct Deposit guarantees timely payments without delays.

2. Understand Tax Implications

Remember that CPP survivor benefits are taxable income. This includes the one-time supplemental payment, so factor this into your 2025 tax planning. If you aren’t sure, chat with a tax professional to avoid surprises.

3. Budget Smartly for the One-Time Boost

Since the $758 raise is one-time only, resist the temptation to treat it as recurring income. Instead, consider using it to:

- Pay down high-interest debt,

- Cover upcoming medical or home care expenses,

- Build or replenish an emergency savings fund.

4. Apply Promptly if You Haven’t

If you lost a spouse or common-law partner recently and haven’t applied for survivor benefits yet, don’t wait. The sooner you apply, the sooner payments begin—and you could qualify for this raise if you’re 60+ by November 2025.

How to Apply for CPP Survivor Benefit Raise?

Follow this straightforward process:

- Gather Essential Documents: Including the death certificate, proof of your relationship, and your government-issued ID.

- Apply Online or by Mail: The fastest way is through your My Service Canada Account. Paper forms are also available.

- Submit Your Application: Ensure completeness to avoid delays.

- Respond to Follow-Up Requests: Service Canada may reach out for more info.

- Begin Receiving Benefits: Payments typically start the month after approval.