In December 2025, millions of Americans who rely on Social Security benefits will receive their final regular payments before the scheduled cost‑of‑living adjustment (COLA) takes effect. While the payment dates for most recipients will follow the typical schedule, some will receive two payments in a single month.

This guide breaks down the key dates, explains who receives what, and sheds light on the significant COLA increase set for 2026.

December 2025 Social Security Overview

| Key Fact | Detail |

|---|---|

| Standard Social Security (retirement, disability, survivors) | Paid in December on Wednesdays, according to birth‑date cycle (or Dec 3 for pre‑May 1997 beneficiaries) |

| December 2025 payment dates | Dec 3, 10, 17, 24 depending on beneficiary cycle |

| Supplemental Security Income (SSI) | Regular payment Dec 1; extra payment Dec 31 (for January 2026) |

| COLA increase for 2026 | 2.8% increase beginning with January 2026 payments (SSI Jan benefit pays out Dec 31) |

| New 2026 maximum SSI federal payment | $994/month for individuals, $1,491 for couples (before state supplements) |

How December 2025 Payments Are Scheduled

Regular Social Security (Retirement, Survivors, Disability)

Social Security payments are spread out over the month to avoid overloading the system. Payments for regular benefits (retirement, disability, survivors, or spousal) follow a schedule based on the recipient’s birth date. If your birthday falls between:

- 1–10 of any month, you will receive your payment on Wednesday, December 10, 2025.

- 11–20, your payment is scheduled for Wednesday, December 17, 2025.

- 21–31, expect your check on Wednesday, December 24, 2025.

Those who began receiving Social Security benefits before May 1997 are on a legacy payment schedule and will receive payments on Wednesday, December 3, 2025. This division helps to evenly distribute payments and alleviate processing bottlenecks, ensuring that all payments are processed in a timely manner.

Supplemental Security Income (SSI) — Two Payments in December

SSI recipients — who are typically low-income elderly or disabled individuals — follow a different schedule. Normally, SSI payments are issued on the first business day of each month. However, since January 1, 2026, falls on a holiday (New Year’s Day), the January payment will be issued early, on December 31, 2025.

This results in two separate payments in December: one on December 1 for the month of December, and one on December 31 for January’s payment.

While this may seem like an “extra” payment, it’s important to note that this is simply an early payment — not additional income. Recipients should be aware of this to prevent confusion about budgeting.

What Beneficiaries Will Receive — and What Changes in 2026

Payment Amounts in 2025

The amount you receive from Social Security depends on the type of benefits you’re eligible for. For SSI, the 2025 maximum federal payment is US$ 967 per month for an individual and US$ 1,450 for couples. State supplements may increase this amount, but the federal figures remain the baseline.

For regular Social Security (retirement, disability, survivor benefits), payments depend on a variety of factors, including lifetime earnings, the number of credits earned, and the age at which someone starts collecting benefits.

Upcoming Cost‑of‑Living Adjustment (COLA) for 2026

To help offset rising costs, Social Security benefits will receive a 2.8% COLA adjustment beginning in January 2026 for most beneficiaries. For SSI recipients, this adjustment will apply to their December 31, 2025 payment. This increase is based on the rise in the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers (CPI-W), which tracks inflation.

On average, this will increase Social Security payments by about US$ 56 per month. For SSI, the maximum benefit will increase to US$ 994 for individuals and US$ 1,491 for couples.

Why the December Payment Dates & Double Payment

Birth‑date Payment Cycles

The staggered payment system was introduced in 1997 to help balance the volume of payments processed each month. Depending on their birth date, beneficiaries are assigned a specific payment cycle. Those who began receiving benefits before May 1997 continue to follow the original payment schedule, which issues payments on the third of the month.

The December SSI Double Payment

Due to calendar mechanics, SSI recipients will see a “double” payment in December. This results from the fact that January 1, 2026, falls on a federal holiday. To avoid delays, the January payment will be issued early, on December 31, 2025.

This does not mean an extra month of payments — just that beneficiaries will receive two payments in December. For those relying on this income, it’s important to plan accordingly.

What This Means for Beneficiaries — and What to Watch For

Budgeting and Cash Flow

For many recipients, particularly those relying on SSI, receiving two checks in December may be a windfall. However, it is crucial to remember that this early payment is simply for the following month’s benefits. It’s important not to treat this as extra money. Planning for the following months’ expenses is key to maintaining financial stability.

Anticipated 2026 Benefit Increase

The 2.8% COLA increase in January 2026 should help offset some of the impacts of inflation, but rising costs — particularly in housing, healthcare, and long-term care — could still reduce the purchasing power of Social Security benefits over time. For many, the increase provides modest relief, but it may not fully cover the cost of essential goods and services.

