A legislative audit has found that Kansas has failed to meet federal accuracy standards for administering food assistance benefits every year since 2019.

The findings raise concerns about oversight, fiscal risk, and service reliability as Federal SNAP Accuracy Targets Since 2019 highlights deeper challenges in managing the Supplemental Nutrition Assistance Program at the state level.

Kansas Has Missed Federal SNAP Accuracy Targets Since 2019

| Key Fact | Detail / Statistic |

|---|---|

| Federal SNAP accuracy threshold | 6% payment error rate |

| Kansas SNAP performance | Above threshold since 2019 |

| Highest reported error rate | More than 12% |

| Kansans receiving SNAP | About 188,000 monthly |

What the Audit Found

The Kansas Legislative Division of Post Audit, an independent and nonpartisan oversight agency, reviewed the state’s administration of the Supplemental Nutrition Assistance Program, commonly known as SNAP.

The audit concluded that Kansas has exceeded the federal payment error rate threshold of 6 percent every year since fiscal year 2019. Payment errors include both overpayments, where households receive more assistance than allowed, and underpayments, where eligible households receive less than they should.

Auditors emphasized that both types of errors undermine program effectiveness. In some years, Kansas’s error rate approached or exceeded double the federal benchmark, placing the state among those with the most persistent accuracy challenges.

Why Federal SNAP Accuracy Standards Exist

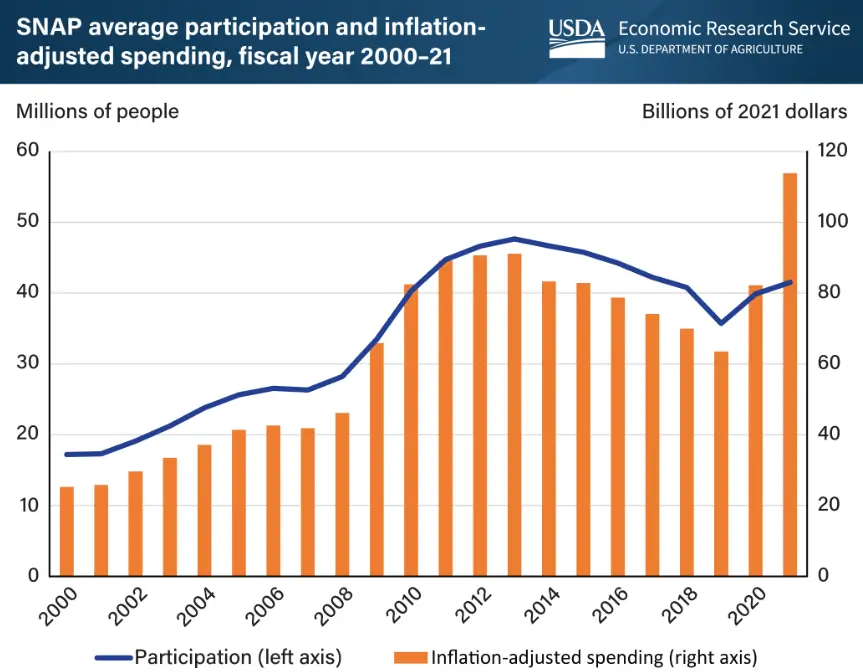

SNAP is funded by the federal government but administered by states, creating a shared responsibility model. To ensure consistent application of eligibility rules nationwide, the U.S. Department of Agriculture (USDA) enforces accuracy standards tied to benefit calculations.

The 6 percent threshold was established to balance administrative feasibility with accountability. States are not expected to be perfect, but they are expected to demonstrate reliable and consistent accuracy.

When states repeatedly miss the target, federal officials may require corrective action plans and, under newer laws, impose financial consequences.

Administrative Errors vs. Fraud

A key finding of the audit is that most SNAP errors in Kansas were administrative, not fraudulent. Administrative errors typically involve:

- Miscalculating income or deductions

- Using outdated verification documents

- Incorrectly recording household composition

Fraud, which involves intentional misrepresentation, accounts for a much smaller share of SNAP errors nationally. Auditors stressed that conflating the two can distort public understanding of the issue. “Accuracy problems usually reflect system strain, not misuse by recipients,” the audit noted.”

Why Errors Persist in Kansas

Complex Eligibility Rules

SNAP eligibility depends on multiple variables, including wages, housing costs, childcare expenses, medical deductions, and household size. Even small missteps can change benefit amounts. Auditors found that income verification errors were the most common issue in Kansas cases reviewed.

