The Social Security Administration (SSA) has confirmed the payment schedule for December’s final checks. This includes an early deposit for January 2026 benefits to account for the New Year’s holiday. With millions of recipients relying on Social Security benefits, these timely deposits play a critical role in their financial planning.

Here’s what beneficiaries need to know about their December payments, including the holiday-week deposit and its implications.

December’s Final Social Security Checks

| Key Detail | What You Need to Know |

|---|---|

| First SSI Payment | December 1, 2025 |

| Holiday-Week Deposit | December 31, 2025 (Early January 2026 SSI payment) |

| Regular Social Security Deposits | Issued on Wednesdays for birth date groups |

| COLA Increase | 2.8% cost-of-living adjustment beginning January 2026 |

December Social Security Payment Schedule

Social Security benefits are issued based on a fixed schedule set by the SSA, with different programs, such as retirement, disability, and Supplemental Security Income (SSI), having varying payment dates. For December 2025, several key dates and conditions apply, including the adjustment of payments due to federal holidays.

Supplemental Security Income (SSI)

- SSI payments for December: The first deposit for SSI recipients occurred on December 1, 2025. This payment reflects the December 2025 benefit, as SSI payments are generally made on the 1st of each month.

- Holiday Week Deposit: As New Year’s Day (January 1, 2026) falls on a federal holiday, the SSA has issued the January 2026 SSI payment early, on December 31, 2025, to ensure beneficiaries receive their funds in a timely manner before the holiday. This special deposit is a regular practice when January 1 is a holiday, ensuring no disruption in benefit delivery.This December 31 deposit serves as January’s SSI payment, meaning recipients will not receive another SSI check in January 2026.

Retirement, Disability, and Survivor Benefits

For recipients of retirement, disability, and survivor benefits, SSA schedules payments based on birth date groups. Those born on the 1st-10th of the month typically receive their deposits on the second Wednesday of the month, while those born between the 11th-20th receive their checks the third Wednesday, and those born 21st-31st see their payments on the fourth Wednesday.

For December 2025, the final payments of the year are as follows:

- December 3, 2025: Payments for those born on the 1st-10th.

- December 10, 2025: Payments for those born on the 11th-20th.

- December 17, 2025: Payments for those born on the 21st-31st.

What Is the Holiday-Week Deposit?

Each year, the SSA adjusts its payment schedule when a holiday falls on the 1st of the month. In 2026, January 1 is a federal holiday, meaning recipients who normally receive their January 2026 benefits on that date will instead see their checks deposited on December 31, 2025, in advance.

This advance deposit helps avoid delays, as recipients will have access to their funds before the holiday. However, it’s essential to note that this deposit does not constitute an extra payment—it is simply an early release of the January 2026 payment, and beneficiaries will not receive another deposit for January 2026.

This early deposit is particularly important for SSI recipients, as the January benefit is typically used to cover essential costs in the first weeks of the new year.

How the Social Security COLA Affects Payments

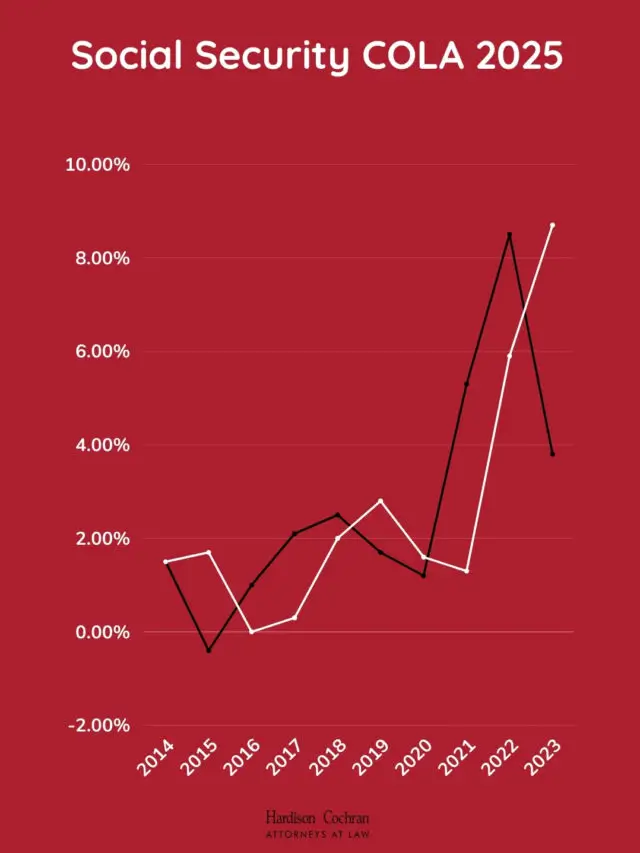

For those receiving Social Security benefits, the 2.8% COLA will apply to their January 2026 payments. The COLA increase is intended to help offset the rising cost of living, particularly in housing and healthcare, which are major expenses for retirees and people with disabilities.

