As February 2026 unfolds, American taxpayers are navigating a complex landscape of expected tax refunds, stimulus claims, and various financial assistance programs. Amid the ongoing uncertainty surrounding future federal aid, millions of Americans are questioning what they can expect in terms of direct payments, refunds, and other financial support in 2026.

Recent rumors about $2,000 stimulus checks have raised concerns about misinformation and confusion, making it increasingly important for individuals to distinguish between legitimate tax-related refunds and speculative claims.

February 2026 Payments

| Payment Type | Expected Disbursement and Amount |

|---|---|

| Tax Refunds | Varies, average of $2,500 – $3,500 (based on individual filings) |

| EITC and CTC | Up to $7,000 for eligible families (based on income and children) |

| Social Security Payments | Consistent monthly payments, with COLA adjustments expected for 2026 |

| No New Federal Stimulus Checks | No official federal payment for February 2026 |

This article aims to provide clarity on what is fact and what is fiction, specifically focusing on tax refunds and stimulus payments that might affect American citizens in February 2026. With careful analysis and expert insight, we will untangle the facts surrounding the government’s financial disbursements and offer actionable advice for retirees and taxpayers.

Sorting the Facts: February 2026 Payments — What to Expect

As millions of American taxpayers prepare for tax season, it’s crucial to understand the two key types of payments that will be issued in February 2026: tax refunds and stimulus claims. Tax refunds, including benefits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), are legitimate sources of financial relief for many individuals.

In contrast, claims about federal stimulus checks—often touted on social media and by certain politicians—should be treated with skepticism unless officially announced.

This section will clarify the nature of the February 2026 payments, focusing on real financial support like tax refunds while debunking myths surrounding the $2,000 federal stimulus checks.

Tax Refund Facts for February 2026

Tax refunds represent one of the most reliable sources of income for many retirees and families during tax season. The Internal Revenue Service (IRS) typically begins processing returns in late January, with most refunds disbursed via direct deposit by February. The IRS “Where’s My Refund” tool helps taxpayers track the status of their refunds.

EITC and CTC Updates

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are two of the most important financial support mechanisms for low- and moderate-income Americans. In 2026, these credits remain critical, particularly for families with children. The EITC can provide up to $7,430 for eligible taxpayers, while the CTC can grant up to $2,000 per child.

Taxpayers should verify their eligibility for these credits, especially as income thresholds and credit amounts are adjusted each year. Filing taxes accurately is vital to ensure eligibility and to prevent any delays in processing or receiving these valuable credits.

IRS Refund Timeline

For those filing early in January 2026, direct deposit refunds are expected as soon as February 9, 2026 for those with valid returns. For paper check filers, the processing time could extend to March 2026.

In 2026, the IRS has also implemented measures to speed up refunds for those who choose electronic filing and direct deposit. Taxpayers can expect an average refund of $2,500 to $3,500 in February 2026, depending on income, family size, and credit eligibility.

Stimulus Claims: Sorting Myths from Facts

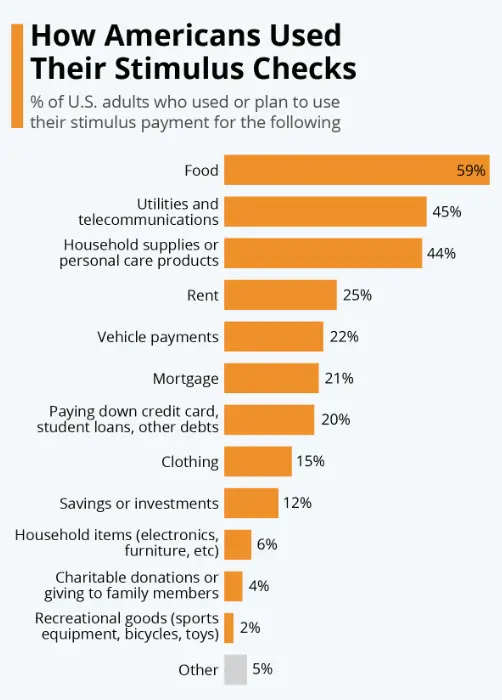

Over the past several years, many Americans have received federal stimulus payments intended to ease the economic burden during the COVID-19 pandemic. However, rumors of new $2,000 stimulus checks for February 2026 have resurfaced, especially amid political discussions about tariff revenues and other relief mechanisms.