Workforce Challenges

The Kansas Department for Children and Families (DCF), which administers SNAP, has struggled with staff turnover and lengthy training requirements. New eligibility workers often require months of training before handling complex cases independently. High caseloads further increase the risk of mistakes, especially during periods of economic stress.

Pandemic Disruptions and Their Aftereffects

During the COVID-19 pandemic, federal emergency waivers expanded SNAP eligibility and reduced verification requirements to ensure rapid food access. Kansas, like many states, processed unprecedented volumes of applications.

While those measures helped prevent hunger, auditors found they also contributed to long-term accuracy issues. Even after emergency rules ended, Kansas struggled to return to pre-pandemic performance levels.

National SNAP error rates increased during this period, but Kansas’s rates remained elevated longer than many peer states.

Who Is Most Affected by SNAP Errors

Children and Families

Households with children represent a large share of SNAP recipients in Kansas. Underpayments can reduce food availability during critical developmental years.

Seniors and People With Disabilities

Older adults and individuals with disabilities often rely heavily on SNAP. Errors can be particularly disruptive for those on fixed incomes with limited alternatives. Advocates warn that correcting overpayments can create sudden benefit reductions, compounding hardship.

Financial Risks for Kansas

Potential Cost-Sharing Penalties

Recent federal legislation allows the USDA to require states with persistently high error rates to share SNAP benefit costs, which were historically fully federally funded. Depending on error severity, states may be required to cover between 5 and 15 percent of benefit expenditures.

Kansas distributed more than $400 million in SNAP benefits in a recent fiscal year. Even a modest cost-sharing requirement could translate into tens of millions of dollars in new state obligations.

Budget Trade-Offs for Lawmakers

If penalties are imposed, Kansas lawmakers could face difficult budget choices. Covering SNAP costs could require reallocating funds from other priorities, such as education, infrastructure, or healthcare.

Some legislators have raised concerns that administrative failures could create ripple effects across the state budget.

How Kansas Compares With Other States

While many states experienced elevated SNAP error rates after the pandemic, several Midwest states have since reduced their rates below the federal threshold.

Kansas remains among a smaller group that has not yet demonstrated sustained compliance, according to recent federal data. Policy analysts say differences often reflect investments in technology, staffing, and quality control systems.

State Response and Reform Efforts

Technology Improvements

DCF officials say they are upgrading eligibility systems to reduce manual data entry and improve automated income verification. New tools aim to flag discrepancies earlier in the application process.

Training and Oversight

The agency has expanded training programs and increased internal quality reviews. Officials report some improvement in recent months, though auditors caution that isolated gains are not yet sufficient.

Debate Over Enforcement and Access

Calls for Stronger Accountability

Fiscal watchdog groups argue that accuracy standards protect both taxpayers and eligible households. “Public trust depends on proper administration,” one auditor told lawmakers.

Concerns About Barriers to Access

Hunger advocates warn that overly aggressive enforcement could slow approvals or discourage eligible families from applying. “The goal should be accuracy without exclusion,” said a nonprofit policy expert.

Long-Term Consequences if Accuracy Does Not Improve

Beyond financial penalties, persistent failures could lead to increased federal oversight, reputational damage, and operational strain. Experts say states that fail to modernize risk falling further behind as SNAP administration becomes increasingly digital and data-driven.

What Happens Next

Kansas lawmakers are expected to review the audit during upcoming legislative sessions. Federal officials will continue monitoring performance and may require corrective action plans if benchmarks are not met.

For recipients, the stakes remain high: accurate administration determines whether families receive the support they are entitled to.

Related Links

Social Security Changes in 2026 — COLA, Medicare Costs, and What It Means for Your Payment

Direct Deposit IRS Payments – How to Make Sure Your Bank Info Is Correct

Why Federal SNAP Accuracy Targets Since 2019 Matters Nationally

Kansas’s experience illustrates broader challenges in administering federally funded safety-net programs at the state level. As SNAP evolves, accuracy, equity, and efficiency will remain central policy questions. How Kansas responds may influence national discussions on accountability and modernization.

FAQs About Missed Federal SNAP Accuracy Targets Since 2019

Does a high SNAP error rate indicate fraud?

No. Most errors are administrative, not intentional misuse.

Could SNAP benefits be reduced?

Benefits themselves are unlikely to be cut, but the state could face financial penalties.

Are recipients responsible for state errors?

In some cases, overpayments may be recovered, though policies aim to minimize hardship.