The Long-Term Outlook: Inflation, Program Pressures, and Funding Concerns

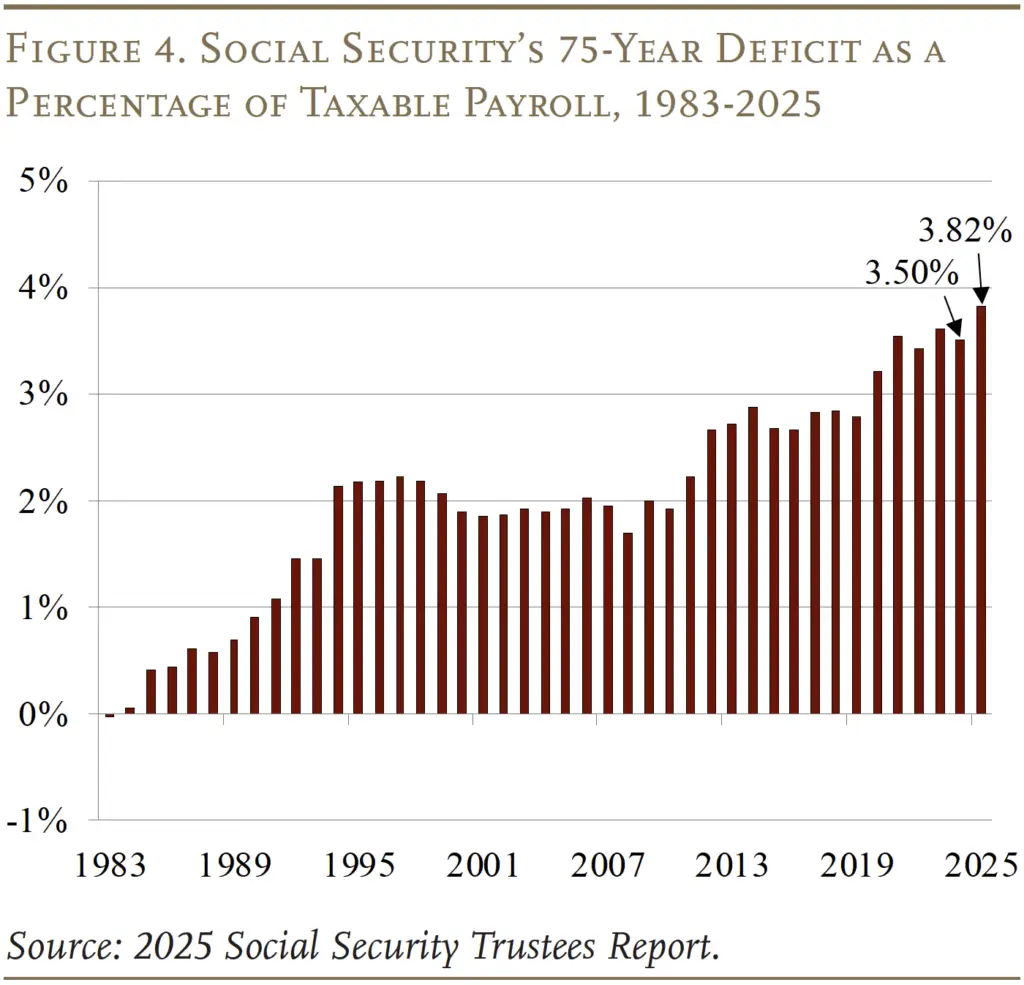

While the COLA helps recipients manage short-term inflationary pressures, Social Security faces broader long-term challenges. As more baby boomers retire and life expectancy increases, the system’s funding structure is under strain. Some analysts predict that without legislative intervention, Social Security may face significant funding shortfalls as early as the 2030s.

Discussions continue in Congress regarding how to ensure the program’s long-term solvency, with some advocating for increases in payroll taxes or changes in the age of eligibility for full benefits. For now, Social Security provides vital support to millions of retirees, survivors, and people with disabilities, but its future remains uncertain.

Related Links

CalFresh Update: Up to $1,789 in Benefits Going Out to More Than 5.5 Million Residents

$1,000 Payments Arrive December 18 — Only Residents in One State Are Eligible!

What Recipients Should Do Now

- Check your payment schedule: Make sure you know when your payments are due based on your birth date or SSI eligibility.

- Plan your budget: Don’t treat the December 31 payment as extra income — it covers January benefits.

- Look for your COLA notice: Review the 2.8% increase for 2026 and adjust your expectations for next year’s payments.

- Stay informed: Keep an eye on news from SSA about potential reforms or policy changes that may affect future benefits.

December 2025 will bring routine Social Security payments for most beneficiaries, but with a notable increase in SSI payments due to the holiday schedule. For many, the COLA increase will provide a slight boost to purchasing power in 2026, but ongoing inflation and systemic pressures continue to shape the broader future of Social Security.