Are $2,000 Stimulus Checks Coming in February 2026?

As of now, there is no official announcement or plan from the U.S. government regarding new stimulus checks for February 2026. While some political figures have floated the idea of a “tariff dividend” or a $2,000 relief check, these discussions remain speculative and unsubstantiated by any legislation.

The last direct stimulus payments from the federal government were issued in 2021 under the American Rescue Plan, and since then, the Biden administration has not moved forward with similar blanket payments.

While individual states may provide targeted relief to certain communities, no federal government checks are planned or expected at this time.

Scams to Watch For

Due to the ongoing speculation about stimulus payments, scammers have taken advantage of the confusion, targeting vulnerable individuals with fraudulent claims about receiving government relief.

Be wary of emails, text messages, or phone calls asking for personal information or payments in exchange for supposed “stimulus checks.” The IRS has consistently emphasized that it will never ask for sensitive information via phone or email.

Maximize Your Tax Refund and Retirement Savings

Given that $5,000 monthly budgets are common for many retirees, understanding how to optimize your tax refunds and other financial disbursements is essential for ensuring financial security in retirement.

Maximizing Tax Refunds

Retirees can maximize their refunds by ensuring they take full advantage of tax deductions, including those for medical expenses or charitable contributions. Some retirees also qualify for tax credits like the Saver’s Credit, which incentivizes retirement savings.

Retirement Planning and Tax Strategies

It’s also crucial for retirees to plan their retirement savings with tax-advantaged accounts such as 401(k)s, IRAs, and Roth IRAs. Contributing to these accounts before retirement can provide long-term tax benefits and a more substantial nest egg. Similarly, tax-efficient withdrawal strategies can help retirees maximize the value of their savings.

Scam Awareness: Protecting Your Refund and Personal Information

Scammers often target people during tax season by sending fraudulent offers related to stimulus checks. It’s essential to stay vigilant and recognize official communication methods from the IRS. Here’s how you can protect yourself:

- Verify all claims: Check directly with the IRS or your tax professional before trusting any unsolicited offer.

- Secure your personal information: Never share Social Security numbers, banking details, or tax information unless you are sure the contact is legitimate.

- Use official IRS tools: For refund status, use the official IRS “Where’s My Refund?” tool.

State-Specific Relief Programs in 2026

In addition to federal tax refunds and benefits, several states have implemented their own relief programs for residents. States like California, New York, and Florida have introduced rebates and direct payments to eligible residents in response to economic hardships.

For example, California has issued inflation relief payments in 2026, providing rebates for middle-income households. Similarly, New York has expanded its tax rebate programs to assist families with children.

Each state has specific eligibility requirements, so residents should check their state’s tax authority website for details.

Related Links

Audit Shows Kansas Has Missed Federal SNAP Accuracy Targets Since 2019 – What Does this Mean

DoorDash Expands SNAP Access as More Grocers Join the Platform

Sorting Fact From Fiction in February 2026 Payments

As February 2026 progresses, it’s clear that tax refunds and Social Security benefits will be the primary forms of financial relief for millions of Americans. While stimulus claims have gained traction on social media, it is important to recognize that there are no new federal stimulus checks slated for release.

Tax refunds, particularly those based on credits like the EITC and CTC, will provide real financial relief for many families.

Taxpayers should remain cautious of scams and stay informed through trusted sources like the IRS. By carefully managing their refunds, retirement savings, and tax strategies, retirees and taxpayers can maximize their financial security in 2026.