- For retired workers, the average monthly benefit in 2026 will increase by about $56, moving from $2,015 to $2,071.

- For disabled workers, the monthly benefit will increase from $1,586 to $1,630.

- For couples receiving benefits, the total monthly payout will increase by about $88, rising from $3,120 to $3,208.

The 2.8% COLA marks a moderate increase compared to recent years and will provide essential support for recipients facing rising living costs.

Manage Your Social Security in December

Here are some tips for beneficiaries managing their Social Security payments in December:

- Track the Early Deposit: If you are an SSI recipient, ensure that you know the December 31 deposit is for your January benefit. Be mindful of budgeting to account for the absence of a second January deposit.

- Plan for Increased Payments in 2026: With the 2.8% COLA increase kicking in January, ensure you’re prepared for slightly higher monthly payments.

- Consult SSA Online Accounts: If you have an account with the Social Security Administration, be sure to review your 2026 payment schedule and benefit amount via the my Social Security portal.

Historical Context: Why the SSA Adjusts Payment Schedules

The Social Security Administration has a long history of adjusting payment schedules around holidays to ensure that beneficiaries receive their funds on time. This practice ensures that no recipient faces delays during the holidays, which can disrupt budgets.

When holidays like New Year’s Day fall on the 1st of the month, SSA deposits early to prevent disruption. Historically, these adjustments were more frequent during periods of significant economic change, but in recent years, the SSA has established a consistent policy of moving payments ahead when necessary.

These practices have proven crucial to ensure that people relying on Social Security benefits for daily living expenses are not left without access to their funds during the critical first days of the month.

Impact of the Early Payment on Budgeting and Financial Planning

The early deposit on December 31 offers a valuable opportunity for those receiving Social Security and SSI benefits to adjust their budgeting. Since no additional payment will be made in January 2026, recipients should:

- Plan ahead for January’s expenses: The December 31 payment serves as January’s funds. Be sure to manage these funds to cover essential costs until the next deposit arrives in February.

- Factor in the COLA increase: Recipients will see a higher monthly payment starting in January. It’s important to budget for this increase, especially for those with fixed expenses like housing and utilities.

By carefully managing their funds, beneficiaries can ensure they are financially prepared for the months ahead.

Social Security and SSI Taxation: What You Should Know

Although most Social Security and SSI payments are not taxed at the federal level, high-income beneficiaries may still face taxation on their benefits. Up to 85% of Social Security benefits can be taxable for individuals whose combined income exceeds certain thresholds.

It’s crucial for beneficiaries to understand these thresholds to avoid unexpected tax liabilities. For SSI recipients, benefits are generally not subject to income tax, but if you are receiving other forms of government assistance or have substantial other income, you may be required to file taxes.

Forthcoming Changes to Social Security in 2026

Beyond the COLA increase, there are other anticipated changes for Social Security recipients in 2026. One notable adjustment is the increase in the maximum taxable earnings cap, which affects how much income is subject to Social Security taxes.

In addition, Medicare premiums are likely to rise, affecting the net benefits for many retirees. These premium adjustments, along with the COLA increase, will be key to understanding how much Social Security beneficiaries can expect to take home in 2026.

Related Links

2026 Social Security COLA Raises Benefits, but Rising Medicare Costs Limit Real Gains

Social Security Offices Are Shutting Down—Key Dates, Hidden Risks, and What You Must Do Now

As December comes to a close, Social Security recipients can expect a special early deposit on December 31 for January 2026 benefits. While this advance helps ensure timely access to funds before the New Year, beneficiaries should plan carefully to account for the absence of a second payment in January.

The 2.8% COLA increase, also set to take effect in January 2026, will provide a much-needed boost for retirees and those with disabilities facing rising living costs. Beneficiaries should carefully review their SSA accounts, manage their budgets, and be aware of the upcoming changes to fully navigate their Social Security payments in the New Year.